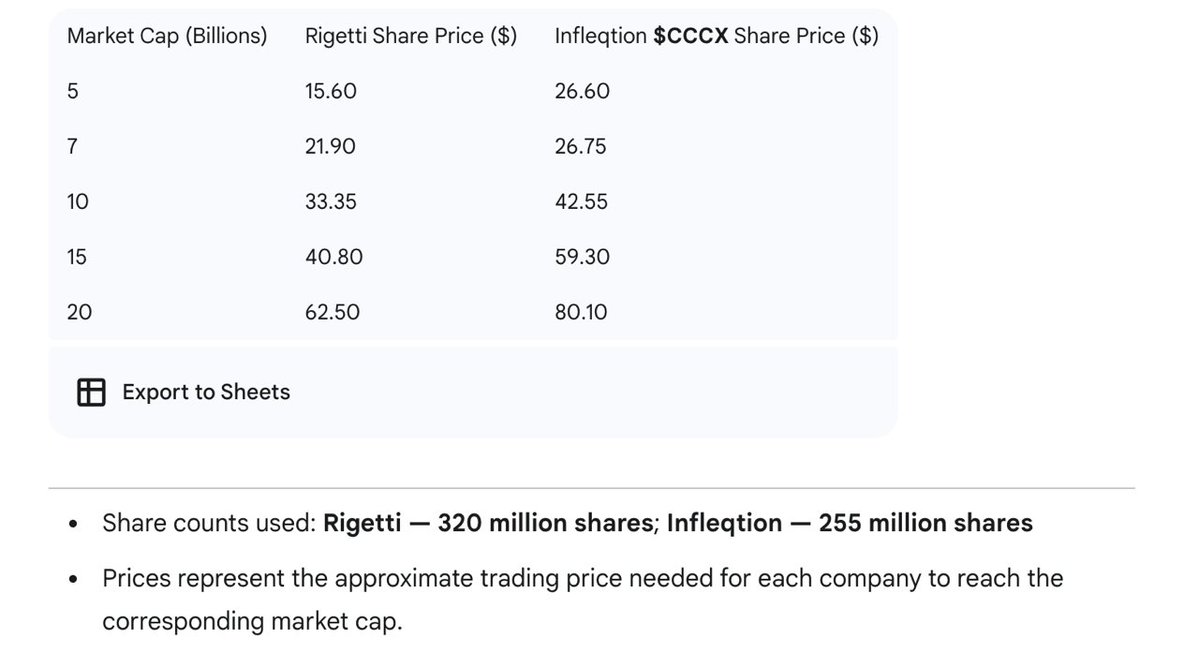

Why did Infleqtion ($CCCX) surpass Rigetti ($RGTI)—and why hasn't the market priced this in yet? The chart below explains.

1. Actual Revenue vs. Research Funding

Infleqtion's actual hardware and sensor sales were approximately $29 million. Rigetti's approximately $11 million came primarily from government R&D contracts. One project was executing, another was conducting experiments.

2. Diversified Quantum Monetization

Infleqtion sold sensors, atomic clocks, and RF systems to fund its QPU roadmap. Rigetti survived through equity dilution and cash burn. Infleqtion built a business, while Rigetti burned one.

3. A True NVDA Partnership

NVIDIA mentioned Infleqtion in the CUDA-Q blog, at GTC events, and in developer presentations. Rigetti only received occasional name mentions. Integration vs. association—credibility is crucial. 4. Neutral Atoms > Superconductors

Infleqtion's neutral atom technology scales faster: it can achieve full qubit connectivity at room temperature and could reach 1,000 logical qubits by 2030. Rigetti's superconducting approach pushes the limits of physics.

5. Real Market, Real Return on Investment

Infleqtion sells deployable systems to the defense, aerospace, and telecommunications sectors. Rigetti is still working on demonstrations.

Summary:

Infleqtion has customers, revenue, and NVIDIA's endorsement. Rigetti faces equity dilution and press releases. The market hasn't assessed the gap between execution and vision—at least not yet.