Running Finance - FinaceRun

Crypto Newbie

07-31 12:02

Follow

Analysts: The BTC market is about to cool, but the correction may be limited.

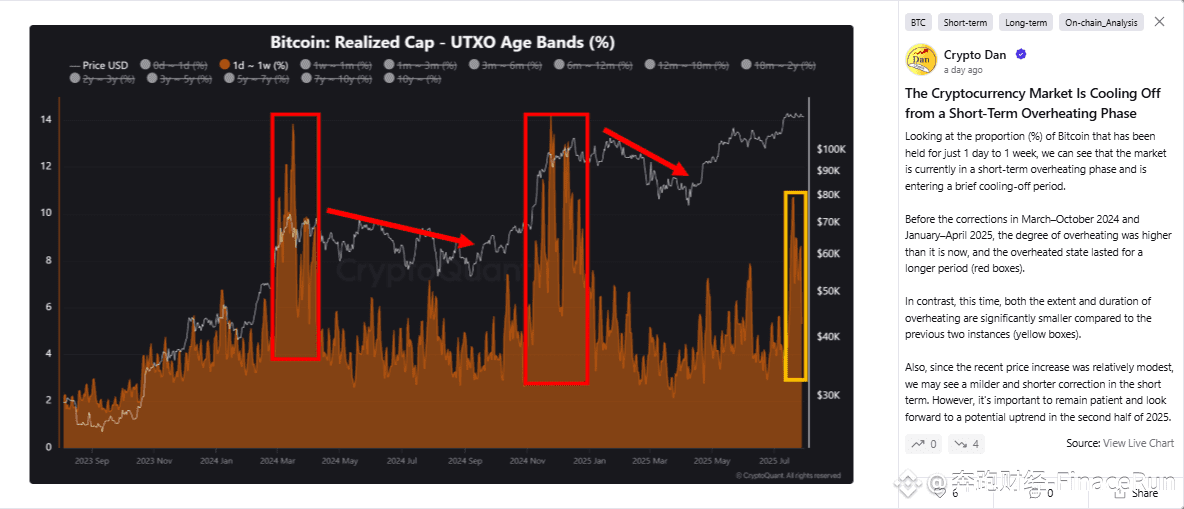

According to CryptoQuant analysis, the current market overheating is both less intense and less prolonged than previous corrections, suggesting that Bitcoin's correction may be relatively limited.

The agency predicts a brief market cooling, with Bitcoin likely facing only short-term, small declines in the near term, which is seen as part of a healthy cycle.

Observing Bitcoin's realized value and UTXO distribution over a one-day to one-week period, the intensity and duration of the current market correction are significantly weaker than the more intense and prolonged overheating period in 2024 and early 2025. Therefore, analysts expect this price correction to be brief and limited.

Analyst Axel Adler also observed that when Bitcoin reached $118,000, some long-term holders (LTH) began selling, and this trend is likely to intensify as the price rises. This pattern mirrors the cyclical price increases seen since the fall of 2024, when BTC prices rose from $65,000 to $100,000.

