⚡️ Some say I'm just spouting nonsense, but given the current trend of US debt, I'm not exaggerating when I say that Bitcoin could one day reach $1 million.

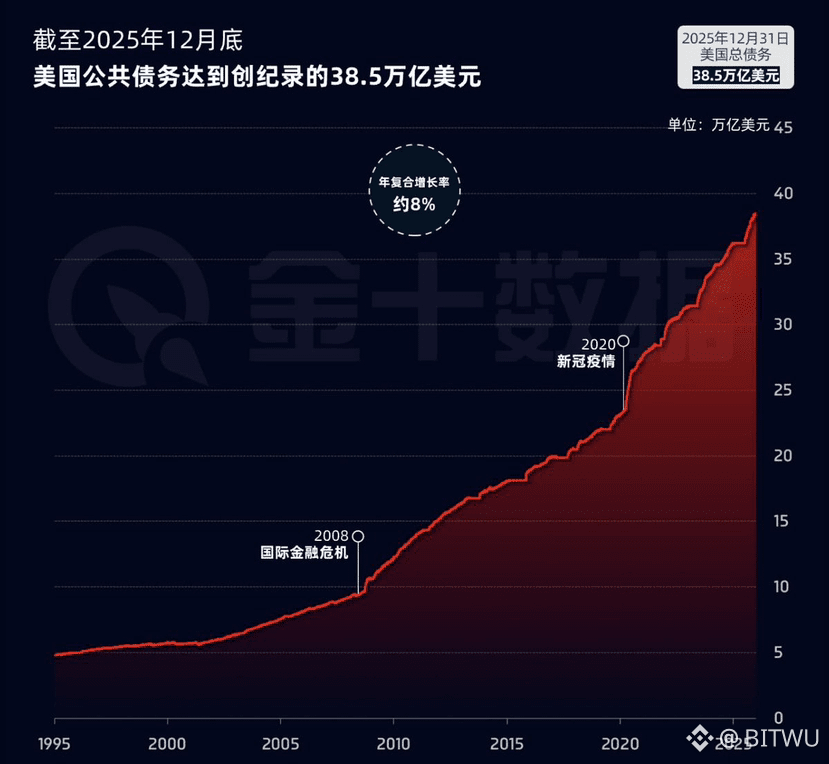

Over the past 25 years, US public debt has ballooned from less than $6 trillion to $38.5 trillion, a compound annual growth rate of nearly 8%!

At this rate, nominal growth can't keep up with the compound interest on debt. Simply maintaining 2%-3% inflation and economic growth is simply not enough to reduce the debt!

This raises a very real question: with the debt already at this level, what path can the US choose?

A true hard landing to repay the debt is almost impossible; that would mean fiscal austerity, asset price collapse, and soaring unemployment. In realpolitik, there's virtually no room for maneuver; which government would dare take the blame?

The remaining options are some less-than-honorable ones:

1⃣ Tariffs + Territorial Aggression + Economic Colonization: Small investment, quick returns—just make money regardless of the rules!

2. A combination of tools: suppressing real interest rates, tolerating inflation, and gradually releasing debt pressure through the financial system and global pricing power.

In other words, what the US truly seeks may not be a substantial reduction in debt size, but simply a seemingly manageable level. This necessitates relying on fiscal dominance, financial repression, or a weakening dollar to maintain debt sustainability.

This has been my consistent assessment:

For a long time to come, risks will not be released in a textbook-style collapse, but rather gradually smoothed out by policy and inflation.

This insidious nature is precisely what's most dangerous. Those who firmly believe in the value preservation of nominally safe assets, cash, and fixed income will see their purchasing power eroded imperceptibly over a long period.

Therefore, in a system where debt can only be diluted, not liquidated, assets like gold and Bitcoin, which cannot be diluted by issuance, will become increasingly important, naturally possessing hedging properties.

Even if Bitcoin is currently relatively quiet and its price performance is lagging, its inherent characteristics determine that it will eventually reach heights unattainable by most!

If you don't believe me, come back in 10 years and prove me wrong!