ETF fund flows are quietly reshaping the BTC/ETH trading landscape. 📊

Yesterday's US Bitcoin ETF:

- Trading Volume: $3.9 billion

- Assets Under Management: $124.1 billion

- Net Inflow: +$49.16 million

After significant outflows in November, BTC fund flows have shifted to a small, stable inflow. This appears to be a cautious reaccumulation rather than a new wave of frenzy.

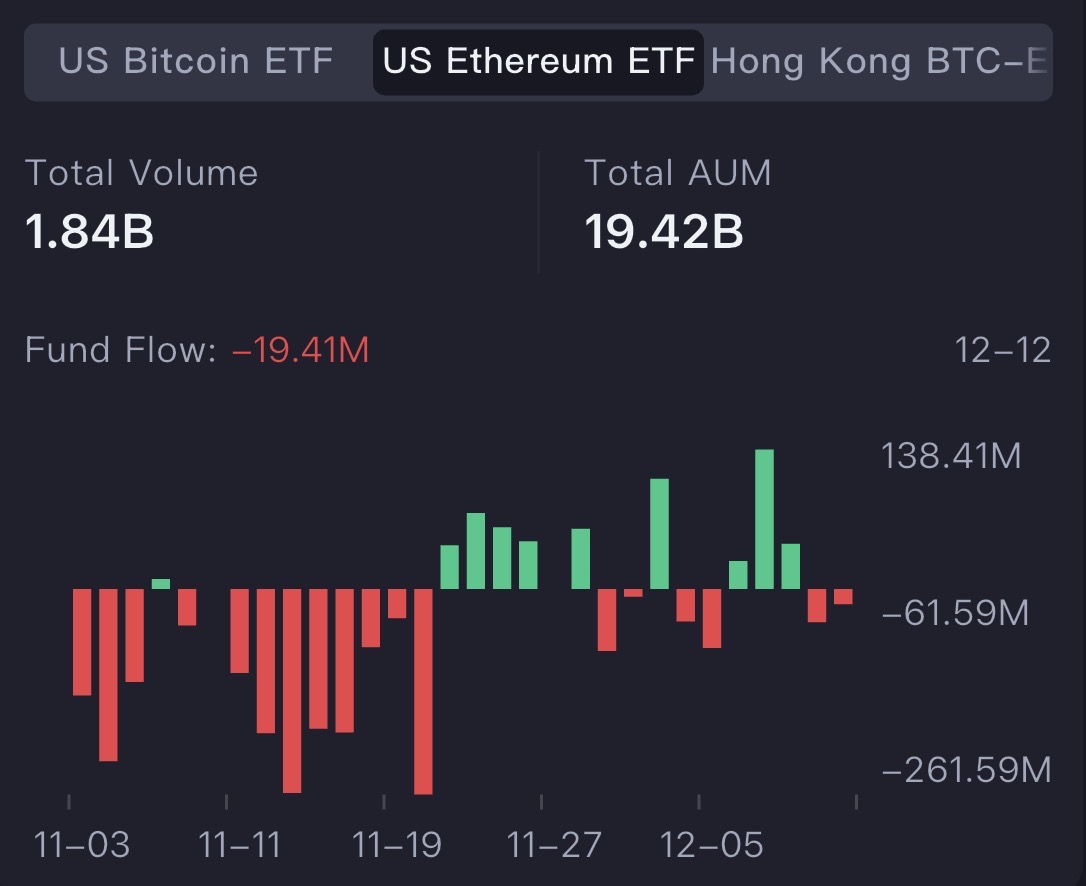

Yesterday's US Ethereum ETF:

- Trading Volume: $1.84 billion

- Assets Under Management: $19.42 billion

- Net Inflow: -$19.41 million

ETH experienced a strong inflow in late November and early December, but the outflow subsequently turned into a moderate one. This is more likely due to profit-taking and risk aversion.

Conclusion: US ETF funds are flowing back into BTC, while demand for ETH has decreased. The slow fund flow is not a clear signal of risk appetite.