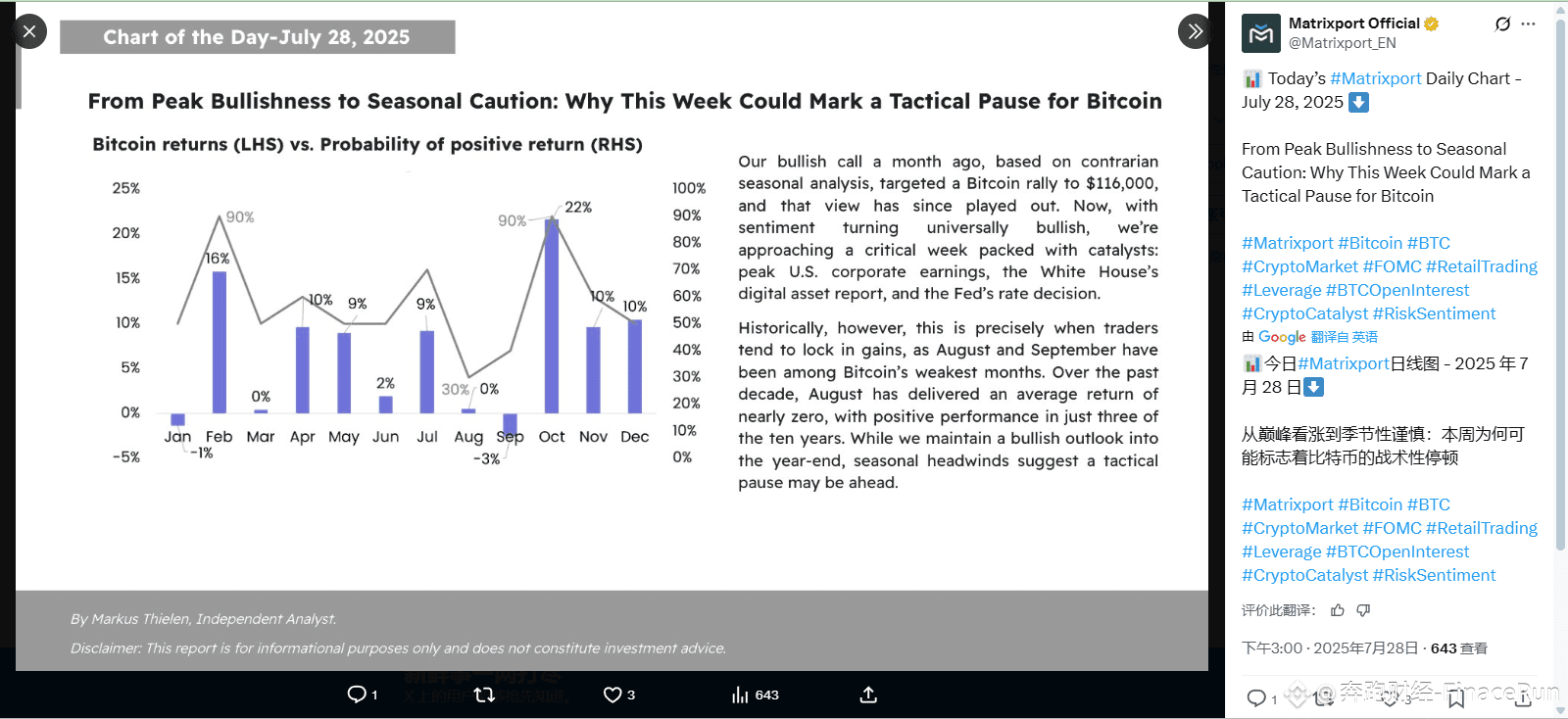

Meanwhile, macroeconomic uncertainty is also impacting the market. Matrixport warns that key macroeconomic events, such as the Federal Reserve's decision and the White House report on digital assets, may temporarily curb BTC's upward momentum. While the long-term bullish momentum remains, the historical weakness in August and September could trigger short-term profit-taking and sideways trading.

