$C

Understanding how to trade futures is a dead end.

Observe those who have managed to survive and consistently profit from long-term futures trading. Their common traits are very clear:

Never use high leverage

Never open a trade without a full position

Always set a stop-loss

Never go all-in, never gamble your life

In contrast, many new traders habitually make three fatal mistakes upon entering the market:

Full position

Maximum leverage

No stop-loss

Then they are wiped out by the market in less than three days, without even realizing their mistake.

Those who can trade futures for the long term usually only use one-third or even one-fifth of their position size for trial trading, ensuring sufficient margin.

If you always go all-in with 10U, open a trade with full leverage, and the commission fees pile up, you could lose even your principal after a few losses. Furthermore, some platforms don't refund commissions. In this case, you're not fighting the market, but rather giving the platform money.

Don't forget, Macau relies not on your wins and losses, but on commissions. The same is true in the futures market; commissions are a hidden killer.

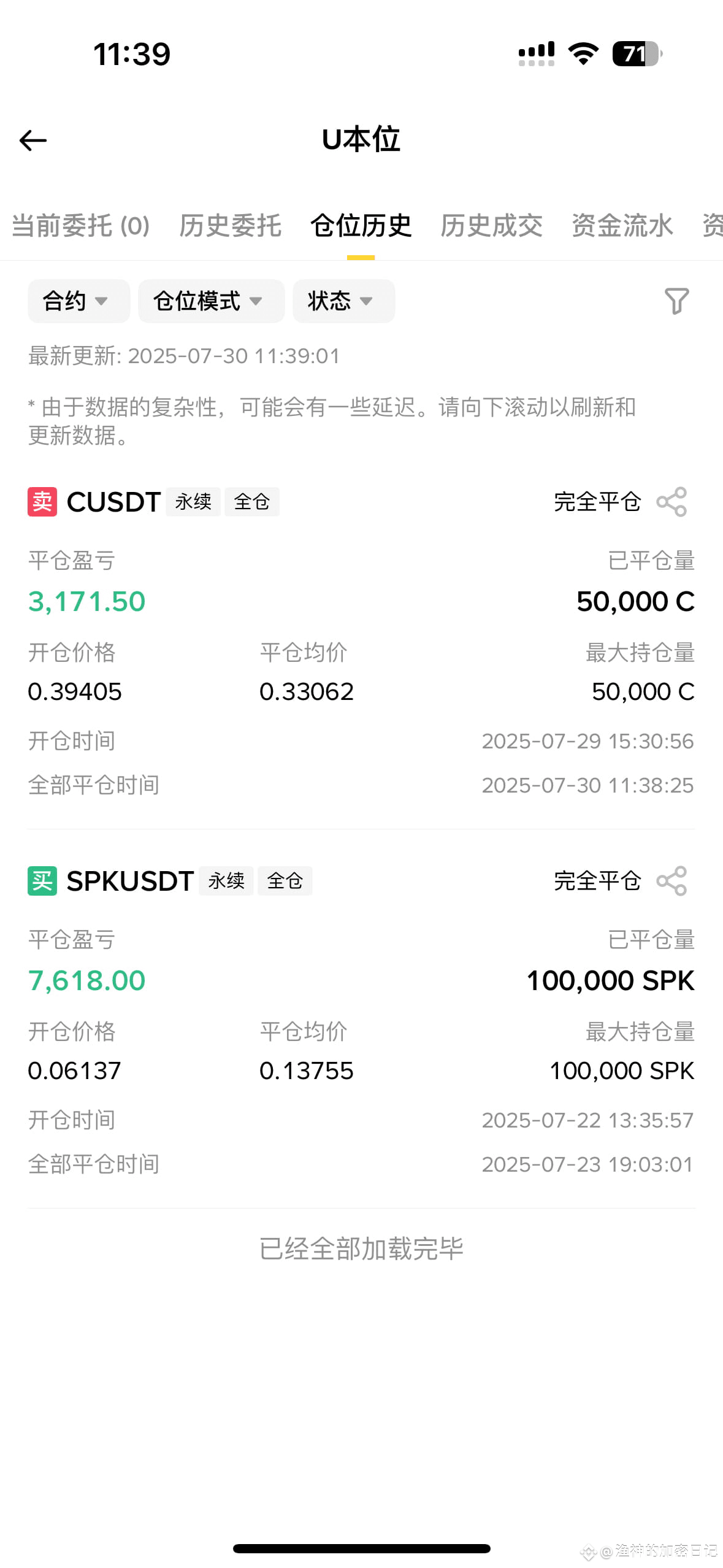

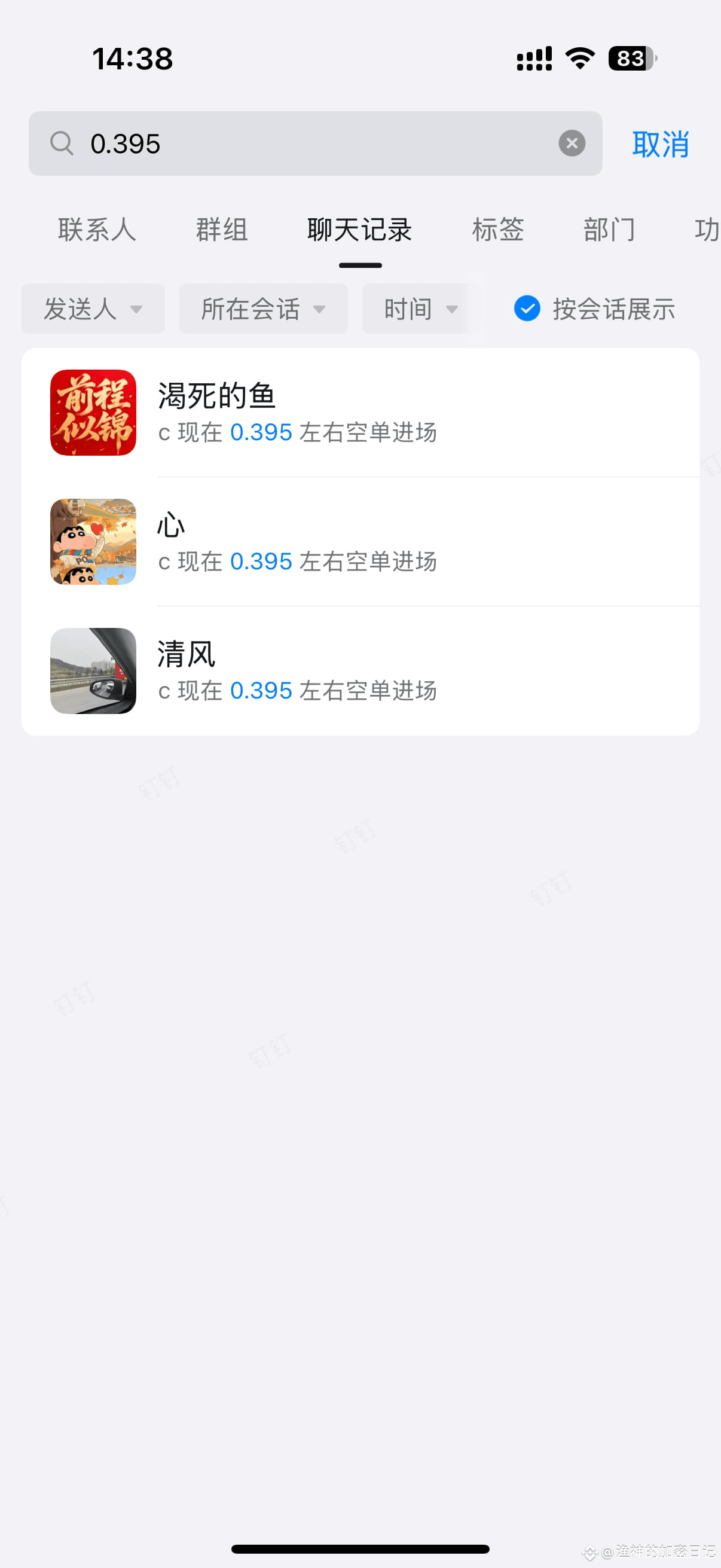

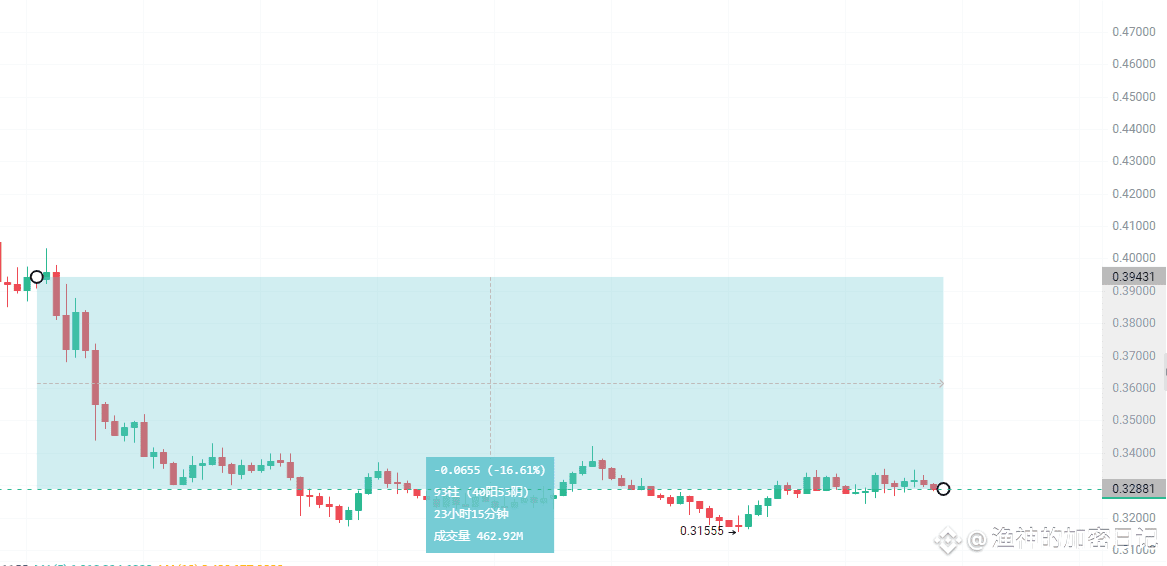

Like yesterday, my friends and I took a short position in C at 0.395. We didn't rush to close it, but held on steadily, with profits deposited directly into our accounts.

Why were we able to hold on? Because we had a clear understanding of our position, position control, direction judgment, and risk management plan, so we naturally took advantage of the market.

Remember this: Contract trading isn't about courage, but about knowledge and execution.

If you want to survive in contracts long-term, get rid of the "gambling" mentality.

If you want to make stable profits, learn to control risk first. Only after you can achieve these two points can you be qualified to consider turning over a position.

The cryptocurrency world is full of pitfalls. Don't jump in headfirst and regret it later. See clearly before you act. 💪

{future}(CUSDT)