$BTC A 90s-born crypto veteran: From 100,000 to tens of millions in 10 years, I relied on just one "simple method"

$ETH I'm 30 years old, from Yueyang, Hunan, and now live in Shenzhen.

$ZEC Two apartments, one for my family, one for myself.

In my 7th year in the crypto world, I grew my initial capital of 100,000 to tens of millions, not through insider trading or luck, but through the experience honed through a simple "simple method."

After over 1500 days of setbacks, losses, and comebacks, I've summarized the core principles into 6 key points.

Understanding even one of these points will save you 100,000; mastering three will put you ahead of 90% of retail investors.

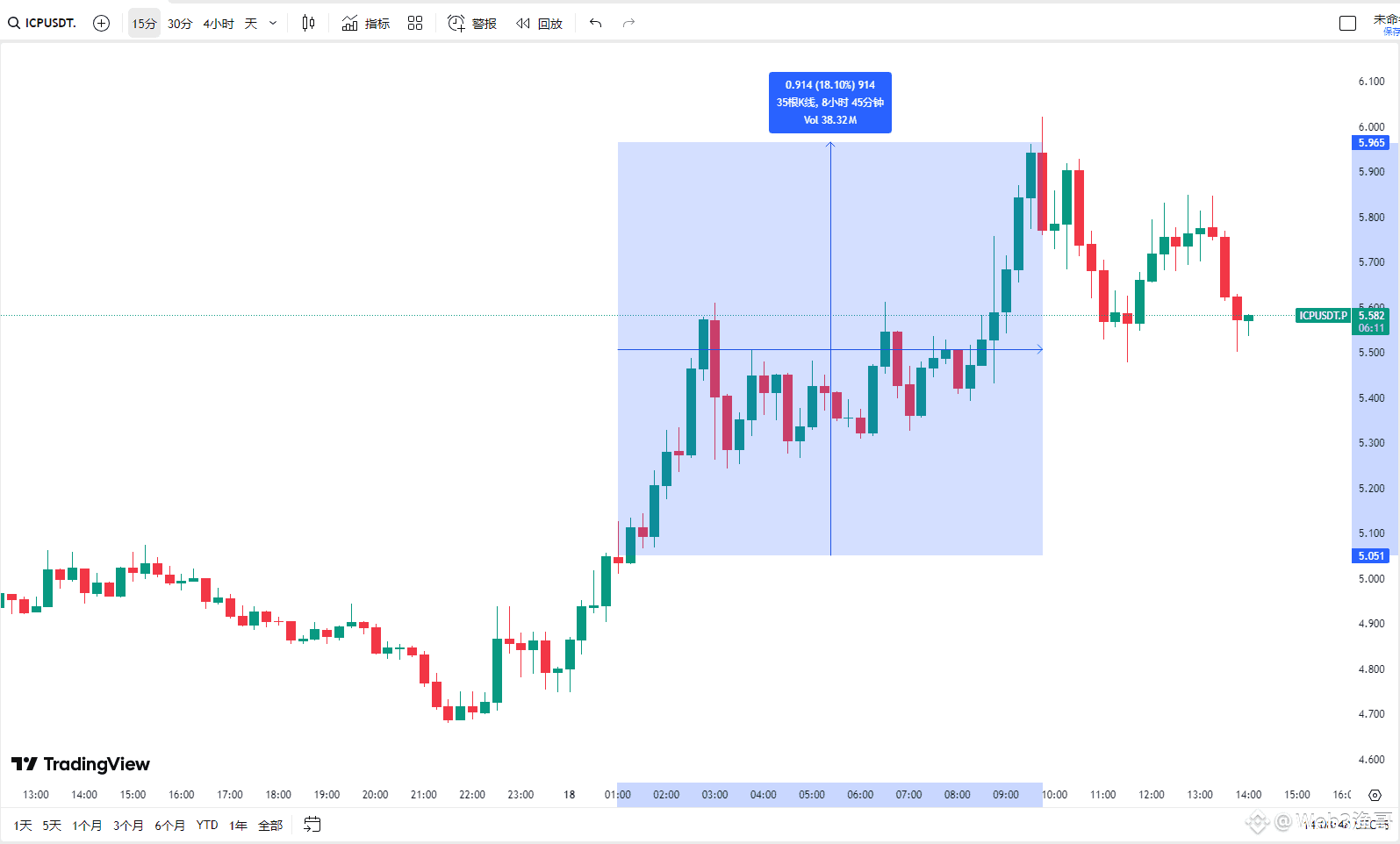

First point: Fast rises, slow falls—this is the big players accumulating shares.

A sudden surge followed by a slow pullback isn't a top, but a shakeout.

Don't rush to jump ship. The real danger is: a surge in volume followed by an immediate crash—that's a trap to lure in buyers and unload shares.

