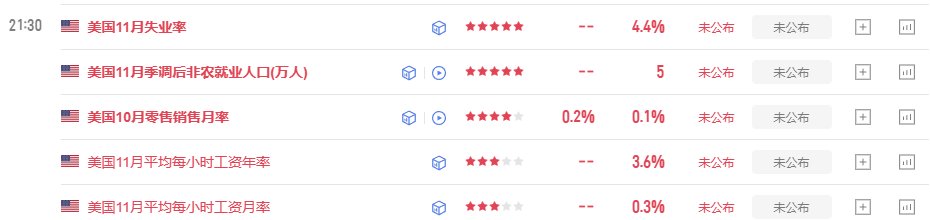

Tonight's non-farm payroll data release predicts an unemployment rate of 4.4% and a non-farm payroll figure of 50,000 new jobs.

However, market liquidity is currently very weak. If there's a negative impact, BTC is likely to plummet. The best approach is to avoid both positive and negative news.

Tonight, not only will the November data be released, but also the October data.

Currently, both the US stock and cryptocurrency markets are betting on a "soft landing"—a slowdown in the economy without a collapse, and continued quantitative easing by the Fed. BTC already adjusted last night, falling below 86k before rebounding to around 88k, with over $500 million in liquidations across the network.

The main reason is excessive leverage among long positions and risk aversion. However, on-chain data shows limited selling pressure from long-term holders, and institutions (such as BlackRock) are still accumulating at low levels. If the data doesn't disappoint, tonight could very well see a "sell the rumor, buy the fact" scenario, with BTC's short-term target at 92k-95k.

I just checked the data, and there are so many long positions again!