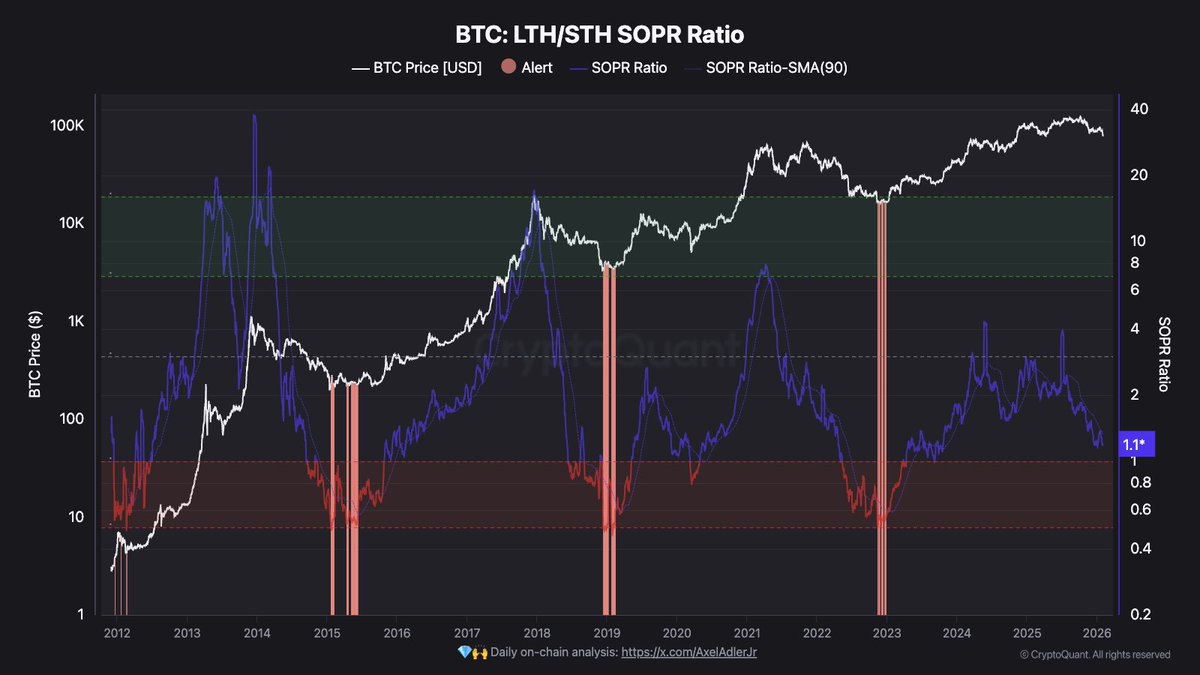

The BTC LTH/STH SOPR ratio is approaching the capitulation warning zone. ⚠️

Key Point: Market sentiment is often more important than price.

This indicator can help you determine who will collapse first.

Points I Watch:

- If the ratio falls below 1 = STH holders are selling at a loss (stress/forced selling)

- If the ratio remains above 1 = Market sentiment is stabilizing, and the pullback may be nearing its end.

Background:

- This is not a macro bottom prediction.

- This is a market stress indicator. Monitor it closely, but don't rely on it excessively.

LTH vs. STH:

- STH (Short-Term Holders) = Holders with less than 155 days of holding time. They react more strongly and are more prone to panic.

- LTH (Long-Term Holders) = Holders with more than 155 days of holding time. Typically patient investors.

SOPR (Spending-to-Output Profit Margin) indicates whether the transferred coins are profitable or loss-making:

- SOPR > 1 = Profit Transfer

- SOPR < 1 = Loss Transfer

Therefore, the LTH/STH SOPR ratio compares who is realizing profits and losses:

- Ratio Decrease = STH losses increase relative to LTH. Stress/Capitulation Risk.

- Ratio Stable/Increasing = Weak players exit, stress relieved.

My Understanding: This is a sentiment/stress indicator, not a magic stop-loss button.