For the past few months, I've been focused on precious metals investing, neglecting my original goals.

Now, I'm starting afresh!

🚨January 2026 Stablecoin Awards🚨

I will be selecting strategies based on the highest returns, best risk adjustment, highest expected airdrop, and other return categories.

View the winners🧵👇

🏆Highest Base Yield

Please remember, high returns mean high risks.

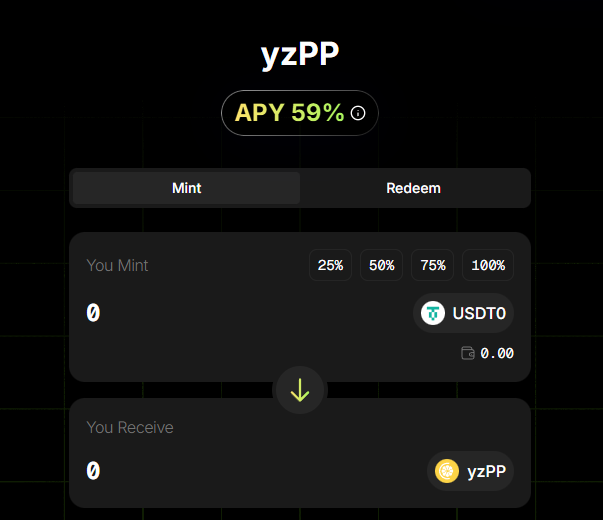

🥇 @OuroborosCap8 yzPP: 59% Annualized Yield (Initial Batch)

🥈 @OstiumLabs OLP: 53.6% (Counterpartner Vault)

🥉 @avantprotocol avUSDx: 21% (Initial Batch)

Of particular note is the allocation of risk premiums.

Avant provides a 10% risk premium for its sub-funds, and Yuzu provides 15%.

Ostium also provides additional fee compensation when the CR falls below 100%. 🏆Most Risk-Adjusted Strategies

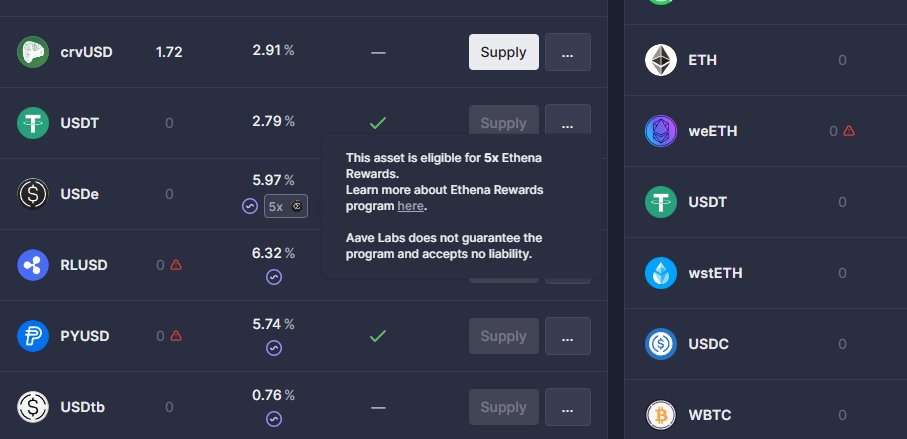

🥇 @aave 🤝 @ethena_labs "Aavethena" (10-18%)

🥈 @dolomite USD1 Lending (10%)

🥉 @upshift_fi Earning AUSD on @monad (11%)

Note: While I really like earnAUSD because @withAUSD is a great stablecoin, this vault now participates in multiple strategies, taking on significantly more risk than simply holding or lending AUSD.

