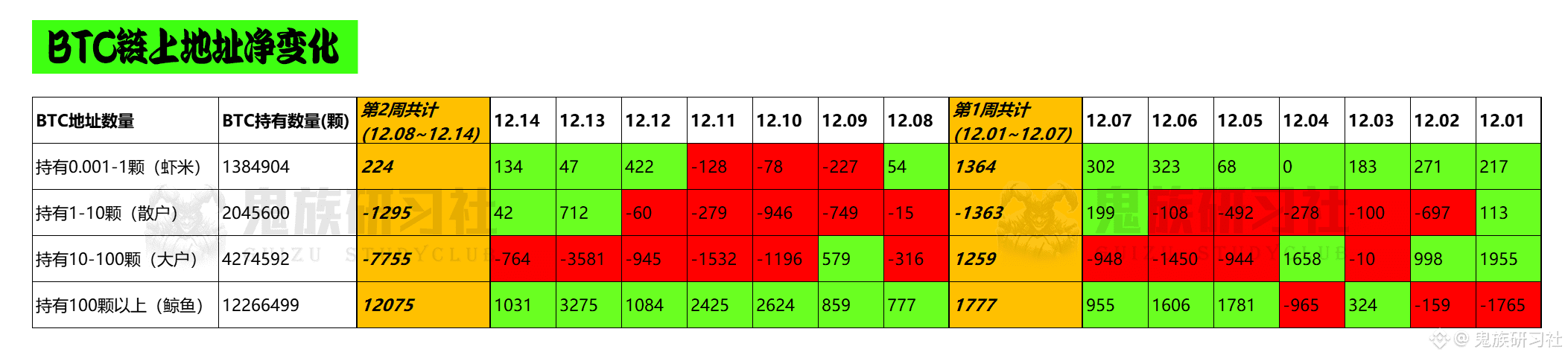

Wow, last week, the whale address saw a net inflow of 12,075 tokens. From December 1st to 7th, there was a net inflow of 1,777 tokens. From November 24th to 30th, there was a net inflow of 3,916 tokens. From November 17th to 23rd, there was a net inflow of 25,594 tokens. From November 10th to 16th, there was a net inflow of 3,840 tokens. From November 3rd to 9th, there was a net inflow of 17,327 tokens. Therefore, I absolutely cannot believe that the market makers haven't started a phase of bottoming out over the past month.

Of course, does the market makers starting a phase of bottoming out and accumulating shares mean that the price won't fall further? Not at all. Because during this process, the market makers will use some methods to acquire more shares. One of these is a sharp drop. A sharp drop is the most effective method.

However, a sharp drop is not an endless decline. Its purpose is to scare people. But the potential for further decline is truly limited. In plain terms, any sharp drop presents an opportunity. Don't worry about a continuous decline.

Based on price action analysis, I believe that before the price reaches the 100,000 mark, all declines are merely tactics, means, not the end goal. Therefore, buy heavily on big drops and lightly on small drops; you can still profit from rebounds. After all, it could be several percentage points.

This is in terms of the broader picture. However, the current environment remains what I consider a bear market. This means that even if the market makers begin a phase of bottoming out, what follows will only be a phase of upward movement. At best, it might only reach between 100,000 and 110,000. #ETHPriceAnalysis #WhaleMovement #FedRateCut