Analysts Warn: Bitcoin Has Broke Below 100-Week SMA, Historical Patterns May Lead to a 50% Deep Correction

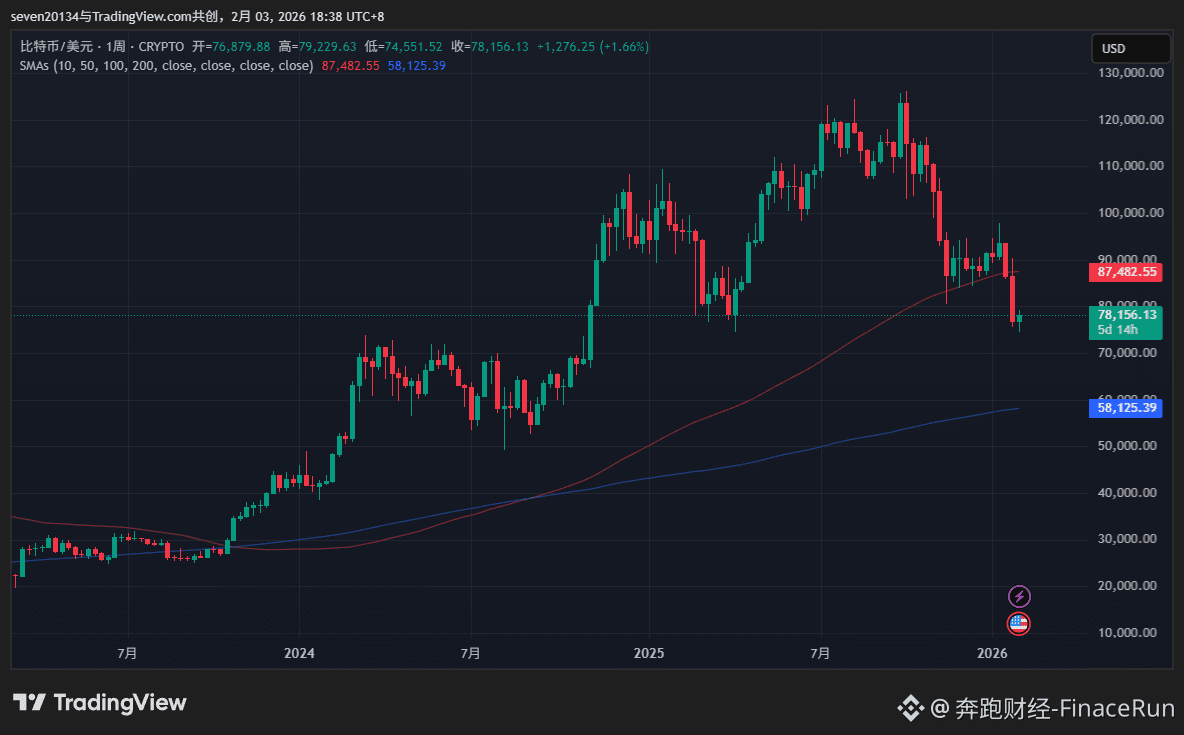

February 3rd news: According to on-chain analyst Ali Charts, Bitcoin closed below the key macro support level of the 100-week Simple Moving Average (SMA) last week, indicating a pessimistic market sentiment.

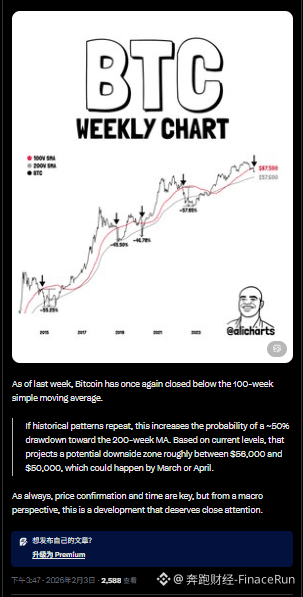

Analysts believe that if historical patterns repeat themselves, a deep correction of 45% to 58% may occur within the next 30 to 50 days. This is because, historically, Bitcoin's breach of the 100-week moving average has often been a prelude to a test of the 200-week moving average.

Specifically, since 2015, every time Bitcoin broke below this level, it failed to recover quickly and ultimately fell to near the 200-week moving average. For example:

* In December 2014, after Bitcoin broke below its 100-week moving average, it plummeted 55% in 35 days.

* In November 2018, after falling below its 100-week moving average, Bitcoin retraced 45% in 28 days.

* In March 2020 (affected by the pandemic-induced price drop), Bitcoin fell from its 100-week moving average to its 200-week moving average in just one week, a 47% correction.

* In May 2022, after breaking below its 100-week moving average, Bitcoin underwent another 49-day correction, ultimately resulting in a 58% drop.

Based on these patterns, the downtrend from when Bitcoin breaks below its 100-week moving average to when it touches its 200-week moving average typically lasts between 30 and 50 days.

It is worth noting that Bitcoin's closing price last week again fell below its 100-week SMA. If historical patterns repeat themselves, this round of correction could see a drop of approximately 50%, with a target price between $50,000 and $56,000, potentially occurring between March and April of this year.

Overall, while the above projections are purely based on historical price patterns and provide a technical risk warning for the market,

history does not simply repeat itself. The final price movement will depend on the combined effects of the macroeconomic environment, regulatory policies, and market structure. Participants need to remain cautious and flexible.

#Bitcoin #DownsideRisk