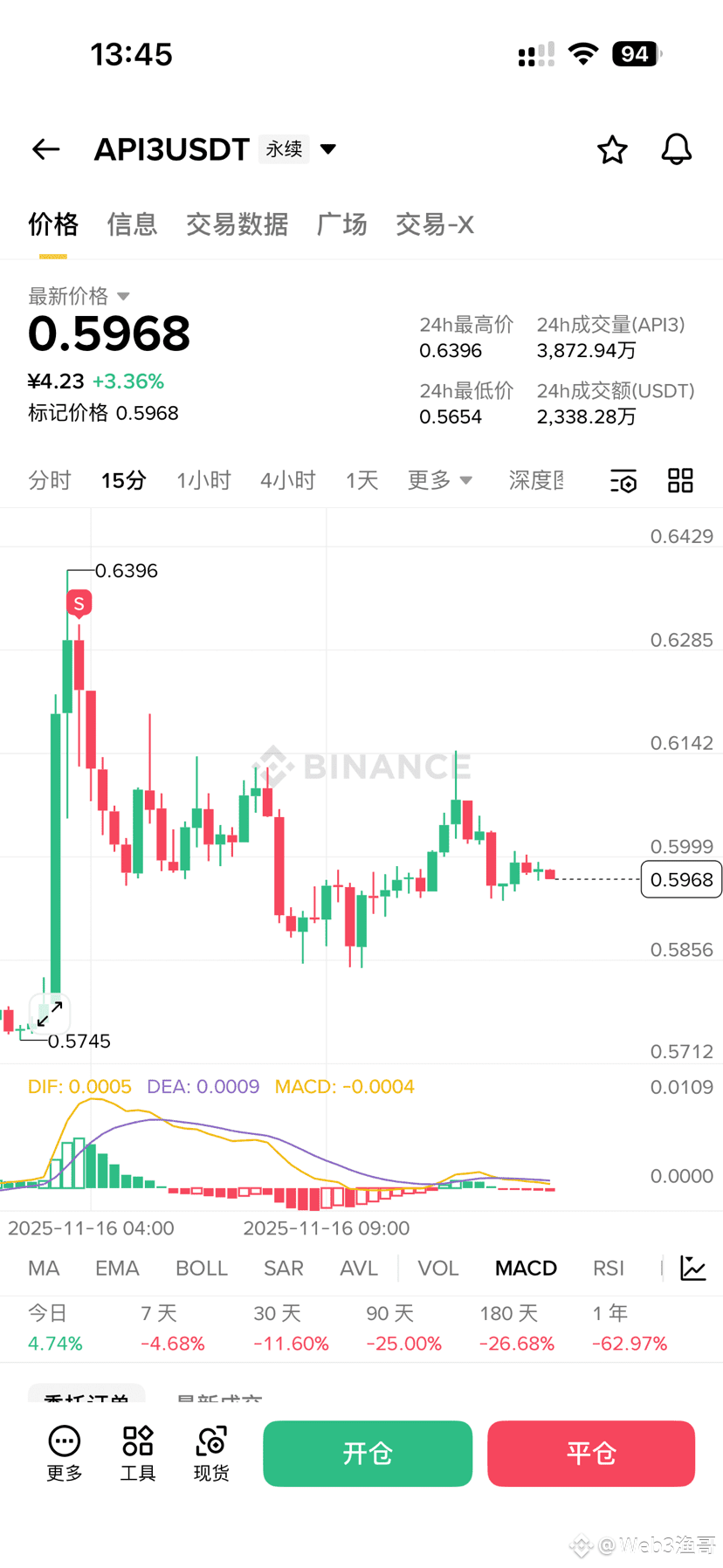

Second rule: A rapid drop followed by a slow rise—the big players are retreating.

A slow rebound after a flash crash may look like an "opportunity," but it's actually the final trap to lure in more buyers.

Don't ask, "Will it fall further after such a drop?"

The moment you ask that question is the sentiment the big players want.

Third rule: High volume at the top doesn't necessarily mean the end; no volume is the most fatal.

If volume continues to rise at high levels, the market often has another upward push;

But if volume shrinks and becomes lifeless at the peak, that's a signal that a collapse is imminent.

Fourth rule: Don't get excited about high volume at the bottom; look for "sustained volume."

A single huge volume spike is often a trap.

The true bottom is:

Low-volume consolidation → several consecutive days of high volume → improved market sentiment.

This rhythm is the logic behind the big players' accumulation.

Article 5: Cryptocurrency trading isn't about candlestick charts, it's about sentiment.

Trading volume is a mirror of consensus; candlestick charts are merely a surface appearance.

To see trends, look at volume;

To determine whether a breakout is genuine or false, also look at volume.

Weak volume indicates a false move.

Article 6: Achieving "nothingness" is the true beginning.

No obsession: Only then can you dare to stay out of the market;

No greed: Don't chase highs;

No fear: Dare to act.

This isn't being Buddhist; it's the strongest psychological quality of top traders.

There will always be market opportunities; the difficulty lies in having steady hands, a steady mind, and a smooth rhythm.

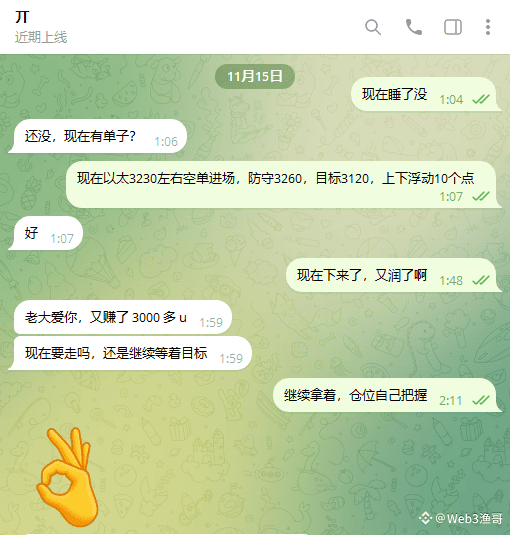

Price fluctuations don't determine your future. Being able to see the big picture clearly, having someone to guide you, will prevent you from repeatedly making the same mistakes.

The abyss is right beneath your feet; I'll only light one lamp—

Whether you have the courage to step ashore is your own choice.

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data