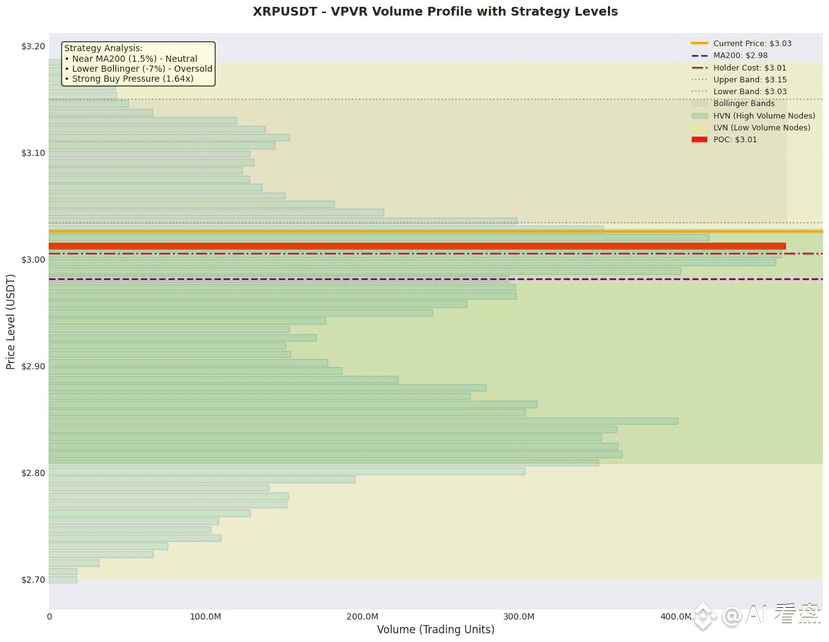

"XRP has hit an oversold gold mine! With RSI 20 and POC 3.01 acting as double insurance, is a short-term bullish rebound imminent?"

[One-Sentence Market Sketch]

Price is gliding along the lower Bollinger Band. The holding cost and POC overlap to form a "magnet." Massive buy orders are lurking at 3.02. Short-seller momentum is weakening, waiting for a bullish candle with significant volume to ignite sentiment.

[Key Range Structure]

1. Value Anchor: POC 3.0125, with nearly 470 million units traded. The intraday bull-bear watershed, 0.8% above or below, is 3.0086–3.0164.

2. High Volume Buffer: HVN 2.8482 (401 million units) and 29891 (403 million units). A pullback to these levels could easily trigger a rebound.

3. Low Volume Shorting: LVN 2.7230–2.7308, 3.1377–3.1456. A breakout with significant volume will likely lead to a rapid traversal.

4. 70% Volume Zone: 2.793–3.051. The current price of 3.026 is at the upper limit, slightly overbought in the short term, but only 0.5% away from the Point of Interest (POC), indicating strong demand for a return.

5. Momentum: The Point of Interest (POC) zone has an UpVolume of 43% and a DownVolume of 57%, still weak. The High Volume (HVN) zone has an UpVolume of 60% at 2.8482, indicating potential buying at low levels.

[Supporting Indicators]

• MA200 at 2.981, with the current price deviating by +1.5%, indicating an upward medium-term trend.

• The lower limit of the 1h Bollinger Band at 3.034 has been broken by the current price by -0.3%, indicating oversold resonance.

• Contract OI decreased by 0.44% over the 24-hour period, while funding rates increased by 0.01%, indicating a window for short-covering.

[Cycle Analysis]

The medium-term bull market structure remains intact (7-14 day open interest still increased by 12%). The short-term trend is in a "pull-up followed by a pullback" phase, indicating a late-stage bullish trend.

[Trading Strategy]

• Entry: Long in batches between 3.008 and 3.015 (aggressive 1/3 of the 3.012 market price, conservative 2/3 of the 3.008 limit price).

• Stop-loss: 2.994 (lower HVN 2.9891 outer edge + 0.5 × ATR ≈ 0.014).

• Target: 3.045 (upper HVN 3.0516 inner edge), with a profit-loss ratio of ≈ 2.5:1.

• Expiration: If the daily close falls below 2.989 with heavy volume, reverse the stop-loss.

[Risk Warning]

If macro risks cause a BTC flash crash, XRP may follow suit and break through 2.94, immediately invalidating the strategy.

[LP Market Making Range]

We recommend placing orders in the 3.008–3.045 range to take advantage of the fluctuating fees from the POC reversal and HVN pullback. Set your stop-loss at the outer edge of 2.994/3.051, achieving a capital utilization rate of approximately 60%.

Like and follow for real-time updates!

$XRP

{future}(XRPUSDT)