"Smart money" is quietly retreating! Internal data: Institutions are using the rebound to unload their holdings, with the next target at $78,000!

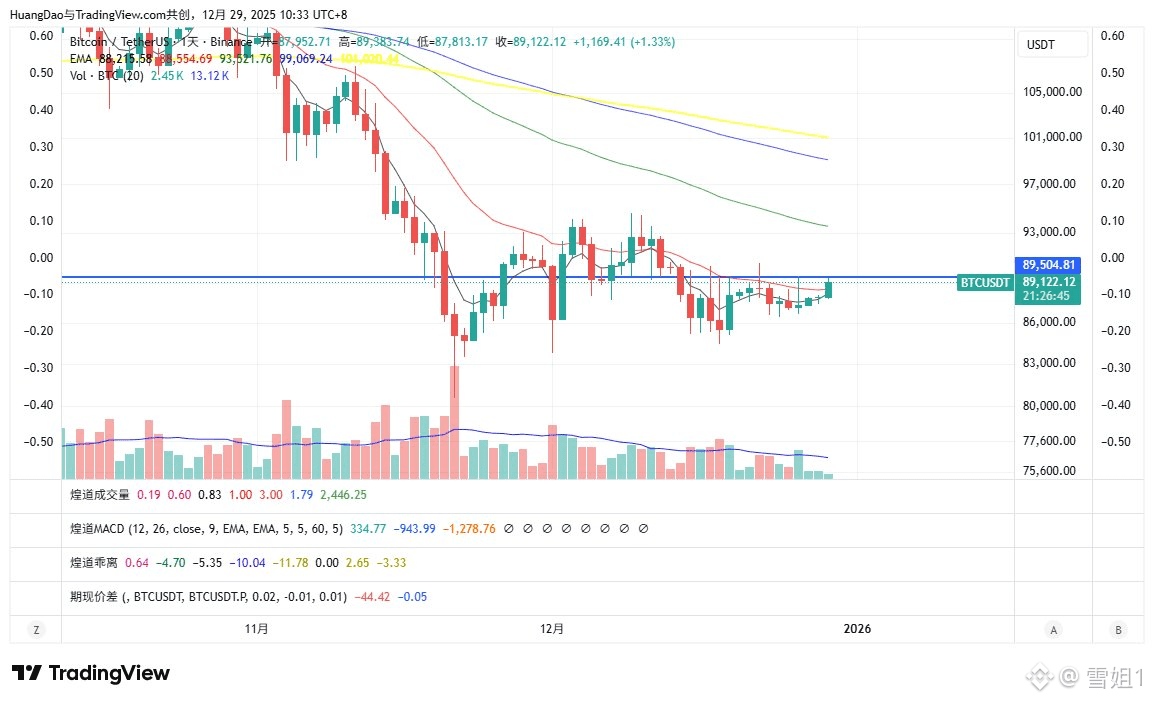

Bitcoin has been consolidating sideways above its recent low of $80,600 for nearly five weeks. This prolonged period of narrow-range trading suggests that market momentum is building, and a directional breakout is increasingly imminent.

Recently, trading has been thin during the Christmas holidays. The stability under low volume does not fully reflect the true balance of power between buyers and sellers. The real battle usually unfolds after major funds return from their holidays.

The key area that the market has repeatedly contested over the past few weeks has formed a "support-resistance interchange zone." The price has repeatedly encountered resistance and fallen back here, indicating that selling pressure is indeed present.

Waiting for confirmation signals: Ideally, the price should be able to hold above $89,500 with significant volume tomorrow. In particular, a closing price above this level would be a strong short-term bullish signal.

Key support level: $86,800 is a crucial support level in the near term. If the price not only fails to break through but also falls below this level, we need to be wary of a potential further decline to seek lower support, such as $85,500 or even lower.

#CryptoMarketWatch #FedRepurchaseAgreementPlan Top-tier news, top-tier positioning, the same opportunities, the same gains—follow along and reap the rewards. The strategy continues; instead of guessing, focus and capitalize on opportunities.