🚨 Tomorrow will be the worst day of 2026!!

The latest macroeconomic data has just been released, and the situation is far worse than expected.

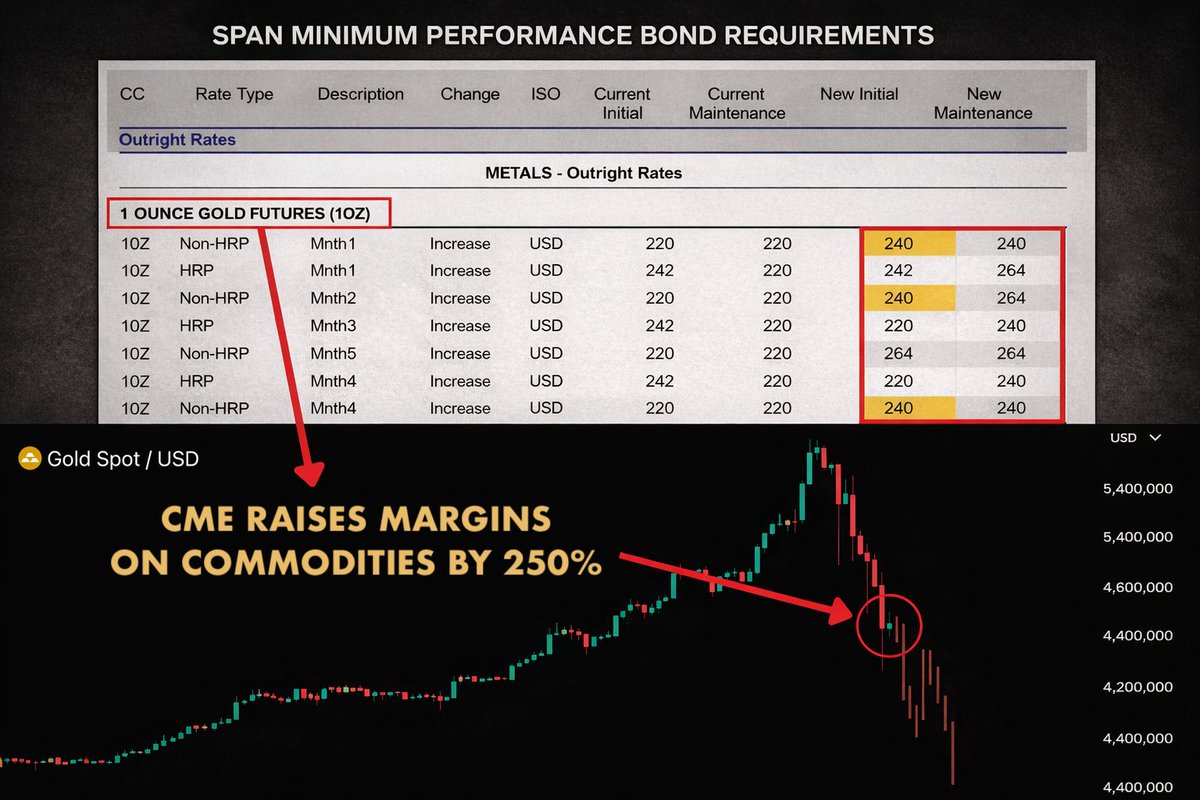

The CME Group has raised margin requirements again—the second time in three days.

This is unprecedented.

This is not normal.

This is panic.

What will happen next:

Maintenance costs are about to skyrocket.

Look at these crazy gains:

→ Gold: +30%

→ Silver: +35%

→ Platinum: +25%

→ Palladium: +15%

This is not "risk management."

This is a desperate move.

Don't be fooled by their volatility theories.

This is not about maintaining market order.

This looks like a large institution about to collapse, with the entire system racing against time to control the situation before it spills over into clearing houses and the wider financial system.

What we saw on Friday was not a real sell-off.

It was forced liquidation.

A margin-driven bloodbath—positions were wiped out because they had to, not because anyone wanted to exit.

And now, they're tightening controls further.

Let's look at the bigger picture.

When liquidity disappears, asset prices don't just correct gently…they crash.

Stocks, cryptocurrencies, commodities.

In a true deleveraging event, nothing is spared.

Confidence vanishes rapidly.

Funds freeze.

Volatility explodes.

And policymakers resort to the same tactics: regulation, restrictions, and bailouts.

This is how a crash unfolds—not all at once, but in waves.

A major market crash is imminent in the coming months.

When I officially exit the market, I will announce it publicly.

No hindsight excuses.

Many will deeply regret ignoring this, not taking it seriously sooner. Warning over.

Please pay attention and enable notifications before it's too late.