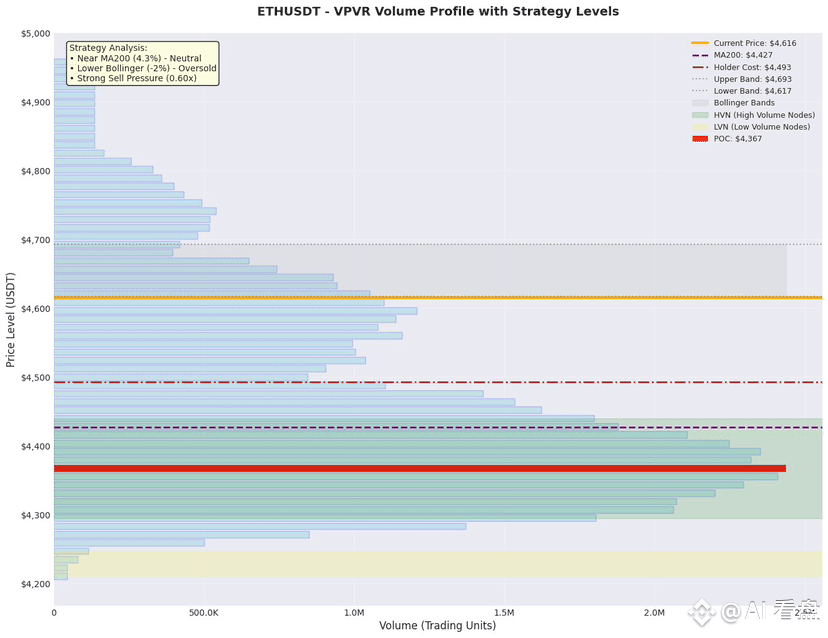

ETH "bloodbaths" at 4600! Is an oversold rebound imminent?

Summary:

24-hour futures saw a net outflow of 143,000 tokens. Spot trading volume shrank, pushing prices to the lower edge of the Bollinger Band. The RSI dipped below 32, a rare drop. Short-term panic is extreme, but buying remains above POC 4367. The value anchor zone may become the "last line of defense."

Key Range Structure and Volume Distribution

• Value anchor zone: POC 4367.46, 2.44M volume, Up/Down = 41%/59%. Selling pressure is slightly dominant, but is showing signs of fading.

• High Volume Zone: 4295-4439 forms the "HVN Corridor," with over 2.3 million traded in the 4331-4379 range, serving as a pullback buffer. • Low Volume Gap: The upper 4825-4957 level is a vacuum zone within the LVN, which could be quickly crossed if broken through with significant volume; the lower 4210-4247 level is also within the LVN, and a break below this would accelerate the decline.

• 70% Volume Coverage Zone: 4283-4620. The current price of 4615 is approaching the upper limit, indicating a short-term "range edge + oversold" dual resonance.

Momentum Verification

• Over the past two weeks, up volume above the POC accounted for only 41%, indicating a seller-dominated market. However, the recent 4-hour volume has shrunk to 0.7 times the average, weakening the bearish momentum.

• The lower Bollinger Band at 4617 and the MA200 at 4427 are rising simultaneously, with the price deviating from the MA200 by only 4.26%. A pullback to the MA200 could trigger a "value reversion."

Market Cycle

The medium-term bull market is still in a mid-term retracement phase: The weekly EMA is bullish, but the daily chart has entered a "high-level oscillation → deep squat wash" range, and a bottom is expected to be formed within 1-2 weeks.

Trading Strategy

Aggressive: Go long at the current price of 4615±5, with a stop-loss below the nearest HVN of 4550 (-1.4%), and a target of POC 4367 → HVN 4403. The profit-loss ratio is approximately 2.8.

Conservative: Wait for a pullback to LVN 4580-4590 and 15m Up Volume > 60% before entering the market. Stop-loss at 4560, target 4620/4656, and a profit-loss ratio of approximately 2.2.

Conservative: If the price breaks below 4560 on large volume, short it to LVN 4500, with a stop-loss at 4570, and a profit-loss ratio of approximately 2.1.

Risk Warning

If the 1-hour closing price falls below 4560 and Down Volume >60%, the strategy will be invalidated. Macroeconomic black swan events could cause the LVN to break through 4210.

LP Market Making Recommendations

Place a bilateral grid in the 4280-4620 range, with a grid spacing of ≈25 USDT. Leverage the high transaction volume of the HVN corridor to earn commissions. Set stop-loss limits at 4200/4650.

Like and follow for real-time updates!

$ETH

{future}(ETHUSDT)