Many followers have asked me when to short ZEC and when to go long.

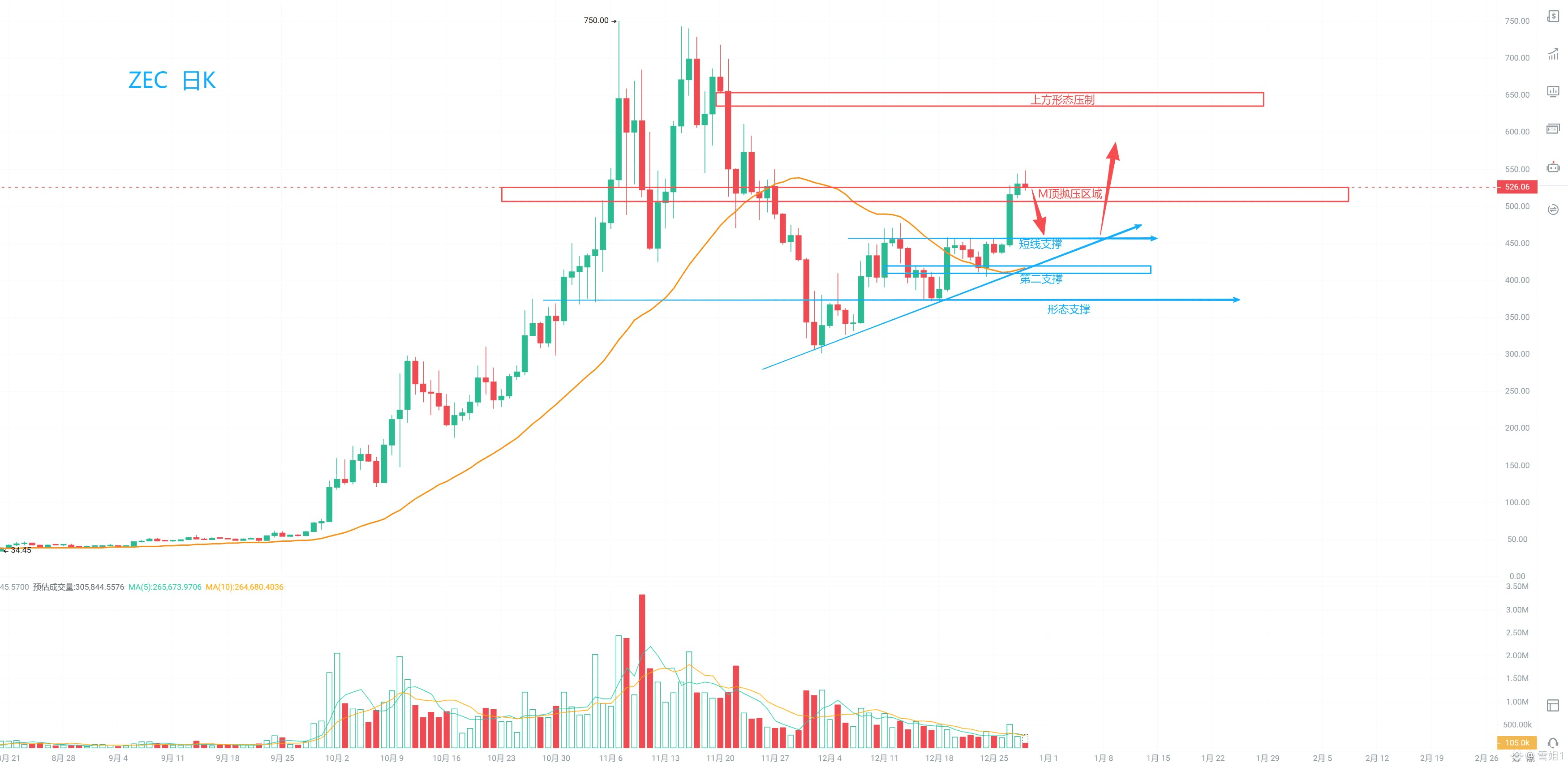

Simply put, ZEC is currently in a state of "limited overall trend, active short-term fluctuations."

Large-scale structural resistance objectively exists. This means that from a long-term perspective, there are heavy overhead resistance and technical obstacles, making a short-term explosive surge unlikely.

However, the internal short-term price action is quite dynamic. This provides opportunities for retail investors skilled in short-term trading, what you call "long-term view, short-term action," finding opportunities to buy low and sell high during the consolidation.

ZEC's upward trend from September to early November did indeed change after the large bullish candle on November 7th. The price subsequently broke below the 30-day moving average that had been supporting the upward trend, forming a "double top" pattern. This change signifies a weakening of the upward momentum, and the market has entered a consolidation phase where bulls and bears are relatively balanced.

In this current consolidation market, clearly identifying key support and resistance levels is crucial.

Major selling pressure zone: $605-$649 This is a key resistance zone. Before a decisive breakout, a price rebound to this level may encounter significant selling pressure.

The core support zone below: $330-$311 is a significant recent support level. A price pullback to this level could attract buying interest. If the price consolidates at a higher level for a period before falling back, a small position could be considered, but quick entry and exit are necessary.

#CryptoMarketWatch #FedRepurchaseAgreementPlan Besides ZEC, are there other severely undervalued privacy coins being quietly accumulated by institutions? And in the volatile market of 2025, how can we strategically position ourselves in advance to avoid being the last one holding the bag? Scan [to join my chat room](https://app.binance.com/uni-qr/cpos/15606889063778?l=zh-CN&r=HGV4CH2I&uc=web_square_share_link&uco=sGrEFA04_L803jygSOTfxQ&us=copylink)!