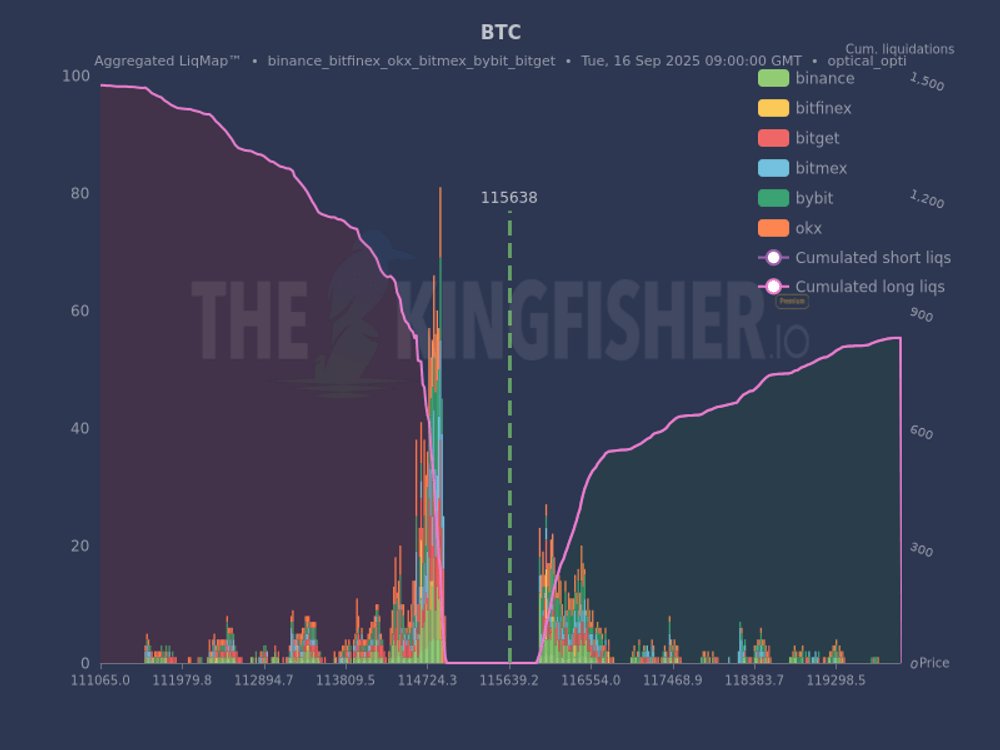

OK, the Kingfisher data is showing some interesting patterns.

There's a significant amount of long liquidation below the current price, especially around 114724.3. This suggests many longs are trapped. The price is currently at 115638.

On the other hand, short liquidation is accumulating above the current price, but not as drastic as the long liquidation below.

This is an optical_opti chart, so these liquidations can be cleared quickly, typically within a few days to a week.

So, what does this mean for us?

The market is often attracted to these large accumulations of liquidations. It acts like a magnet. Longs below are a potential downside driver, washing out overleveraged positions.

If you hold a long position, this chart should serve as a warning. Set your stop-loss wisely, perhaps slightly below 114724.3, or even higher if you want to play it safe. Don't be one of the many who get wiped out.

If you're looking to enter a short position, this could be an opportunity. Look for price targets, targeting the long liquidation area. But remember, once these long positions are liquidated, you may see a rebound. Don't get greedy.

This chart doesn't predict the future, but it will show you where the pain points are. And where the pain points are, price action tends to follow.

Risk management implications: If you hold open long positions, the 114724.3 level is a key support area. A break below this level will accelerate the sell-off as these positions are liquidated. Wise traders will adjust their stops to avoid being part of the chain reaction.

For profit-taking, if the price starts to approach that massive long liquidation pool, it could be a target. Once reached, liquidity could dry up and reverse.

This chart shows that market leverage is high, especially with concentrated long positions. This means that if any one side gets hit hard, there could be some significant volatility.

This isn't so much about predictions as it is about understanding the risks most traders face.

$BTC

Highly leveraged long positions are gone

Best place to cover your position 🎣

Let's move on to the next liquidity cluster 🐟