Beware of the risk of a gold price correction!

┈┈➤ Technical Analysis Shows Gold is Overbought

While technical analysis can be ineffective for assets like gold,

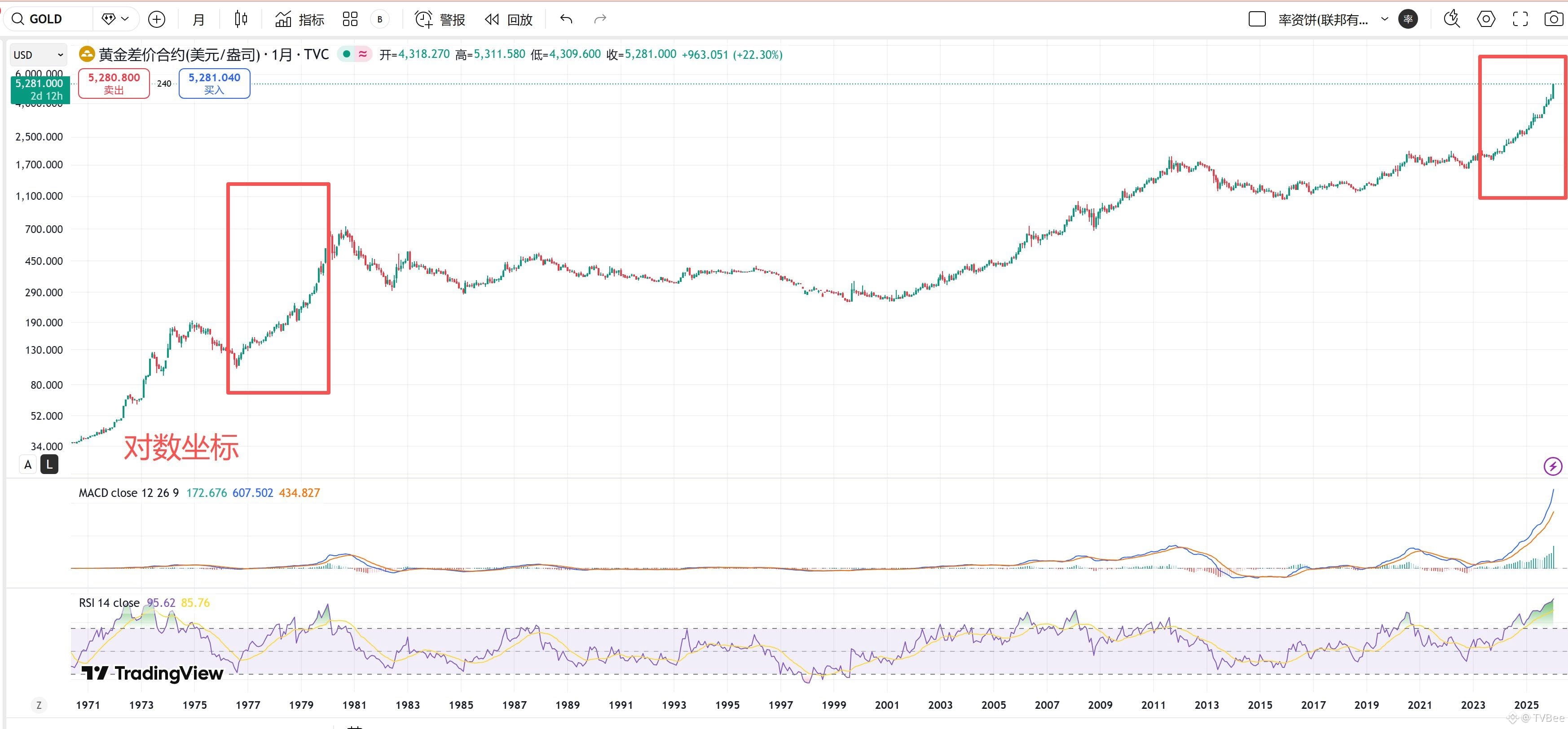

the monthly RSI is 95.6, the weekly RSI is 82.8, and the daily RSI is 88.5, all indicating overbought conditions. The monthly overbought level is likely the highest in 55 years.

┈┈➤ History is Strikingly Similar

First, comparing historical data on a logarithmic scale, the current situation is somewhat similar to that before Reagan took office in 1979.

Second, the US economy experienced stagflation then; now, the CPI is relatively high.

