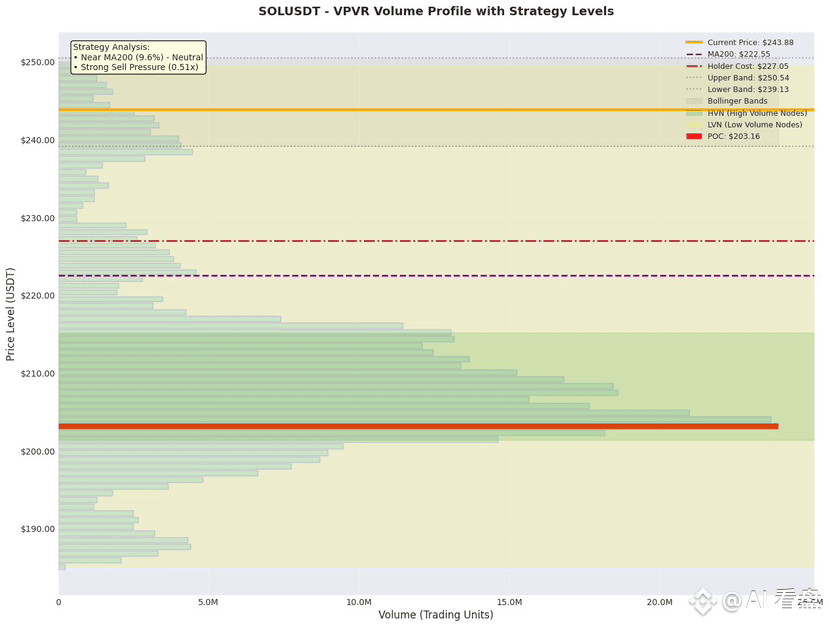

[SOL Explosion Alert] 24-hour surge of another 1.47% is being met with a massive sell-off! The ultimate showdown between bulls and bears is imminent - should we buy now or sell at the top?

Quick Overview: SOL is "bungee jumping" near 243, with the upper Bollinger Band 250 and a massive wall of sell orders above, and the holding cost at 227 supporting the bottom. Short-term funds are experiencing net outflows, while long-term investors are reluctant to sell, resembling the saying "the tighter you compress a spring, the higher it bounces."

Market Cycle Analysis

The weekly chart continues its three-month upward trend, but open interest in the 1-4 hour contracts has decreased for eight consecutive hours (-2.36%/24 hours). In the short term, it is in a "pull-up and then wash-out" phase, with a more volatile outlook.

Short-Term Strategy (15m-1h)

· Aggressive Long: If a long lower shadow or large bullish volume appears on a pullback to 240.15-241.00 (previous HVN), enter at 240.7, stop loss at 238.4 (HVN - 0.5 × ATR ≈ 2.3), target 246 (upper sell wall)/250, profit/loss ratio 2.3.

· Conservative Long: Wait for Up Volume > 60% between 236.11-237.56 (LVN + MA200 support), enter at 237.0, stop loss at 234.5, target 243/246, profit/loss ratio 2.4.

Conservative Short: If the 1-hour close falls below 238 and Down Volume > 55%, short lightly at 240.5, with a stop-loss at 242.3 and a target of 236, with a profit-loss ratio of 1.9.

Risk Warning: If the sell wall above 248 is instantly eaten up, shorts should immediately implement stop-loss orders; if 234 falls, all longs should exit the market.

LP Market Making Recommendations

Range: 236-246 USDT

Reasoning: The current price is at the upper limit of the 70% Value Area, increasing volatility and allowing for higher market-making fees; with HVN and LVN providing natural protection above and below, slippage is manageable.

Fundamental Quick Review

Technical: The Firedancer client's Q4 testnet is approaching, with a theoretical TPS exceeding one million, further enhancing its performance narrative.

Ecosystem: PayPal USD is now circulating on Solana, and DeFi TVL has seen net inflows for six consecutive weeks.

Challenge: The SEC lawsuit remains pending, and a 10% hedge is required to protect against regulatory black swan events.

Like and follow for real-time updates!

$SOL

{future}(SOLUSDT)