Will tonight's unemployment rate data mark a turning point for the market?

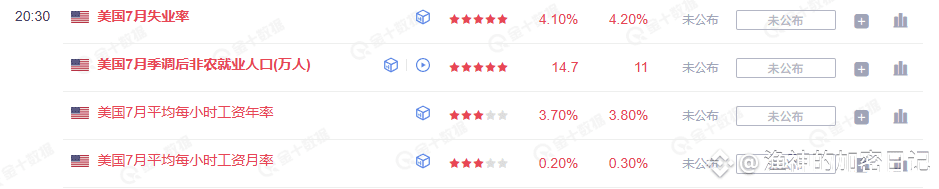

Attention everyone! Tonight (August 1st), the US will release its July unemployment rate data, which could be a key factor influencing future market trends.

Why is this data important?

The unemployment rate is a crucial reference for the Federal Reserve to gauge the health of the economy.

If the unemployment rate rises, it suggests the economy may be slowing down, and the Fed may be more inclined to cut interest rates, which will favor risky assets.

If the unemployment rate remains low or even declines, it suggests the economy is still overheating, and expectations of rate cuts will be delayed, potentially putting continued pressure on risky assets.

Based on the current market conditions:

ETH is currently trading sideways between 3650 and 3680, with trading volume continuing to shrink. The market is waiting for a direction.

The MACD daily crossover has not been resolved, and the momentum bar has not turned positive, indicating a bearish technical outlook.

The RSI indicator is declining, indicating weak trend momentum.

Downward support is seen around 3610; if this level breaks, a reversal to the 3200-3300 range is possible.

Upward resistance lies between 3730 and 3750; a break above this level could reverse the short-term trend.

Tonight's data release, if positive, could trigger a market rebound. If negative, market sentiment could decline, potentially leading to a sharp decline.