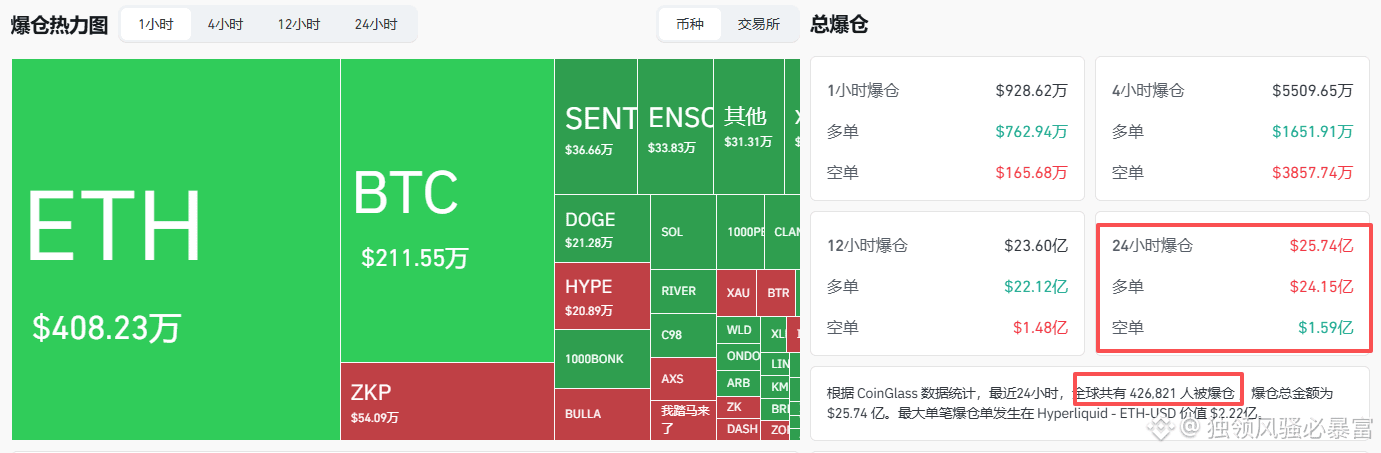

The tenth largest single-day liquidation in history has been recorded, surpassing the record set on May 13, 2021; that night, the market plundered $2.6 billion, leaving 426,557 people bankrupt and with nothing!

Looking back at the top ten largest liquidations in the cryptocurrency market, April and May 2021 accounted for four of them, meaning that eight of the top ten were during the so-called bull market of 2021!

This is also why bull markets often experience sharp crashes!

These past few days, some people have been asking if we're still in a bull or bear market. My unified answer is: forget about bull or bear markets, just treat it as a normal financial derivatives market; this week, bulls have deeply experienced the harsh reality of how difficult it is to make money!