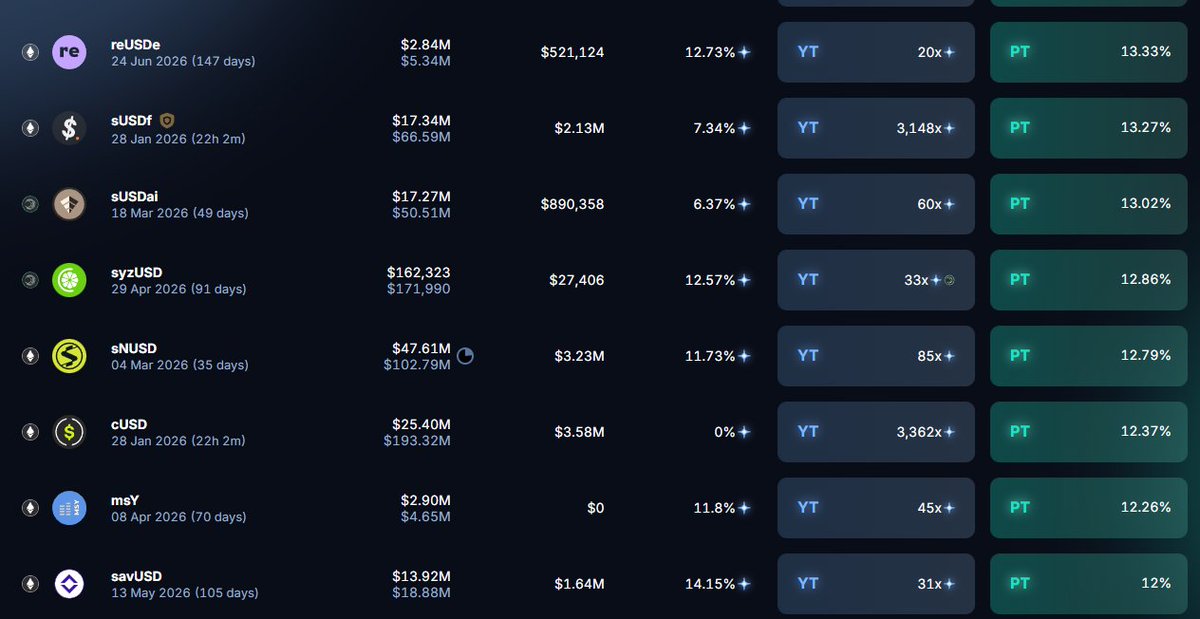

🏆Best Pendle Investment Opportunities

🥇 @re reUSDe: 147 days, 13% (Subordinated Reinsurance)

🥈 @USDai_Official sUSDai: 49 days, 13% (99% Treasury Bills)

🥉 @OuroborosCap8 syzUSD: 91 days, 12.8% (Senior Reinsurance)

The returns on these assets are entirely dependent on my personal preference; that is, I will not recommend any assets that I deem too risky.

reUSDe is not strictly subordinated reinsurance. Re Capital actually has approximately $70 million in subordinated reinsurance, which works in conjunction with this agreement. Therefore, I am not as concerned about the risks of reUSDe as I am about other subordinated reinsurance.

