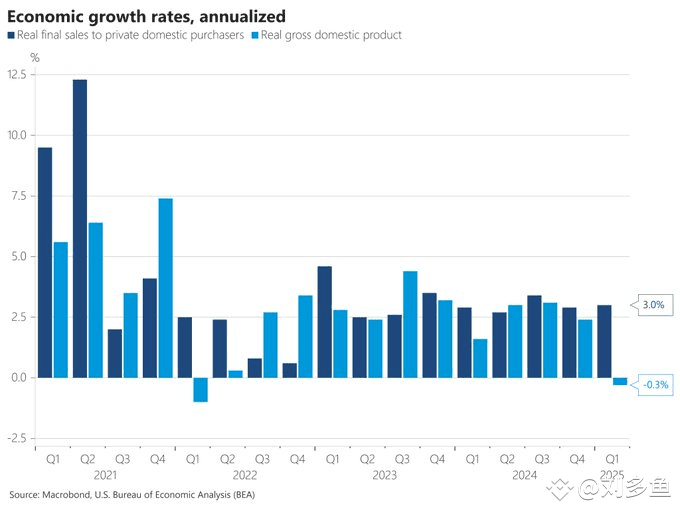

Trump has begun to turn the blame to retired men again. It is easy to understand that tariffs bring short-term domestic demand growth. Tariffs come at the cost of weakening global division of labor, and global division of labor is the core source of modern economic efficiency. The US is now relying on tariffs to increase domestic demand, which is actually a kind of anti-globalization attempt that is drinking poison to quench thirst.

The cliff-like decline in GDP should be a bit humid. The United States insists on adjusting its long-term industrial structure with tariffs. In the long run, international competitiveness is declining, which is not conducive to long-term industrial return.

In the future, global capital investment will shift more to regional collaboration systems such as Asia-Pacific + ASEAN + Middle East + Latin America, and the trend of system marginalization in the United States will intensify. After World War II, a world dominated by unipolar economies will move towards a multipolar composition. The economy is building a new world economic map of multi-center, multi-currency, multi-nodes. It is a good thing for everyone in the long run, and any industry currency circle will also benefit from a diversified economic world.

$BTC $ETH $BNB #btc #eth #bnb

{spot}(BNBUSDT)

{spot}(ETHUSDT)

{spot}(BTCUSDT)