Bitcoin ETF fund flows are a lagging signal of sentiment amplification.

1. ETFs are not dominating BTC.

2. ETF sentiment amplification may signal a periodic correction.

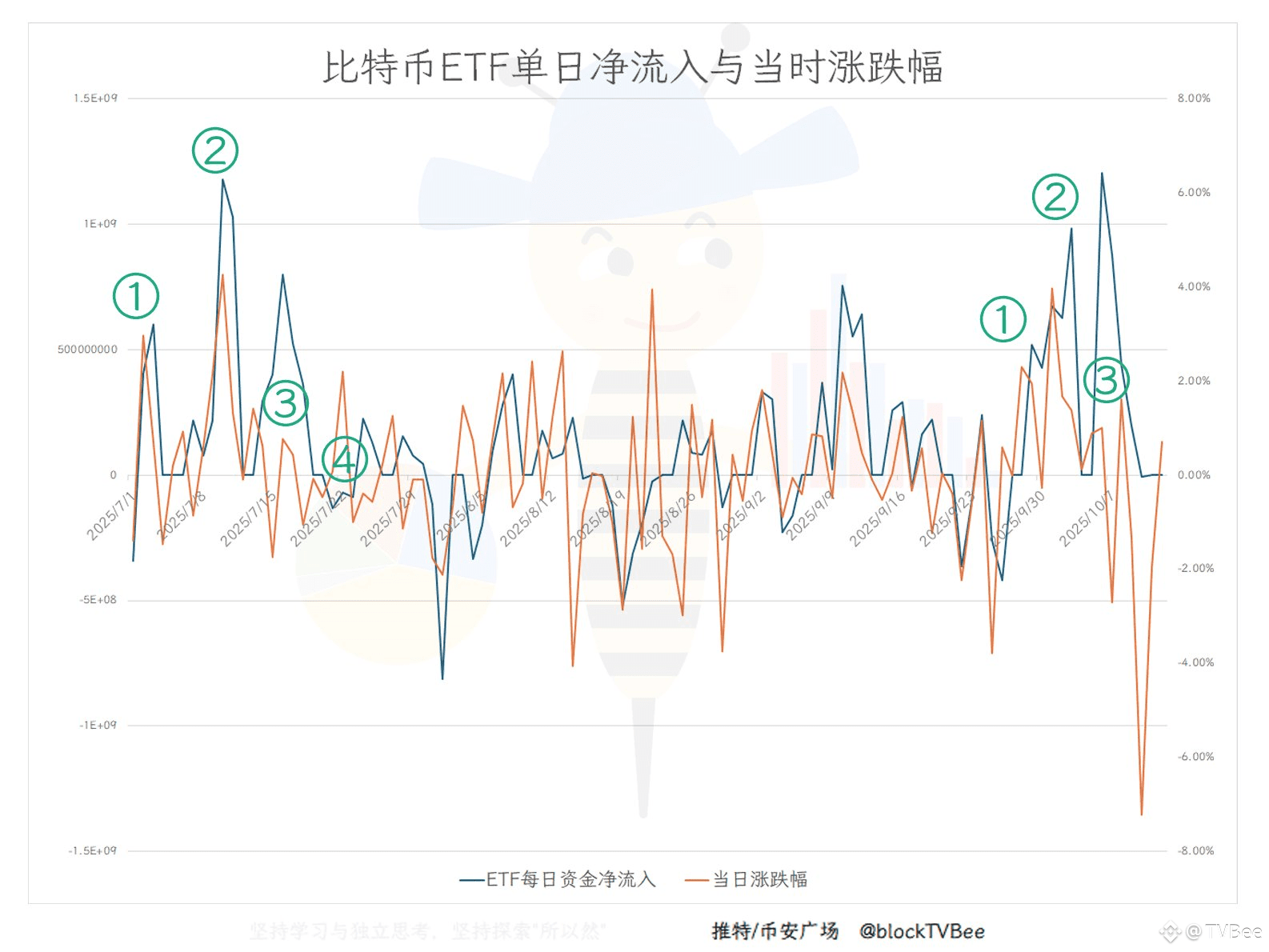

We continue to combine daily ETF fund inflow data with daily price fluctuations.

This time, we focus on the period after July 1, 2025, which allows for a clearer picture.

┈┈➤ Bitcoin ETF fund flows and price fluctuations

Focus on the July 2025 rally:

In Phase 1, ETF fund flows (blue) tracked the daily price fluctuations (orange).

In Phase 2, ETF fund flows (blue) exceeded the daily price fluctuations (orange).

During this phase, BTC's rise slowed (the orange line remained above the horizontal axis, indicating continued growth, but the increase was smaller). However, ETF fund flows (blue) continued to accelerate.

In Phase 3, BTC fell (the orange line fell below the horizontal axis), but ETF inflows continued to accelerate.

In Phase 4, BTC resumed its upward trend, but ETFs experienced net outflows.

The current wave started in October, and stages ①, ②, and ③ are generally similar to those in July.