In the third quarter, we observed a clear optimism in the options market regarding the fourth quarter. Even in late August, when Bitcoin prices continued to fall, Q4 options positions remained bullish.

We referred to this at the time as the Q4 rally or the Christmas rally; however, the crash of October 11th and the continued decline in November have shattered the previous market structure. In the current market context, the talk of a new price high in the fourth quarter has completely disappeared, and pessimism has spread.

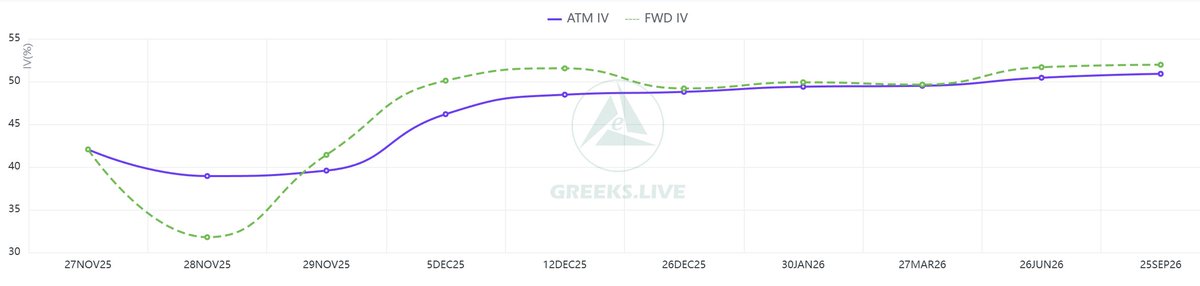

Although RV, IV, and 25D Skew all showed a pullback this week, market panic has not subsided, and year-end and next-year medium-term options data still point to a bearish outlook.

Due to the approaching monthly expiration, price fluctuations this month have been significant, resulting in very strong demand from whales for position rollovers. The large orders mentioned by Jake O should also be part of this rollover.

Overall, the data suggests that a short-term bottom has formed, and the options market's preference for continued declines has weakened, with a higher expectation of short-term volatility. However, the market in the last month of the year remains risky, and volatility expectations remain high.