The current market makes me hesitant, not because of the size of the rate cut, but how many there will be this year. The dot plot and market trends create uncertainty about the future. I received the 4430 order yesterday, but I'm not sure if it's the bottom. I'm going to sleep and waiting for Powell.

First and foremost, there's a high probability of a 25 basis point cut tonight, and the US dollar will definitely fall slowly.

What's uncertain is whether there will be two or three rate cuts in total. Generally speaking, after a September cut, there will also be an October cut. It's possible that they'll consider stopping in December after data changes, but the likelihood is slim.

If the rate cut is 25 basis points, the market will recover, with a certain probability of an immediate rally. However, there's a high probability of a spike in the evening followed by a rally. I'm not sure whether it will be during Powell's speech or the release of the dot plot. The dot plot is crucial, and there's a high probability of another rate cut in October.

If it's 50 basis points, then sorry, the market will first spike up and then down. The needle in the sky is killing.

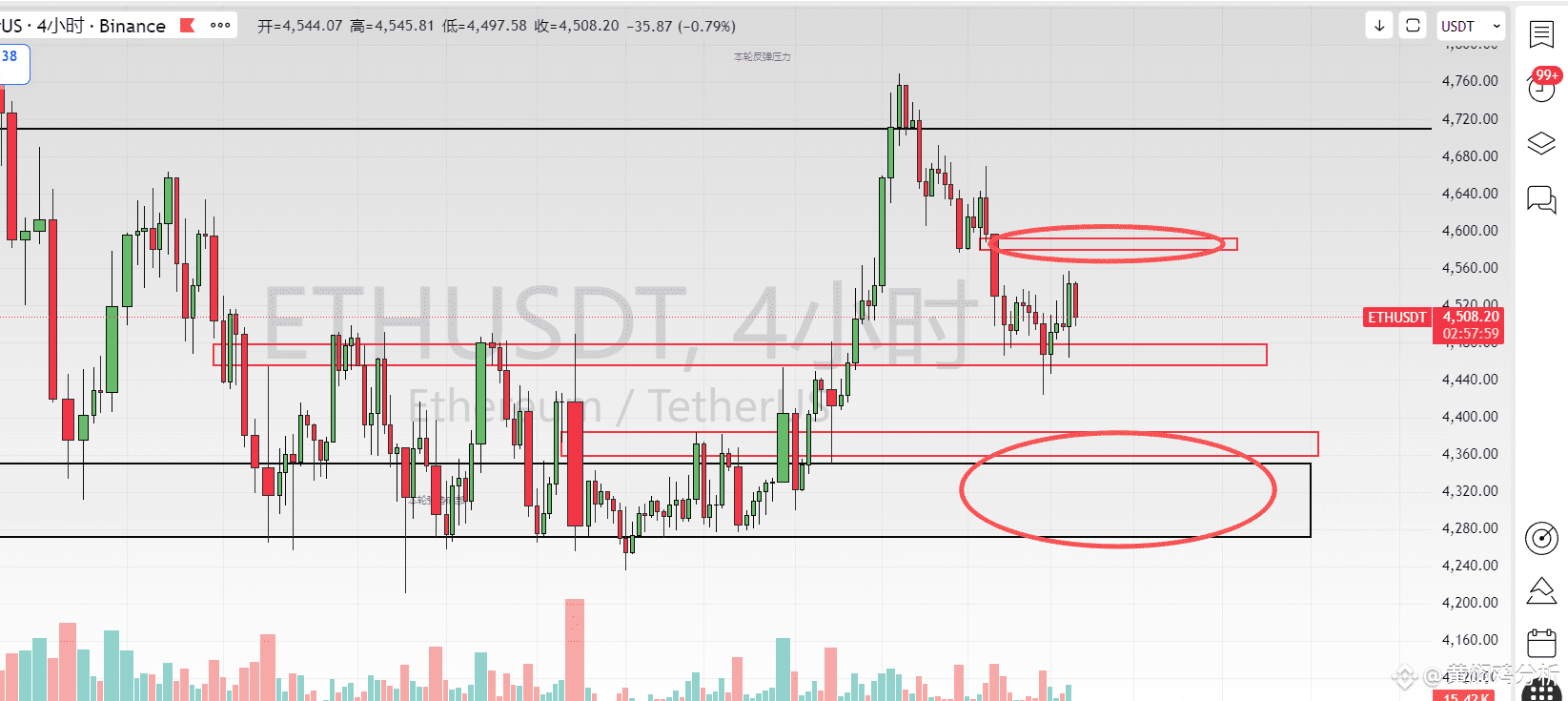

Ethereum's bottom remains at 4280, with around 4330 considered a solid bottom. The short-term defensive target remains around 4450. Yesterday's position was quite favorable. If 4450 is broken today, the market will continue to move towards 4370 and 4410.

Bitcoin funds are pouring in, likely representing safe-haven funds. My advice at this point is to wait and see. Bitcoin has reached 117, so it should see a decline. It's possible that a sustained decline could lead to a market crash at 111,700. However, Bitcoin's support is strong, with support between 115,200 and 116,000. As long as it doesn't break, there's no reason to think it's going to fall.

Today's market is uncertain. Spot trading is still slowly replenishing, leaving room for further buying on dips. As long as interest rates are cut, even if it's a major risk, a drop will be an opportunity, signaling the start of a rate cut cycle and influx of funds. #USDiscussionBTCStrategicReserve #ExpectationsRisingFederalReserveRateCut