There aren't that many reasons for the decline! It's simply due to insufficient liquidity!

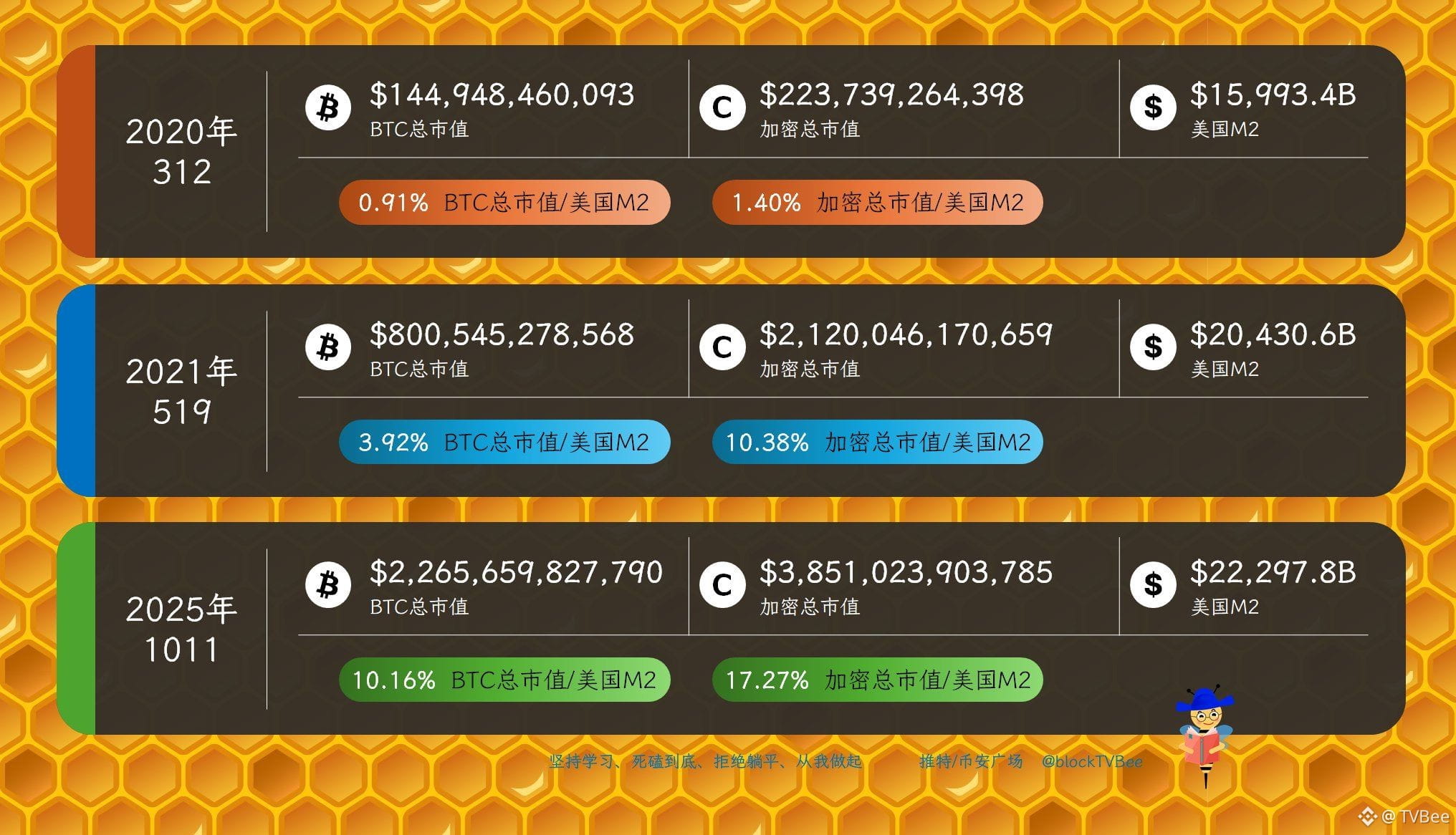

On March 12, 2020, BTC's market capitalization accounted for only 0.91% of US M2, and the total cryptocurrency market capitalization accounted for only 1.4% of US M2.

On May 19, 2021, BTC's market capitalization accounted for 3.92% of US M2, and the total cryptocurrency market capitalization accounted for 10.38% of US M2.

