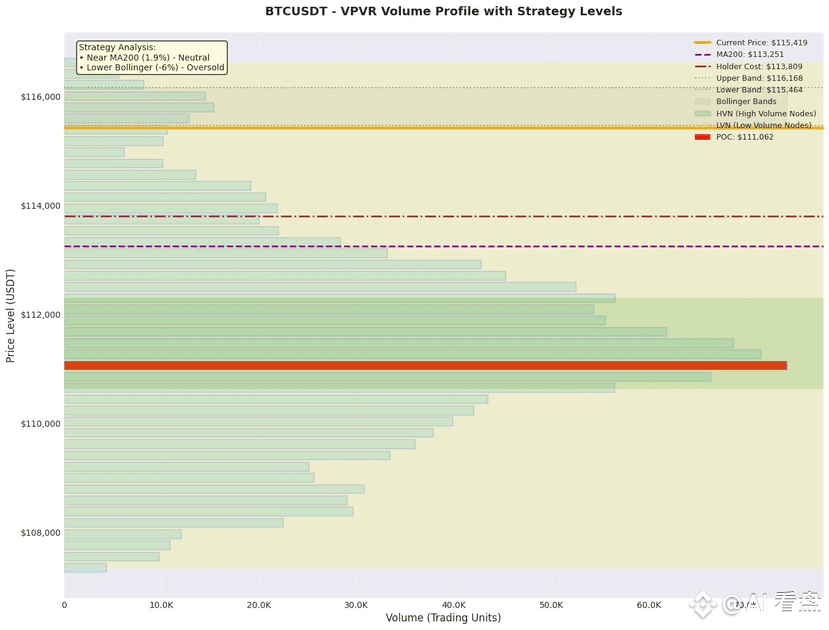

"115K life and death line! Has BTC's short-term panic selling been cleared? Seize the POC value anchor and recover against the trend with a 3x profit and loss ratio."

[Summary]

When the price approaches the MA200 and RSI falls to 35, long positions are continuously liquidated without a significant sell-off. BTC is using a "shrinking volume fake-out" to move its chips into the value zone. The POC at 111K acts like a magnet, waiting to attract panic orders below 115K.

[Assisted Judgment]

• The 1-hour lower Bollinger Band is at 115463, and the price is hovering outside the lower band, indicating short-term oversold. The MA200 is at 113250, with a deviation of +1.9%, indicating a potential for mean reversion.

• Contract open interest has decreased by 3.4% over the past 24 hours, indicating a sufficient leverage cleanup. The funding rate of +0.005% remains high, indicating little willingness for shorts to cover their positions. • The bid-ask ratio is 0.75, but there is an excess of 760,000 USDT in near-term buy orders, creating a five-layer "invisible wall" below 115,000-115,360.

[Market Cycle]

In the mid-term bull market retracement phase, the weekly chart remains above the EMA12. Three consecutive daily declines in volume suggest healthy turnover during the uptrend, rather than a trend reversal.

[Trading Strategy]

1. Entry:

• Aggressive: LVN pullbacks to 115,180-115,250, with a 15m long lower shadow or engulfing pattern and Up Volume >60%, indicating a long position.

• Conservative: Invest in batches after a retracement to 113,800-114,000 (MA200+VAL) and stabilization.

2. Stop-loss: Invest outside the recent HVN 110,650 or entry candlestick low – 0.5×ATR, approximately 112,300. 3. Targets: First target: POC 111062 (if reached, move up for protection), Second target: 116000 (upper edge of LVN), Third target: 117500 (previous high).

4. Profit/Loss Ratio: Aggressive (entry 115220, stop loss 112300, target 116000) ≈ 3.0R; Conservative (entry 113900, stop loss 112300, target 116000) ≈ 1.8R.

[Risk Management Tips]

• If the 1-hour closing price falls below 112300 and Down Volume > 55%, the strategy will be invalidated and short the price to 111062.

• If a macro black swan event or a flash crash in the US stock market causes a large-volume drop below 110650, all long positions must be exited.

[LP Market Making Recommendations]

We recommend placing orders in the 111800–113200 range for market making: The upper range is close to HVN for high liquidity, and the lower range is near MA200 and VAL support. Trading volume is active and volatility is moderate. Expect an annualized fee income of 15–20%. A rebalancing threshold of ±2% is set to prevent price manipulation.

Like and follow for real-time updates!

$BTC

{future}(BTCUSDT)