🏆Best Airdrop Opportunities in Q1

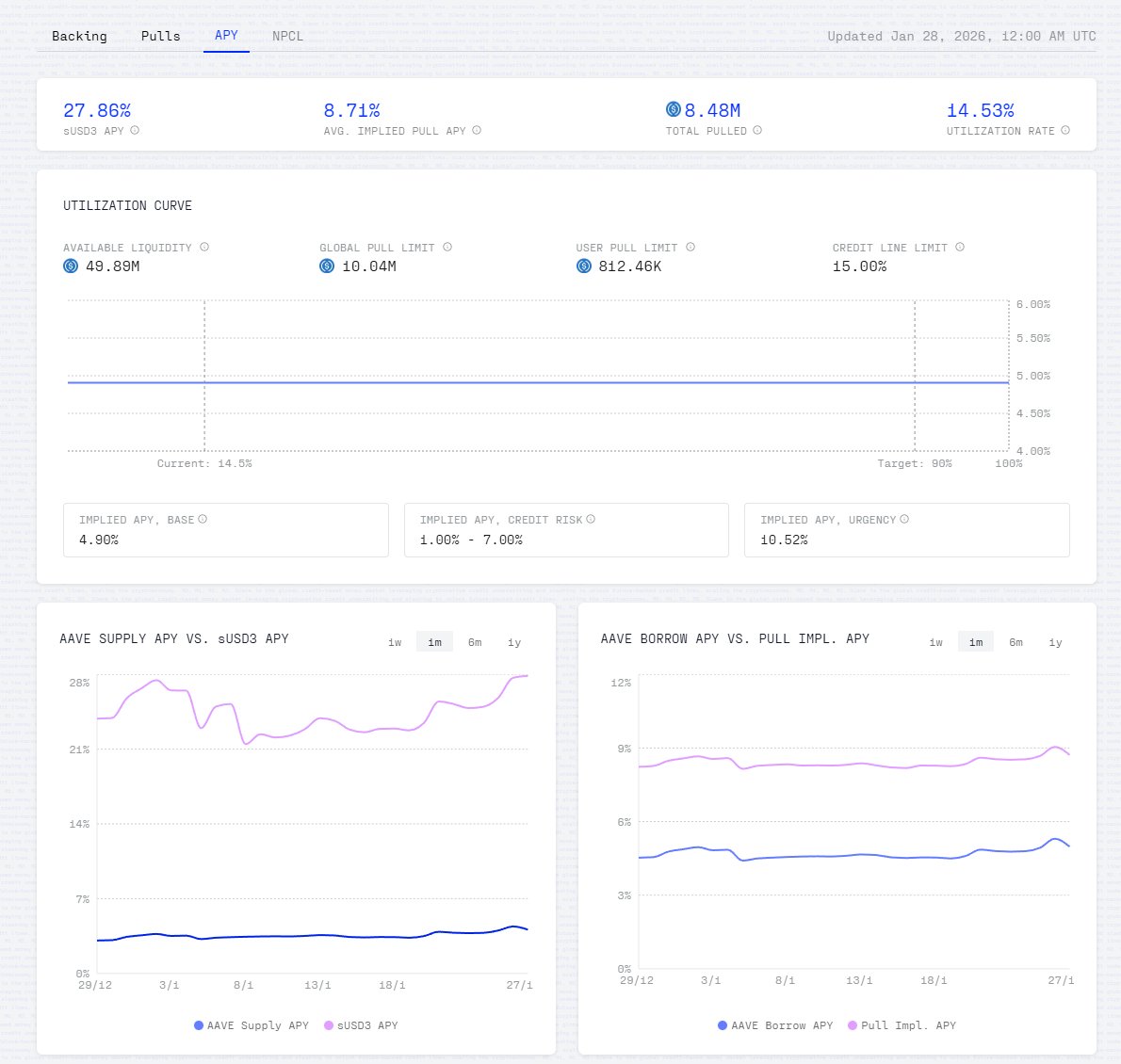

🥇 @3janexyz On-chain Unsecured Credit Line

🥈 @Neutrl OTC Basis

🥉 @infiniFi Maturity Tiered

Many projects actually meet this criterion, so selecting only three wouldn't be fair.

My goal is to pick projects with the most unique value propositions and that stand out from the crowd.

Even so, @USDai_Official is worth watching. @capmoney_ and @strata_fi, with their unique strengths, should be able to stand out and become leaders in their respective fields.

