Tonight's crypto-currency drama is more thrilling than a thriller—the unexpectedly strong non-farm payroll figures sparked a market reversal.

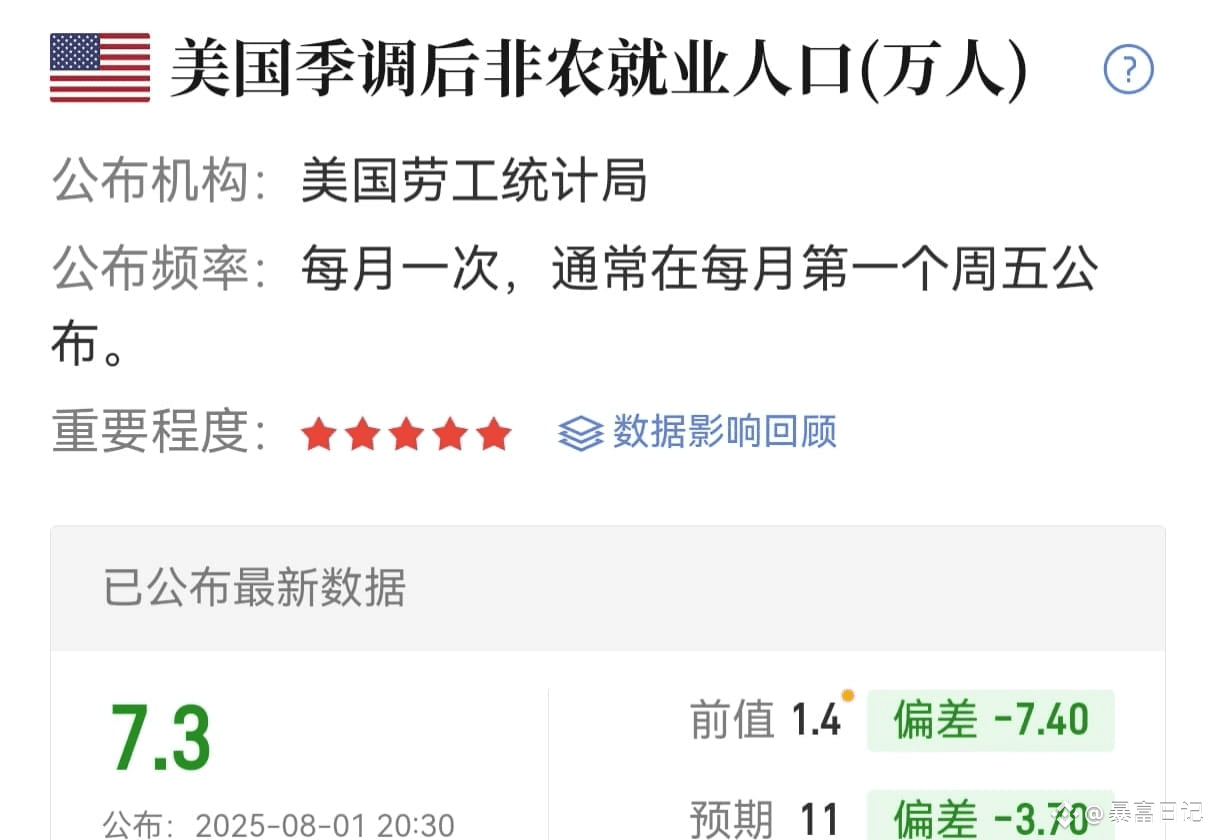

The non-farm payroll figures were expected to be 110,000, but the actual figures were only 70,000. The signal of weak employment was clear. Logically, the US dollar should have retreated, and gold (the small yellow fish) would have surged with a large bullish candlestick pattern. This scenario would have been perfectly logical. However, Bitcoin, considered "digital gold," did the opposite, crashing through the $114,000 support level. This move is truly baffling.

Ultimately, it's the "bind" to the US stock market that's at work. As the dollar weakened, the Nasdaq succumbed to the sharp drop, and crypto stocks suffered even more, dragging Coinbase down with them. After all, this bull market was fueled by ETFs, institutions, and crypto stocks, and they are tied to the US stock market more tightly than 502 glue. When the US stock market plummeted, the crypto market couldn't escape the impact and was inevitably caught in the crossfire.

The pressure now rests squarely on the Federal Reserve and Powell. Despite such weak employment data, market bets on a September rate cut have skyrocketed to 75%, with Chuanzi still urging, "If there's no rate cut, I'll take over the Fed." The clash between these two veterans is even more unsettling than the price fluctuations of cryptocurrencies. While the expectation of a rate cut should be positive, the short-term panic in the US stock market hasn't fully subsided, and the crypto market still has to weather the storm.

Two key points remain: First, can Bitcoin stabilize at the 110,000 mark and prevent further ripples from chain liquidations? Second, will the Fed be forced into relenting by the market and Chuanzi? If the expected rate cut materializes and the US stock market stabilizes first, the crypto market, which has been a follower of the market, will have a chance to breathe. After all, the current bull market is still rooted in the US stock market. If the US stock market doesn't show signs of improvement, Bitcoin and altcoins will likely have to continue to struggle.

#CryptoMarketPullback #BTC #ETH