August 15 Market Analysis:

From an hourly technical perspective, the middle and upper Bollinger Bands remain sloping downward, creating short-term bearish pressure. This suggests that the rebound momentum has yet to fully reverse the downtrend, and upward momentum is currently limited. However, it's worth noting that the lower band has slightly turned upward, diverging from the middle and upper bands. This divergence typically suggests an easing of oversold pressure, and support is beginning to emerge around 117,500. After a period of sustained short selling, the bears are weakening, and interest in buying at lower levels is gradually increasing.

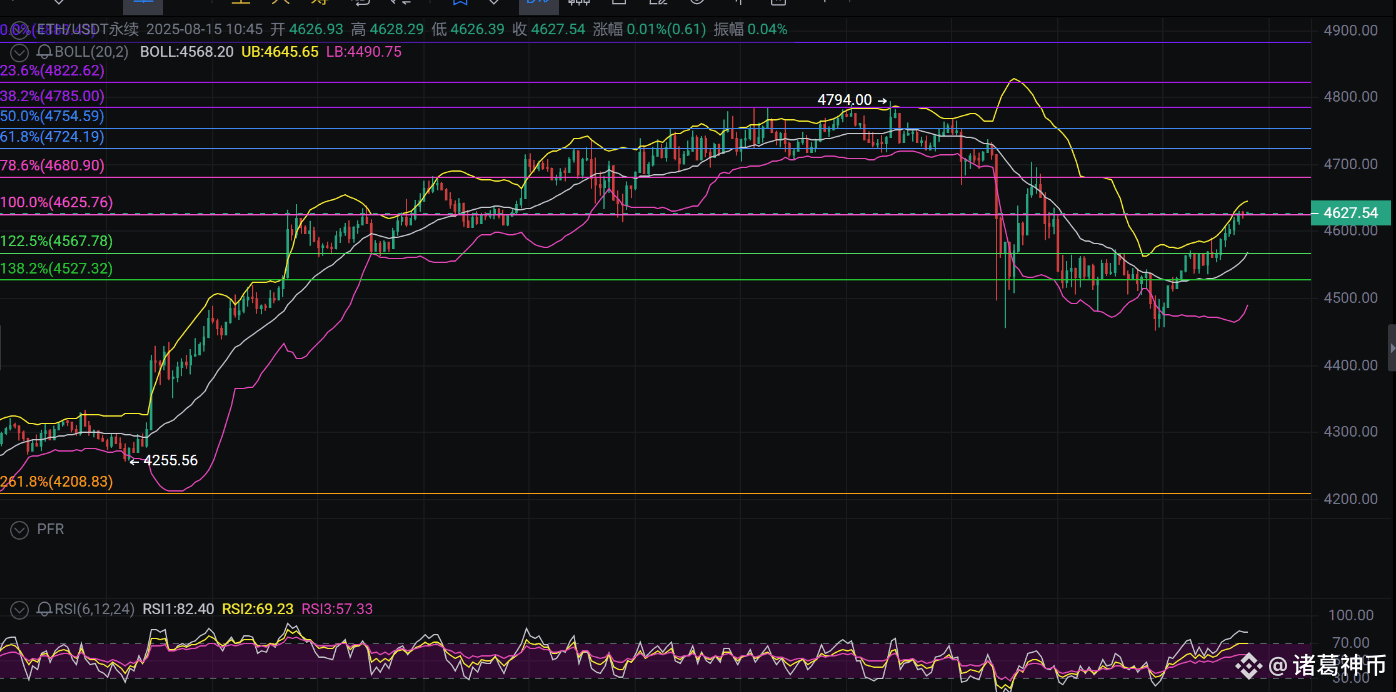

Key support levels are worth considering for dips: Bitcoin should focus on the 118,000-117,500 range. This area serves as initial support after the lower band turns inward, and also serves as a defensive level repeatedly tested and unbroken by bears. If it holds, it could potentially launch a push towards the 120,000 mark. Ethereum is trading around 4,600, which is both the lower edge of the previous range and supports a potential upward move after the lower band turns upward, with a target around 4,700. During a rebound, it's important to observe whether the mid-range resistance can be effectively broken to confirm a true reversal of the short-term trend.

Still unsure how to trade in this market? Follow me, I'll give you strategies, and your execution is up to you! There are only so many positions, so be quick!

$BTC $ETH

#BTC hits new high again #Ethereum countdown to new all-time high