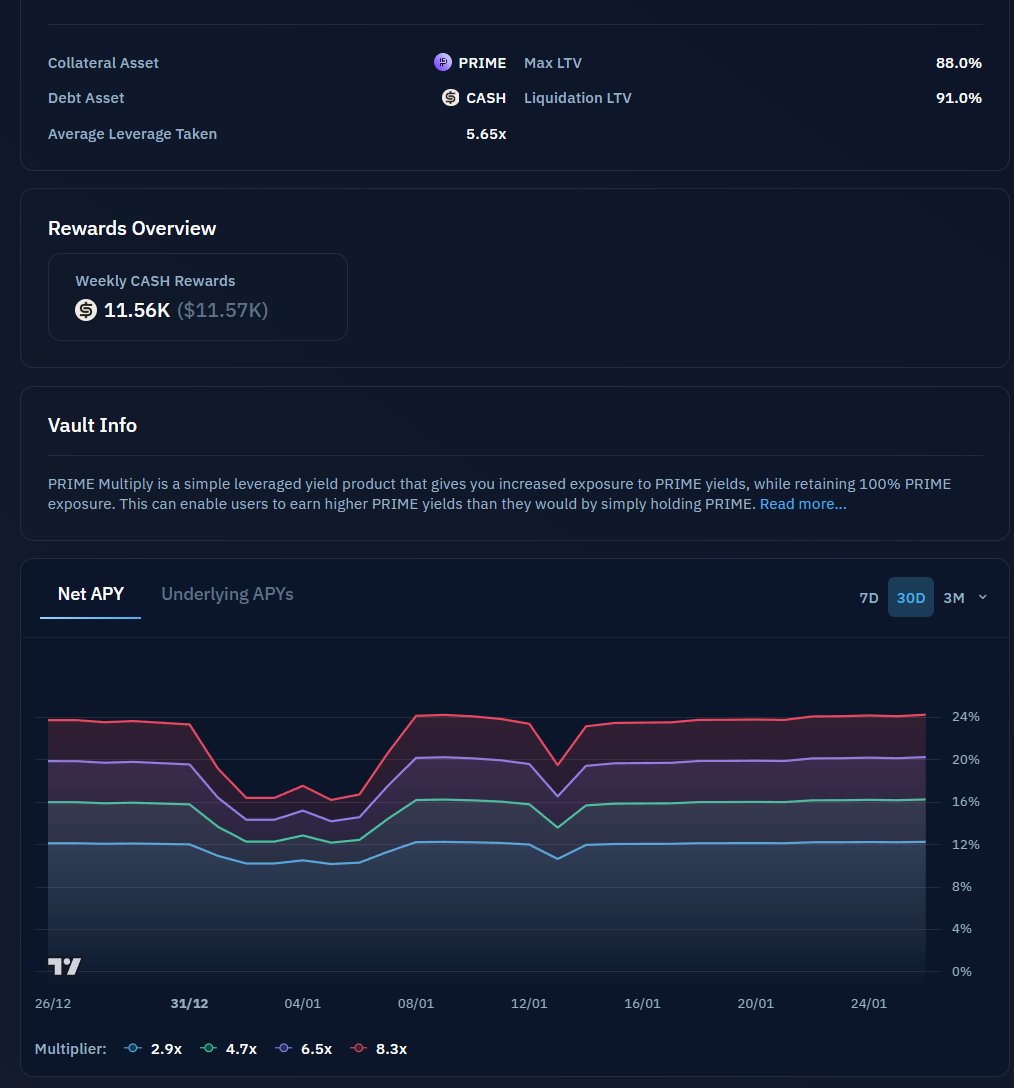

🏆Best Solana Stablecoin Yields

🥇 @HastraFi on @kamino: 24% annualized yield, HELOC stablecoin

🥈 @solsticefi on @ExponentFinance: 12% fixed yield

🥉 @onrefinance LP on Exponent: 16% yield + points

Note that these are relatively unique stablecoins (the Solana platform offers many stablecoins).

Hastra's PRIME is a HELOC-backed stablecoin. Solstice is backed by a benchmark interest rate, so its yield is relatively stable, but recently there have been some issues with its points calculation. However, since PT is simply performing a reverse operation, there's no need to worry too much. Onre also does reinsurance, but I don't know much about it, so I can't say whether its risk adjustment methods are similar to other companies.

There's also SyrupUSDC's revolving reinsurance, but its interest rate volatility has recently been greater than PRIME's revolving reinsurance.

That's all for today, everyone.

The best excess returns are always found in the training ground.