Bitcoin and Ethereum spot ETFs are in net inflows, while BlackRock's single-day net inflows ranks first

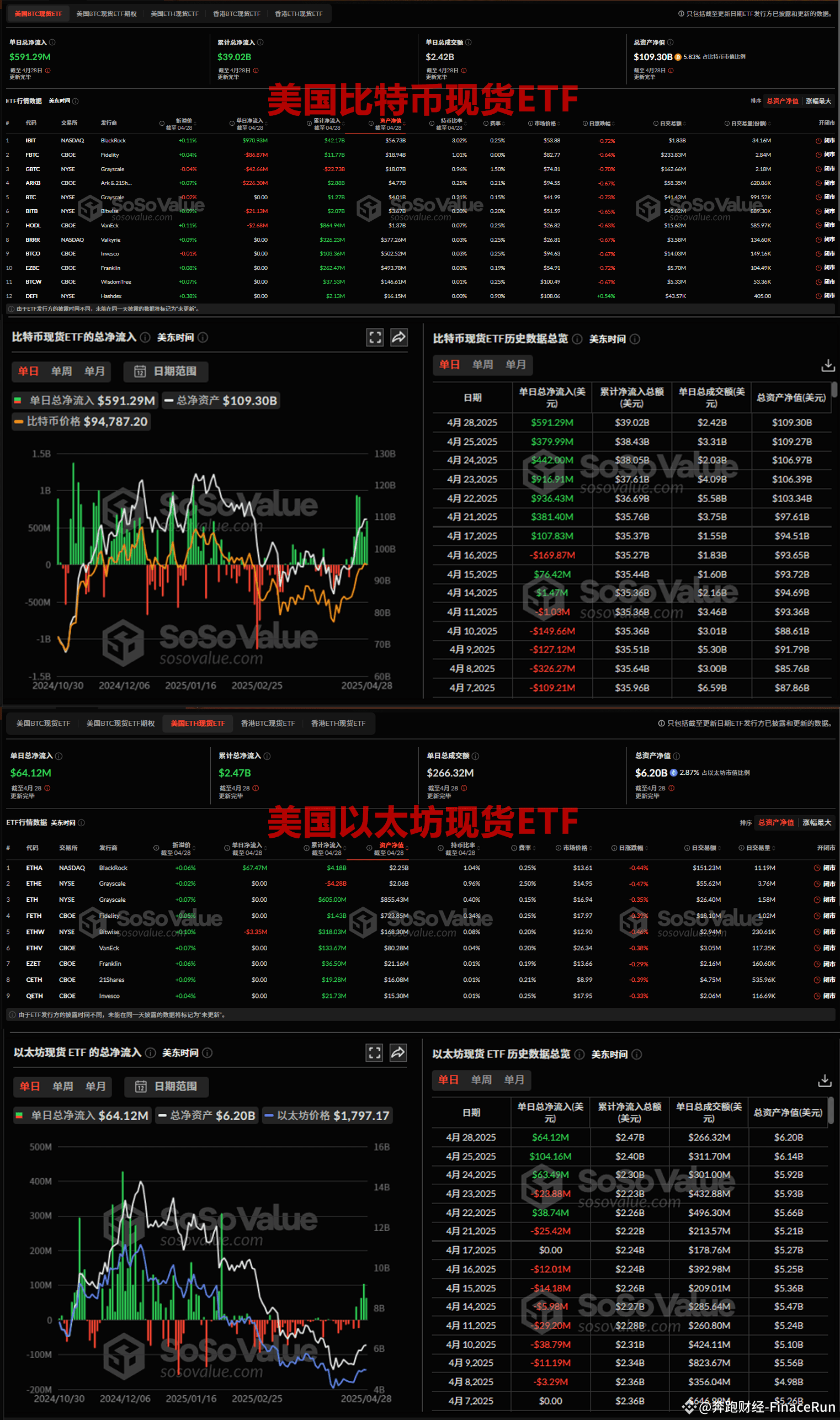

According to SoSoValue data, the total net inflow of Bitcoin spot ETFs in a single day was US$591 million yesterday, recording a net inflow of funds for seven consecutive days.

Among them, Blackrock Bitcoin spot ETF IBIT was the only ETF with net inflows of funds that day, with a net inflow of US$971 million in a single day. Currently, IBIT has a cumulative net inflow of US$42.17 billion.

It is worth noting that Ark & 21 Shares Bitcoin ETF ARKB recorded a net outflow of US$226 million yesterday, ranking first in the daily net outflow. The second is Fidelity Bitcoin ETF FBTC, which recorded a single-day net outflow of US$86.87 million.

Grayscale Bitcoin ETF GBTC, Bitwise Bitcoin ETF BITB and VanEck Bitcoin ETF HODL recorded net outflows of US$42.66 million, US$21.13 million and US$2.68 million respectively in a single day.

As of now, the total net asset value of Bitcoin spot ETFs is US$10.93 billion, accounting for 5.83% of the total market value of Bitcoin, and the cumulative net inflow has reached US$39.02 billion.

On the same day, the total net inflow of Ethereum spot ETFs was US$64.12 million in a single day, recording a net inflow of funds for three consecutive days.

Among them, Blackrock's Ethereum ETF ETHA has a single-day net inflow of US$67.47 million, and the cumulative net inflow of ETHA has reached US$4.18 billion.

However, Bitwise ETF ETHW recorded a net outflow of US$3.35 million in a single day, and the cumulative net inflow of ETHW has reached US$318 million.

As of now, the total net asset value of Ethereum spot ETFs is US$6.2 billion, accounting for 2.87% of Ethereum's total market value, and the cumulative total net inflow has reached US$2.47 billion.

Overall, the market's enthusiasm for ETF investment in Bitcoin and Ethereum continues to rise, especially BlackRock's products have performed outstandingly among many ETFs, becoming the focus of a new round of investment.

What do you think of this net inflow of funds? Does it mean that more investors have already participated in crypto derivatives?

#Bitcoin ETF #Ethereum ETF #Fund flow