By October 11, 2025, BTC's market capitalization accounted for 10.16% of US M2, and the total cryptocurrency market capitalization accounted for 17.27% of US M2.

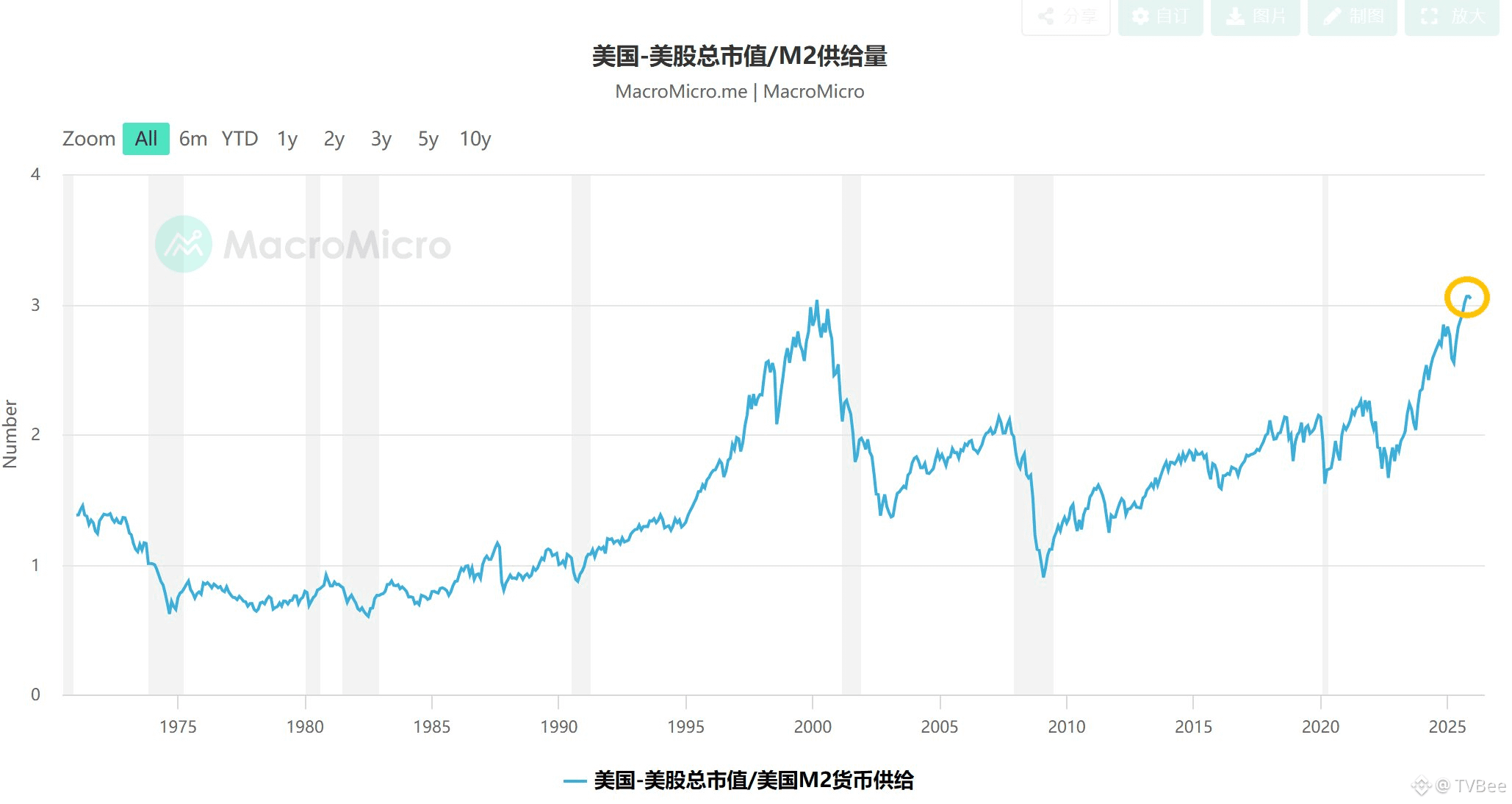

At this point, cryptocurrencies are extremely dependent on and sensitive to macro liquidity! Therefore, Trump's announcement of a 100% tariff increase on October 10th caused a collapse in the crypto market.

