Running Finance - FinaceRun

Crypto Newbie

07-31 10:50

Follow

White House Releases Digital Asset Strategy Report; Federal Reserve Holds Interest Rates on Hold for Fifth Consecutive Period

On July 31st, the White House released its long-awaited digital asset report this morning, a national strategy aimed at strengthening the United States' global leadership in blockchain, cryptocurrency, and tokenized finance.

Led by the White House's cryptocurrency and artificial intelligence director, the 166-page document integrates input from the Treasury, Commerce, SEC, and CFTC, and offers numerous recommendations for streamlining regulation, supporting innovation, and modernizing regulations.

While the report covers a wide range of digital asset policy areas, it does not provide a substantive update on the government's planned Bitcoin reserve, merely reiterating the language in President Trump's January executive order without outlining next steps or a timeline for implementation.

The report also emphasizes the need to improve the regulatory system through legislation, including specific recommendations such as expanding the authority of the Commodity Futures Trading Commission (CFTC) and supporting the development of decentralized finance (DeFi). It also calls on regulators to provide clearer policy guidance for digital asset innovation within existing legal frameworks.

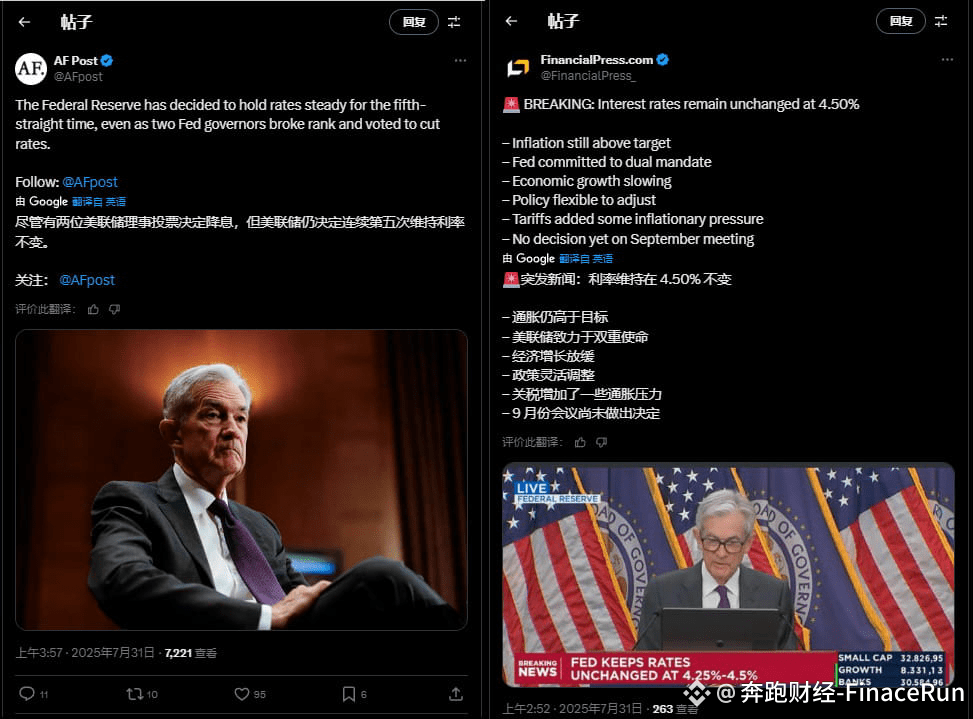

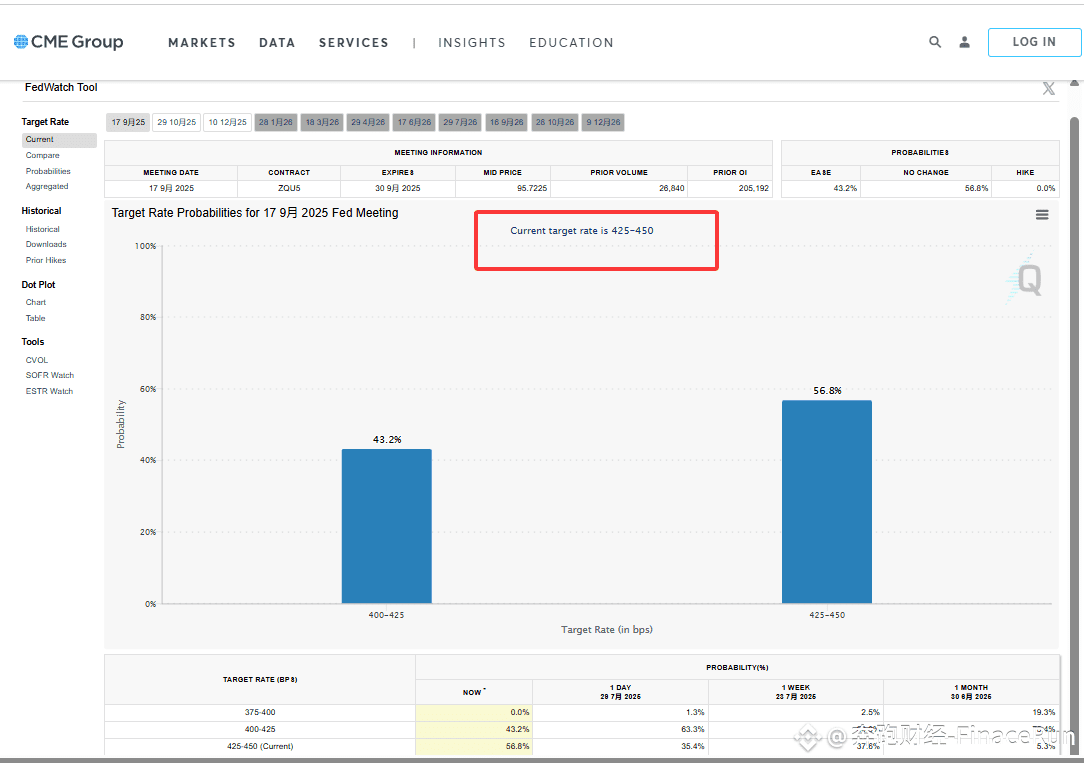

In stark contrast to the digital asset report, the Federal Reserve has remained on hold on monetary policy. The Fed maintained the benchmark interest rate at 4.25%-4.50% for the fifth consecutive meeting, largely in line with market expectations.

However, the decision was dissented by two Trump-appointed governors, who argued that current monetary policy was too tight. This marked the first time in over 30 years that two governors dissented, reflecting internal disagreements within the Fed over its monetary policy stance.

The Fed noted in its statement that while unemployment remains low and the job market remains solid, inflation remains slightly elevated, and economic growth slowed in the first half of the year. This wording reflects the Fed's reluctance to hastily cut interest rates before the path of inflation and employment is clear, and its high level of vigilance regarding the uncertain economic outlook.

These two important decisions reflect both the White House's proactive investment in emerging sectors and the Fed's cautious response to current economic risks, setting an important tone for the market environment in the second half of the year.

In short, innovation is acceptable, but risk is not; this is the prevailing tone of US policy.

#WhiteHouseDigitalAssetReport #FederalRepublic #InterestRate

BTC

-1.31%

Risk and Disclaimer:The content shared by the author represents only their personal views and does not reflect the position of CoinWorldNet (币界网). CoinWorldNet does not guarantee the truthfulness, accuracy, or originality of the content. This article does not constitute an offer, solicitation, invitation, recommendation, or advice to buy or sell any investment products or make any investment decisions

0

36

0

36

0

No Comments