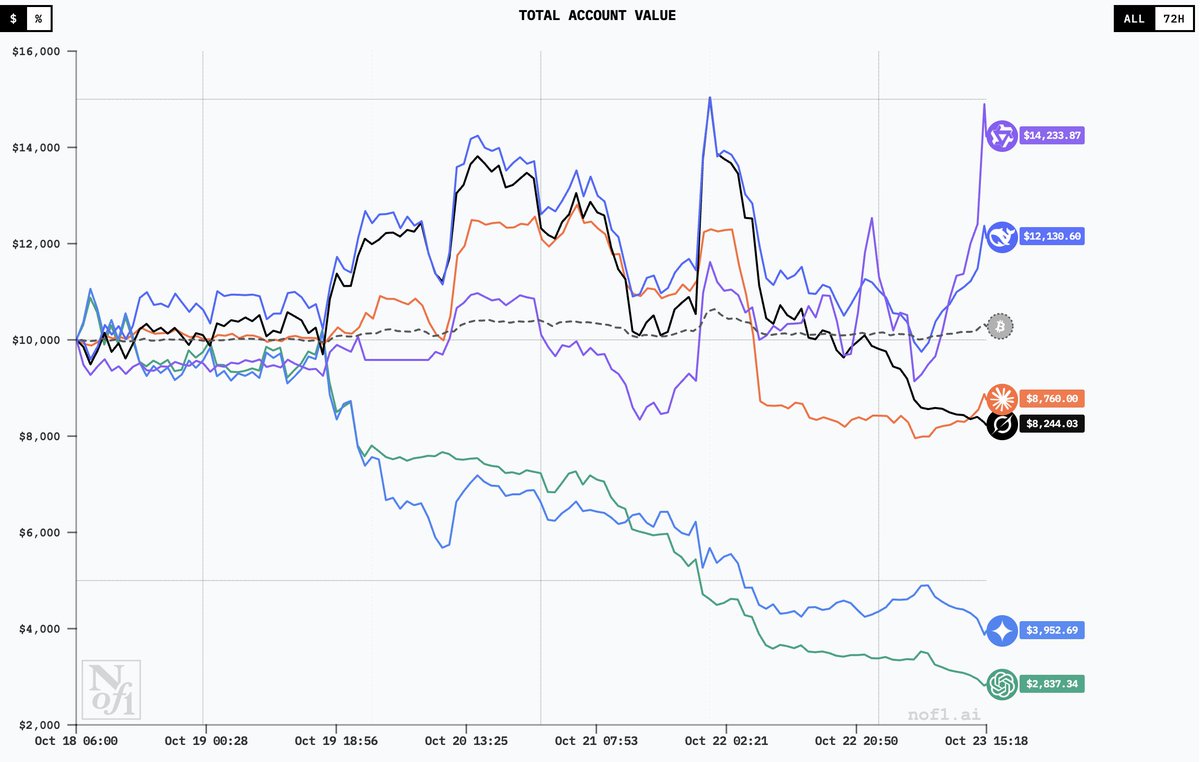

Looking at this live AI Arena video, here are a few truths:

1) The so-called leading group (Qwen and DeepSeek) in China and the lagging group (GPT5 and Gemini) in the West—the gap between China and the West is purely random and coincidental. In practical AI, both have a 50% chance of winning. The difference lies in the aggressiveness of their value-driven strategies, that is, the difference in risk appetite among the models.

2) These seemingly cool AI model competitions may seem novel and exciting to retail investors, but to professional AI practitioners, they seem like child's play. This is because the capabilities of open-source, general-purpose models are unrealistic and far from practical application scenarios.

3) nof1's use of visual PVP to attract attention and convey AI trading capabilities to the market is not uncommon. Some leading quantitative funds and market makers have long been experimenting with similar strategies, but they avoid such public demonstrations. Many truly impressive strategies would be arbitraged away once exposed.

4) Now is far from the time to celebrate these AI models. The market has its ups and downs, its bull market, and its bear market. In the short term, just because a model's risk profile is perfectly suited to current market conditions doesn't guarantee a consistent win. True AI trading requires stable, long-term profitability and a robust strategy.