I saw the news @yalaorg that Yala's TGE will be held next week, just when Bitcoin has just reached a new high, Bitcoin and Bitcoin are climbing to new heights, liquidity is abundant, and sentiment is Fomo.

Looking back, Babylon's TGE was accidentally held in mid-April, which was the only time Bitcoin fell below 80K this year.

It's really fate and time.

Someone once asked what the difference is between the two BTC Fi. Today, I'm going to open a post to talk about it on the eve of TGE.

First, it's the implementation method of the protocol.

Babylon will have its own independent L1 in the future, using Bitcoin collateral as an additional security guarantee, and its status is somewhat similar to that of Bitcoin sidechains. Specifically, $BABY holders will run PoS nodes and be responsible for block generation; while Bitcoin collateralists are responsible for verification and final signatures.

The advantage of this is that independent L1 has faster performance and greater freedom.

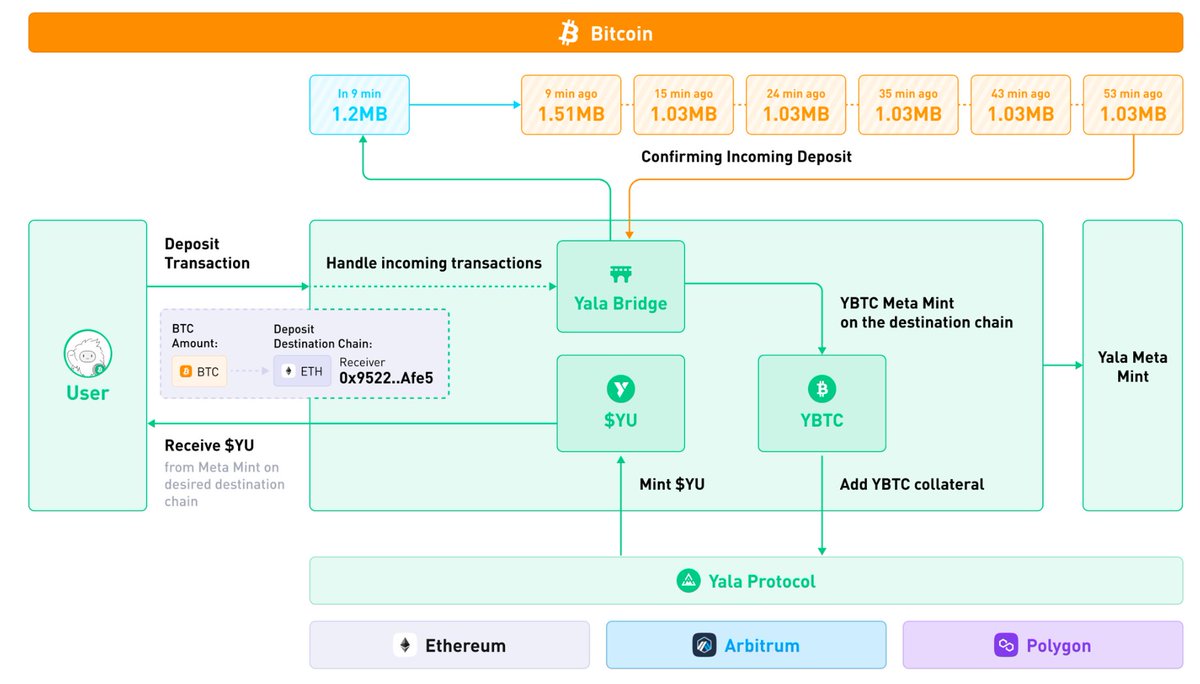

Yala, on the other hand, directly uses Ethereum as the settlement layer and will not issue its own chain, which is equivalent to a packaged version of Bitcoin. In this way, the chain security is guaranteed by Ethereum, and the bottleneck of protocol security is mainly concentrated on cross-chain bridges and multi-signatures.

The advantage of this is that the use of Ethereum will obtain better compatibility, and obviously, product development will be faster.

In addition, the product goals of the two are also different.

After Babylon has its own L1, it will focus on DeFi, RWA and various applications like other public chains. The main focus is a big and comprehensive one.

After Yala crossed BTC to Ethereum, it focused on the stablecoin track. It allows $YBTC to over-collateralize the stablecoin $YU (somewhat similar to ETH over-collateralizing DAI/USDS in MakerDAO), so $YALA specializes in stablecoins.

Considering the recent smooth progress of the genius bill, it is also timely to take advantage of the east wind.

Now more and more people realize that the killer applications of blockchain are actually - Bitcoin, Ethereum and stablecoins, and the applications built around them hope to add icing on the cake.