Even a strong stock market like the US stock market will see its total market capitalization/M2 ratio reach a peak in October 2025, similar to the peak in 2000, before declining in November.

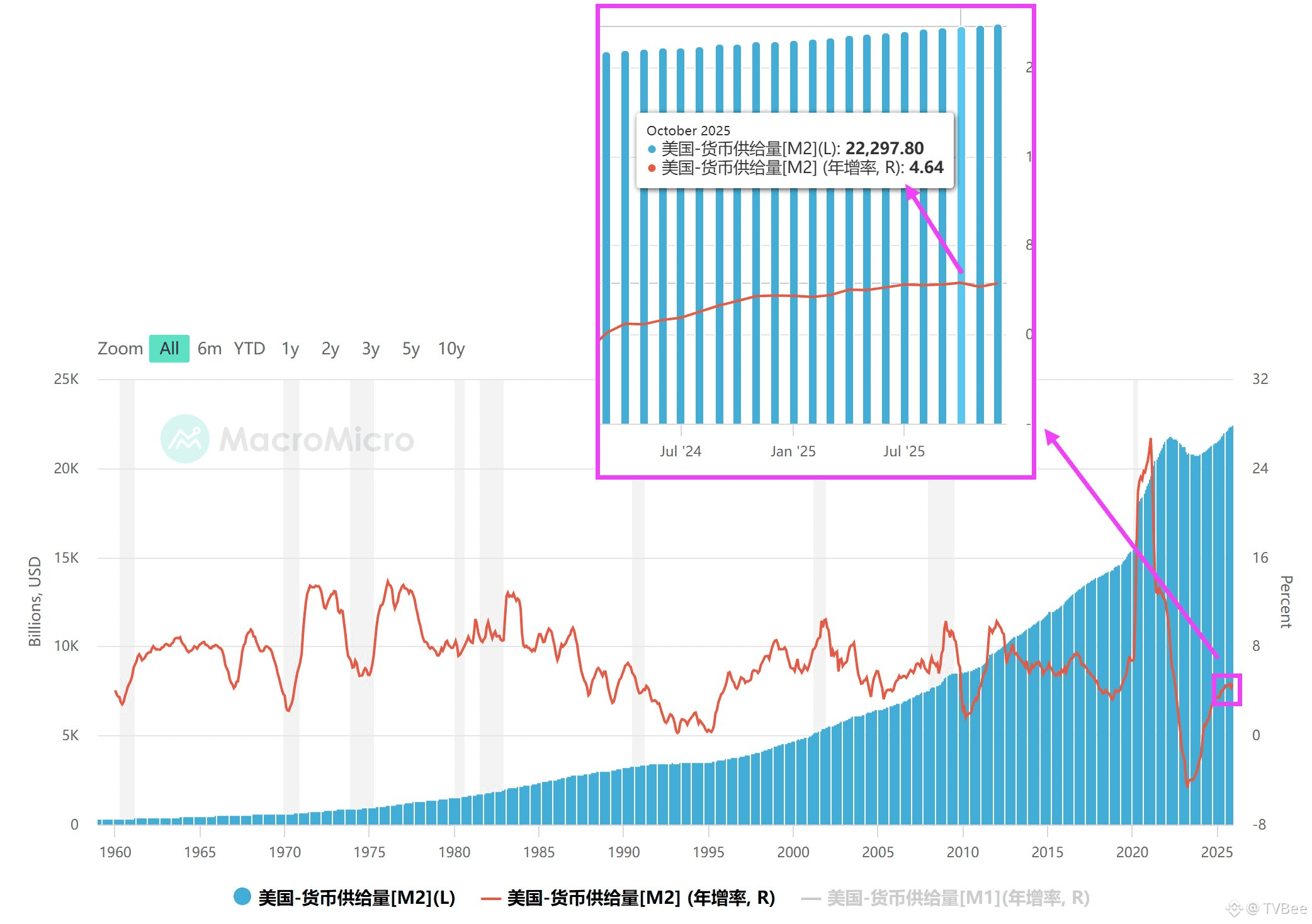

Because the M2 annual growth rate is a direct reflection of market liquidity, cryptocurrencies are more strongly correlated with the M2 annual growth rate.

However, the overall M2 annual growth rate in 2025 is at a historically low level, and in October 2025, the growth rate is close to zero, even beginning to decline in November.