Robert Kiyosaki: Market Crashes are a "Discount Season" for the Rich, Who Are Holding Cash to Buy Gold, Silver, and Bitcoin at Bargains

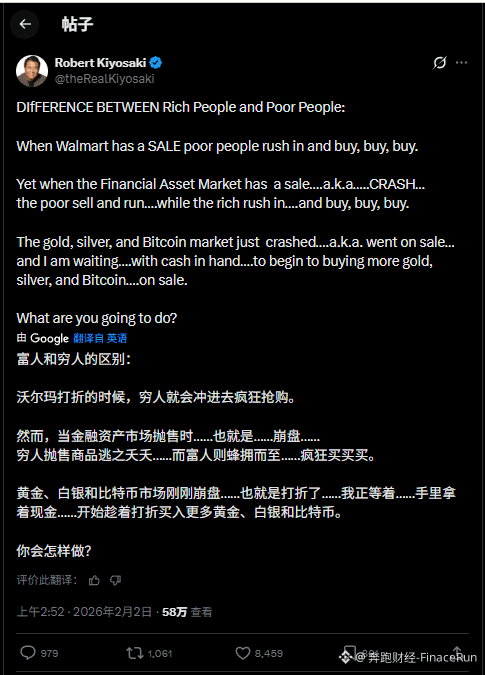

On the morning of February 2nd, Robert Kiyosaki, author of the bestselling book *Rich Dad Poor Dad*, posted on his social media platform X, comparing financial market crashes to "asset discount sales," sparking widespread discussion.

He illustrated this by pointing out that during supermarket promotions like Walmart, the poor flock to the stores and scramble to buy; however, during a market crash where financial assets are "discounted," the poor often panic and sell off, while the rich seize the opportunity to buy in large quantities.

Kiyosaki stated that the gold, silver, and Bitcoin markets are currently experiencing a crash, meaning these assets are entering a "discount sale" phase; he also revealed that he is currently holding cash and waiting for the right opportunity to increase his holdings of gold, silver, and Bitcoin.

It's worth noting that Kiyosaki is known for his bearish views on fiat currencies and his advocacy for hard assets. His definition of the asset price decline caused by market panic selling as a "discount sale" implies that the current correction in gold, silver, and Bitcoin presents a good entry opportunity for value investors.

Overall, at a time when the crypto market is experiencing record-breaking liquidations and a period of low sentiment in gold and silver, the public pronouncements of opinion leaders like Kiyosaki not only add new focus to the market discussion but also bring his contrarian investment logic back into the spotlight.

#RobertKiyosaki