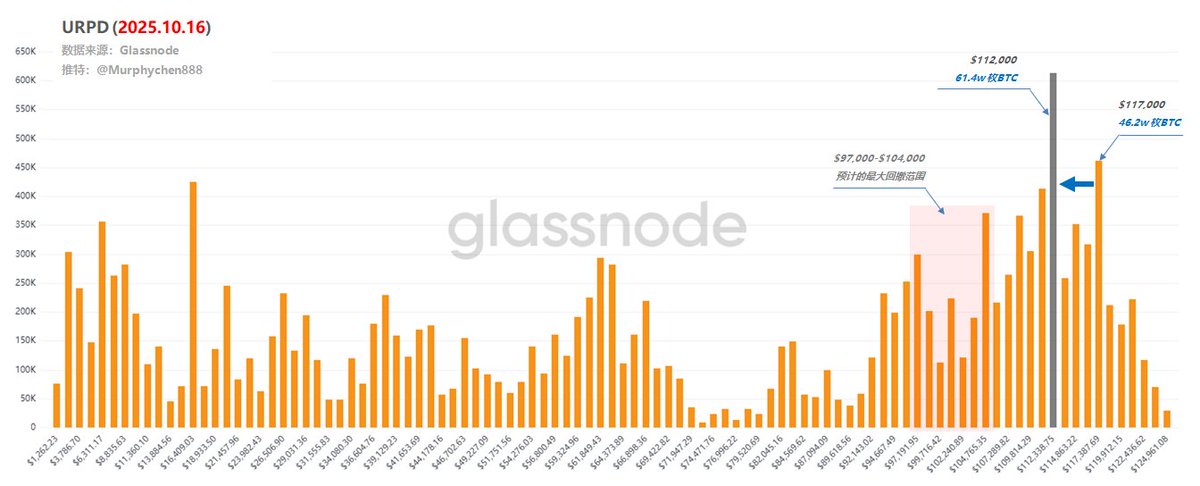

The rapid decline has significantly altered the structure of BTC's holdings in the high-end range.

1. Previously firm holdings at $117,000 have begun to weaken, with investors choosing to sell at a loss as the price further declines; 460,000 BTC remain.

2. A new, massive holding column has formed at $112,000, indicating a significant amount of capital buying the dip here. A total of 614,000 BTC has accumulated, currently the highest column in the entire holding structure.

3. The current influx of capital indicates a certain consensus around the $112,000 price point, making it the current strongest support level.

(Figure 1)

The exchange of high-priced holdings for low-priced holdings will create significant selling pressure, impacting the short-term market. However, from a medium- to long-term perspective, this may not be a negative development.

First, the influx of capital at $112,000 will slow the pace and magnitude of the decline. Second, the overall cost of capital reduction resulting from this turnover will facilitate the initiation of the next trend.

If BTC continues to fluctuate downward, based on the current chip structure, I personally predict that the extreme correction range will be between 9.8 and 10.4. Of course, the actual situation will be affected by macroeconomic policies, market sentiment, and unforeseen black swan events, so we will have to take it one step at a time.

The above is for educational purposes only and is not intended as investment advice.

-------------------------------------------------

This article is sponsored by #Bitget | @Bitget_zh