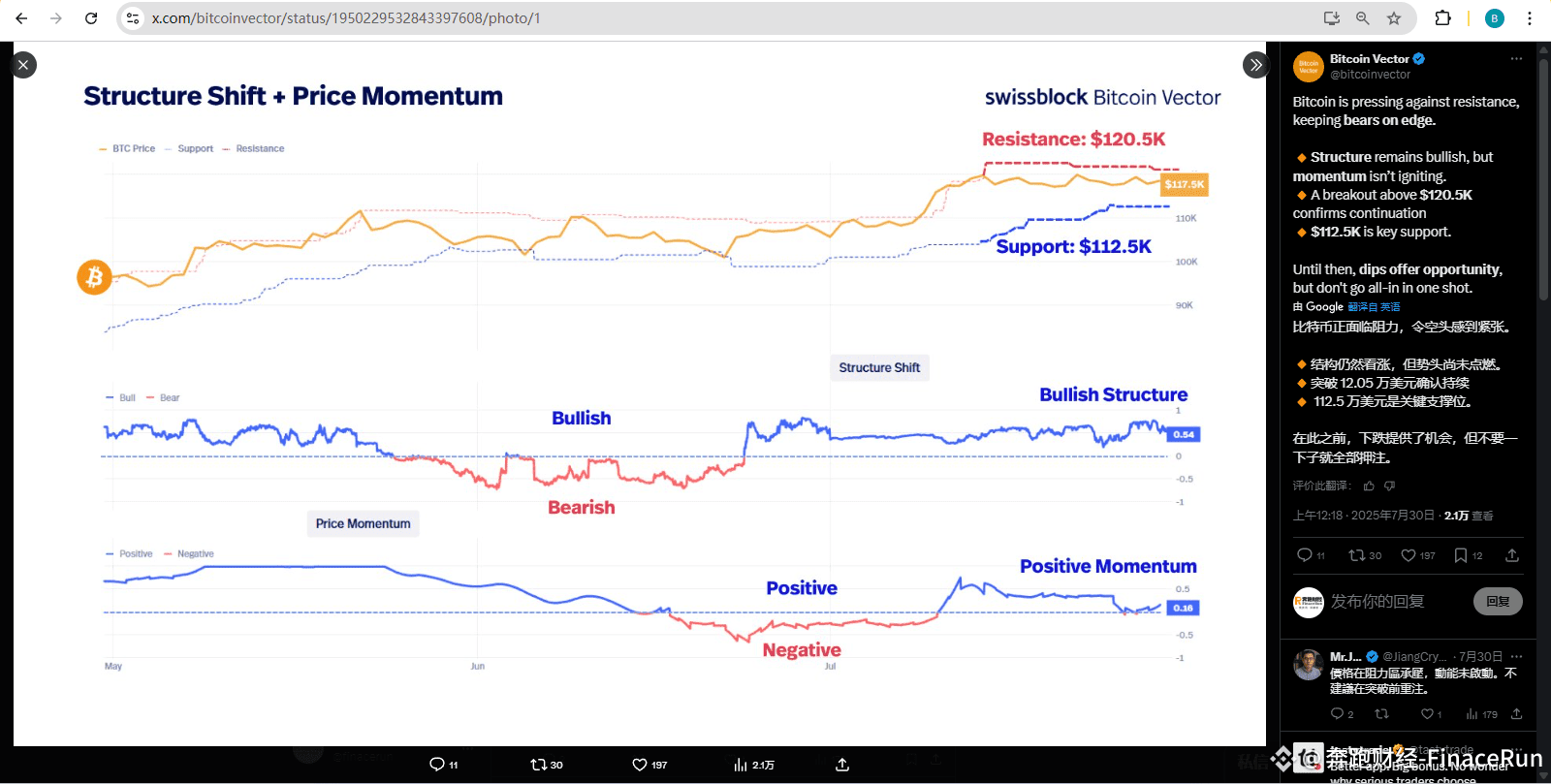

Amidst the market's temporary cooling, Bitcoin Vector also posted that Bitcoin is testing key resistance levels. While the overall structure remains bullish, upward momentum is somewhat lacking. A confirmed break above $120,500 would confirm the continuation of the upward trend, while $112,500 represents key support on the downside. Therefore, as long as BTC can maintain within this price range, a pullback could present an opportunity to enter the market.

In summary, while the current market shows some signs of overheating, the overall correction is expected to be relatively mild. Investors should closely monitor market developments and consider the impact of external macroeconomic factors to rationally plan their investment strategies.

What are your thoughts on Bitcoin's current correction? Do you believe it will be as mild as analysts predict, or will it lead to greater volatility? Leave your comments in the comments section!

#BitcoinMarket #Cryptocurrency #MarketAdjustment #Macroeconomy

BTC

-1.68%

Risk and Disclaimer:The content shared by the author represents only their personal views and does not reflect the position of CoinWorldNet (币界网). CoinWorldNet does not guarantee the truthfulness, accuracy, or originality of the content. This article does not constitute an offer, solicitation, invitation, recommendation, or advice to buy or sell any investment products or make any investment decisions

0

47

0

21

0

No Comments