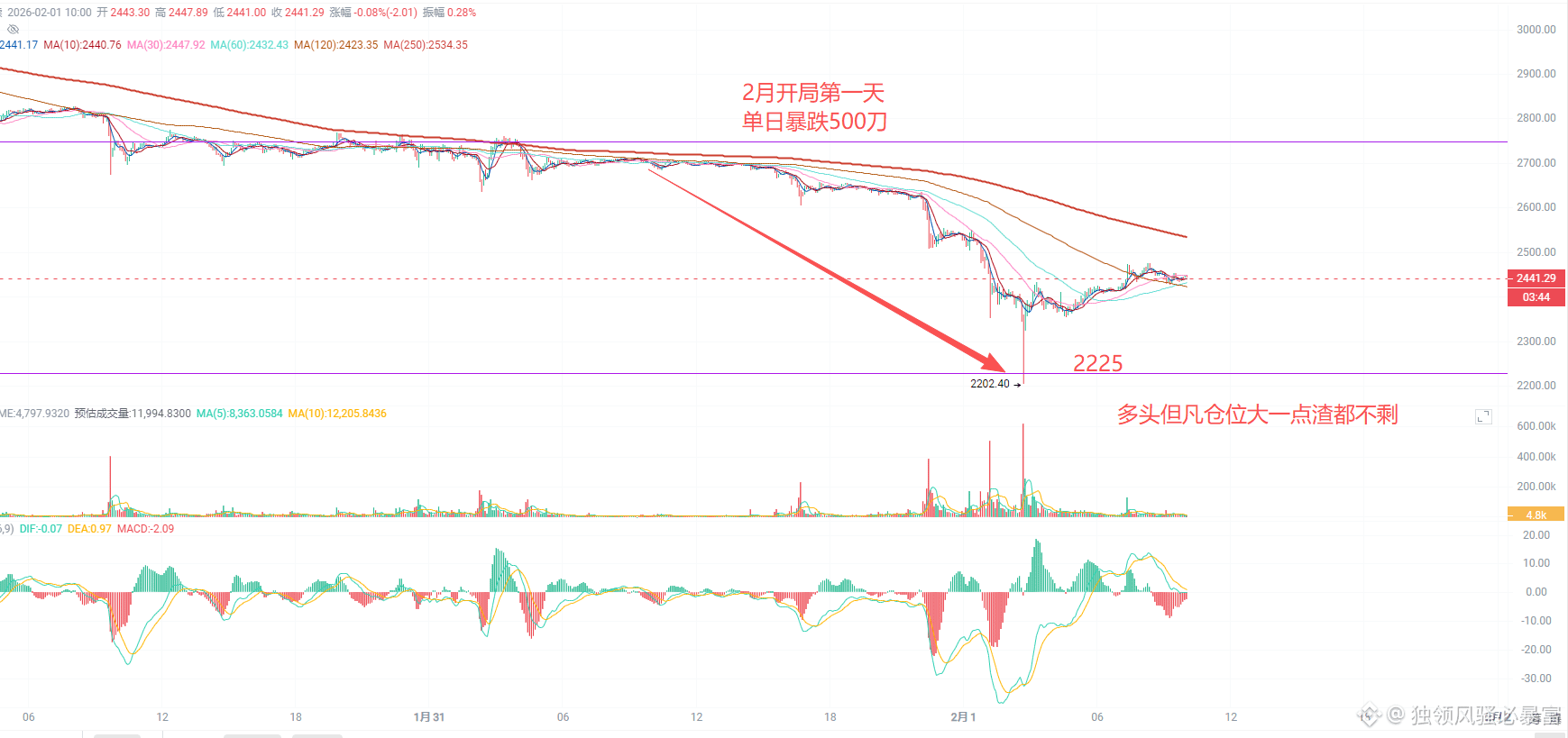

Today's brutality is second only to the recent 10/11, which can be seen as echoing 10/11.

BTC support is at 70900-74450; a break below this range would likely lead to a drop below 60000.

Resistance is at 83960-86670. The current market liquidity is waning, with gold, silver, and US stocks aggressively seizing market share, and memes running rampant. Over the past two years, this market has consumed approximately 50-70% of the users and funds cultivated over five years.

For things to improve, memes must die out, because this kind of trading does nothing to retain existing funds; on the contrary, it requires the high-quality users and funds from the past five years to continuously absorb these losses.

Gold, silver, and US stocks are viable, but if various platforms heavily promote them, doesn't that send a signal that the consensus on BTC as an absolute digital gold standard is no longer supported? This is a double-edged sword! A balance is needed!

You can't have gold and silver, memes, and a stable BTC all at once. Making choices is often the hardest part. After the major consolidation and upheaval, there will be waves of desperate retail investors.

ETH Support: 2225, Resistance: 2749. I predicted a drop this week, and even with Monday's early morning plunge, I didn't expect it to reach 2225 so quickly. Yesterday, my trades plummeted by $500, and BTC dropped by $9000 in a single day. Amidst the heated, albeit silent, criticism yesterday, it was ultimately retail investors who paid the price!

"When the city gates catch fire, the fish in the moat suffer"—the ancients were right!

Those with open positions should honestly engage in day trading. Don't just buy and sell, or hold onto a 1% position indefinitely. Observe the situation calmly!

#USGovernmentShutdown

{future}(ETHUSDT)

{future}(SOLUSDT)

{future}(BTCUSDT)