Third, back then it was the Iranian hostage crisis (after the Islamic Revolution, the pro-American Prince Pahlavi was overthrown and exiled, and Iranian students stormed the US embassy, taking diplomats hostage and demanding the release of Pahlavi).

Now, there is internal turmoil in Iran, with the US exerting military pressure and the possibility of war not ruled out.

Fourth, even many of Trump's actions, including the MAGA slogan, bear some resemblance to Reagan's when he took office in 1980.

┈┈➤ In Conclusion

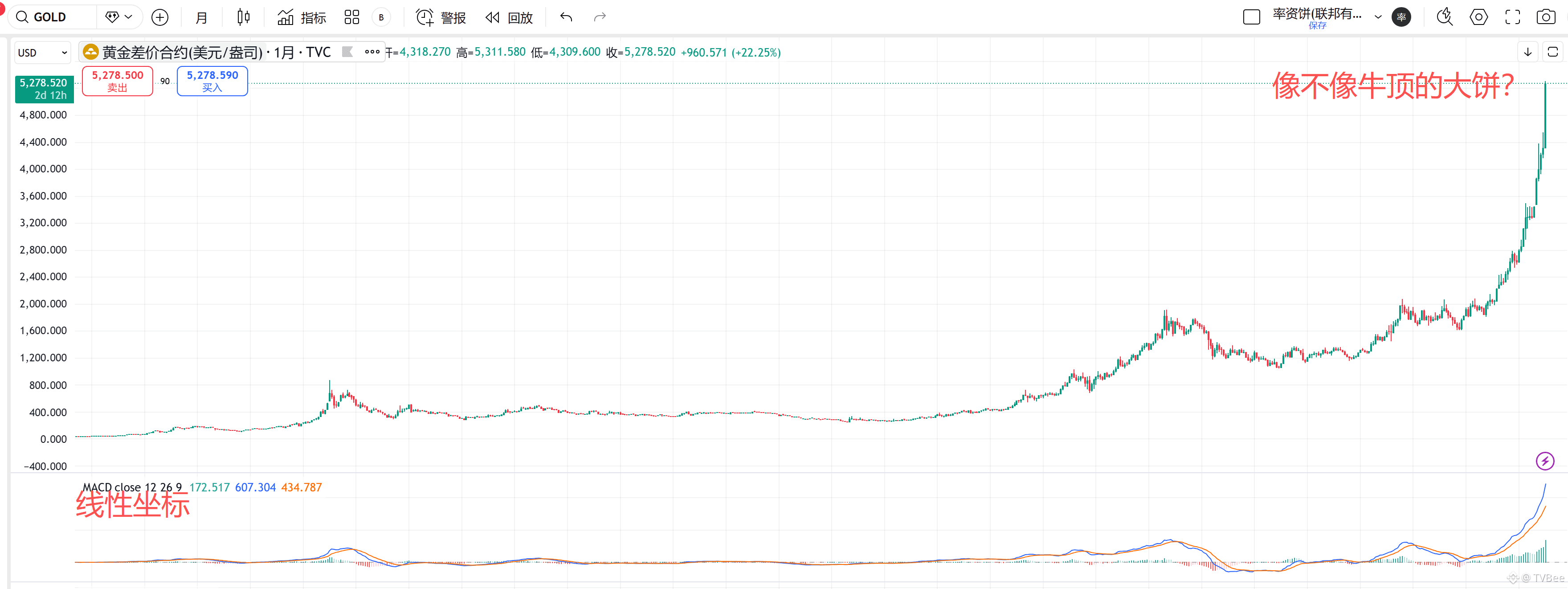

By comparing technical analysis and historical events, gold may continue to rise as the US-Iran conflict escalates.

However, most of Trump's actions this year have been swift and decisive, raising concerns about a sudden reversal in the US-Iran situation (such as Iran suddenly surrendering). After the conflict subsides, be wary of a gold price correction.

From January to September 1980, gold declined before rebounding, then fell continuously for nearly two years from September 1980 to June 1982. It didn't return to its initial high until 2007-2008.

Short selling is not recommended in the short term. The US government may enter a short-term shutdown on January 31st, and the US-Iran situation remains unresolved.

However, chasing the rally requires caution! It's not that buying is impossible, but it's advisable to be highly sensitive and closely monitor the US-Iran situation.

(Note that Figure 1 is on logarithmic scales, while Figure 2 is on linear scales. The monthly upward trend of gold and the peak of Bitcoin's bull market are somewhat similar.)