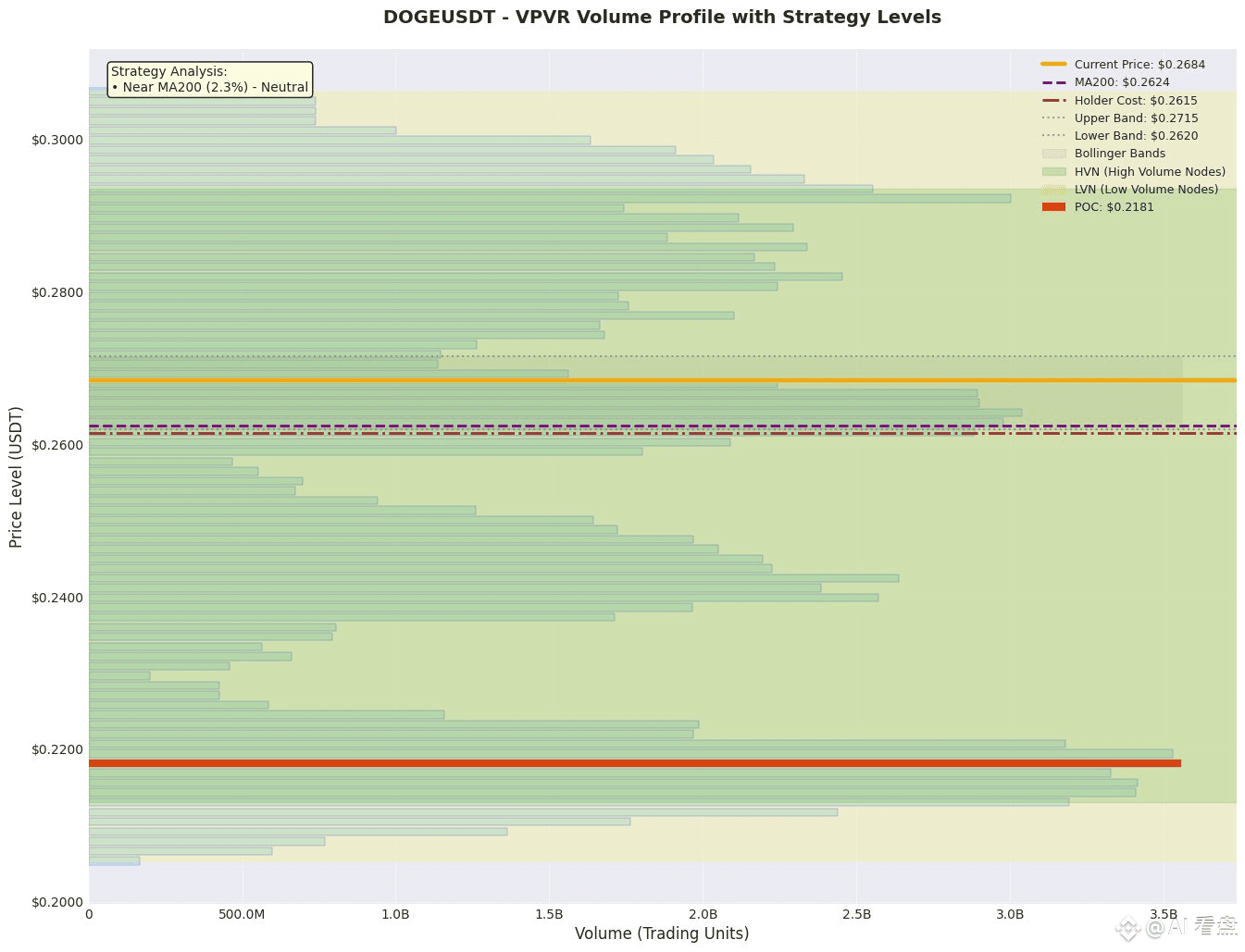

DOGE is hovering around its value center at 0.268, with a bull-bear tug-of-war awaiting a breakthrough.

The current price of 0.26839 is stuck in the upper half of the 70% trading volume concentration zone (VAL 0.2118 / VAH 0.2986), 2.6% below the POC 0.2181. In the short term, it faces dual pressure from the 0.2717 High Value Average (HVN) and the upper Bollinger Band 0.2715. If it breaks through with large volume, the next HVN is 0.2922, with an approximately 8.5% headroom. Momentum is neutral: Up/Down Volume on major HVNs is in the 45%-55% range, with no signs of unilateral dominance. The OI has fallen 4.98% in the past 24 hours, the long-short ratio has dropped to 4.35, and net capital outflows have reached 359 million, indicating a cooling of leverage and a greater reliance on spot market momentum. The order book has a long buy order of 949 kUSDT near the end of the day, but there is a sell order of 1.49 B coins at 0.31, which represents the spot ceiling. From a cyclical perspective: The price remains within the 2-week range of 0.249-0.278, with no trend divergence, and is considered an extension of the central pivot.

Trading Strategy (VPVR Structure Prioritized)

1. Aggressive: Go long on a pullback to LVN 0.258, with a stop-loss at 0.254 (outside the lower HVN 0.255 - 0.5 × ATR ≈ 0.004), and a target of 0.2717 or 0.2922, with a risk-reduction ratio of 2.1.

2. Conservative: Go long on a breakout of 0.2717 and a 15-minute close that stabilizes, with a stop-loss at 0.267 (outside the opposite HVN), and a target of 0.2922, with a risk-reduction ratio of 2.6.

3. Conservative: Short on a pullback below 0.258 and a rebound to 0.261. Stop loss at 0.265 (outside the upper HVN), target at 0.249 (near VAL), RR ≈ 1.8.

(In the absence of ATR, use the recent 24-hour high and low converted to 0.008, with medium confidence.)

LP Market Maker: We recommend placing a two-way order in the 0.258-0.272 range, with a width of 0.0008-0.0010, and a taker volume ratio of <30%. Be aware that the sell wall above 0.2717 could trigger a sudden drop. Set a hard stop loss of 0.275.

Risks: If the 1-hour close falls below 0.249 (VAL), the range will be invalidated and the trend will turn short. A sudden increase in volume >3× average volume above 0.31 could also trigger a short stampede, so adjust your position promptly.

Like and follow for real-time updates!

$DOGE