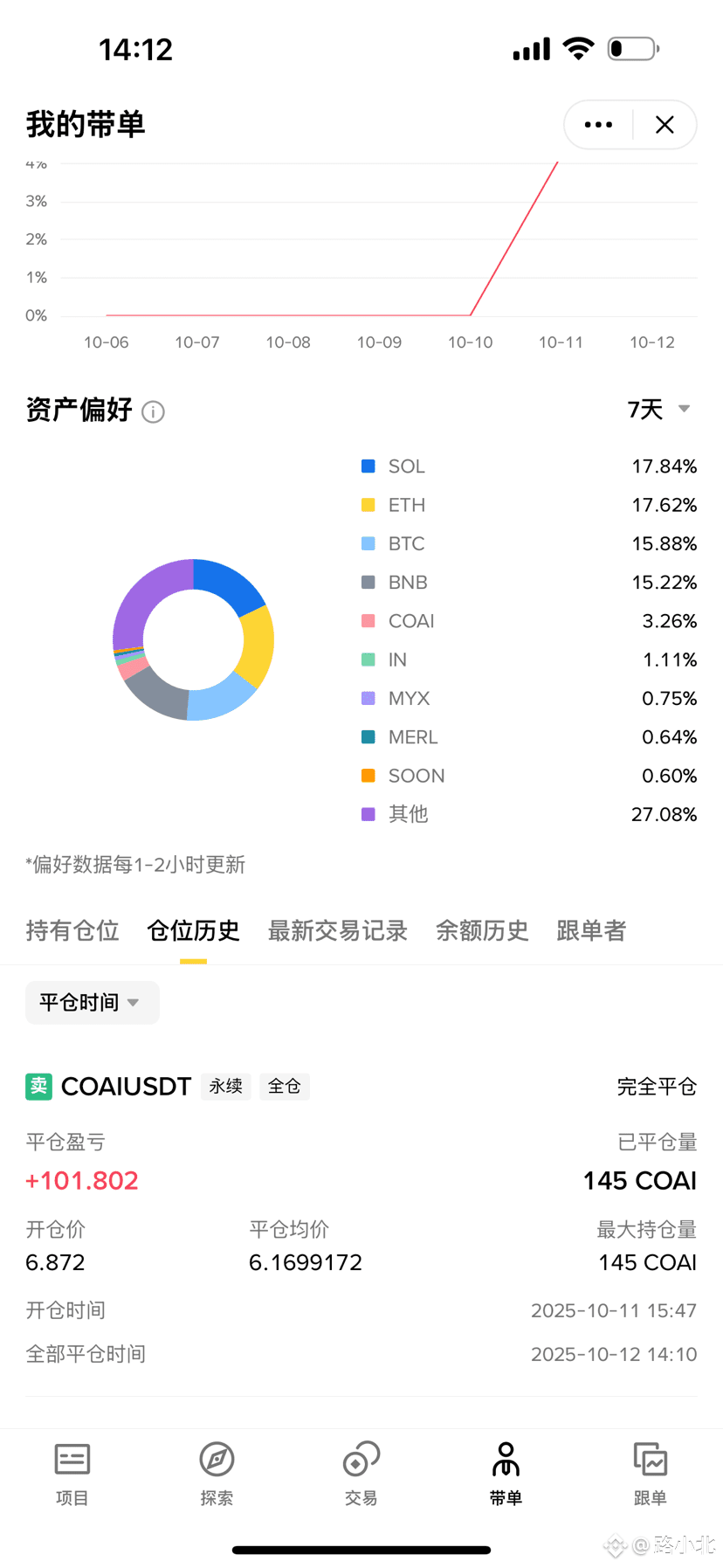

The worst-case scenario for short selling is a loss in both funding rates and market prices... My understanding of COAI is that it can rise freely, with no counterparty and no effective liquidity. I'll just eat my fees and ignore any risk awareness below 10 yuan for now... Right now, I'm facing a headache and a difficult decision! As far as I'm concerned, the entire market is still in a 48-hour equilibrium period, restoring market value!

Shorting means holding on for a while, while the risks of going long require appropriate volatility management! I don't have the time right now, so I'm being prudent and calculating. Shorting well and targeting short positions is perhaps just a hobby for me! The total number of short-listed stocks I'm shorting is 68, a far cry from my target of 120... Based on what I've seen so far, my personal assumption is that the mainstream will begin to adjust and decline at 4:15 PM. I'm sure I'll reach 108,000 bits today!

And my mainstream orders are all set for bedtime! What we're most looking forward to is tomorrow's opening of the A-share market, a 2-point drop... That would at least stabilize the Asian session. After that, I assume the Nasdaq opens lower before the market opens, but quickly recovers its upward trend! This way, the market will stabilize! This assumption demonstrates true faith in finance and also in what's right. #CryptoMarketWatch $ETH

{future}(ETHUSDT)