We are excited to announce that 21X (@tradeon21x), the first EU-regulated on-chain exchange for tokenized securities, has adopted the Chainlink data standard.

https://t.co/WXdhe6KJoj

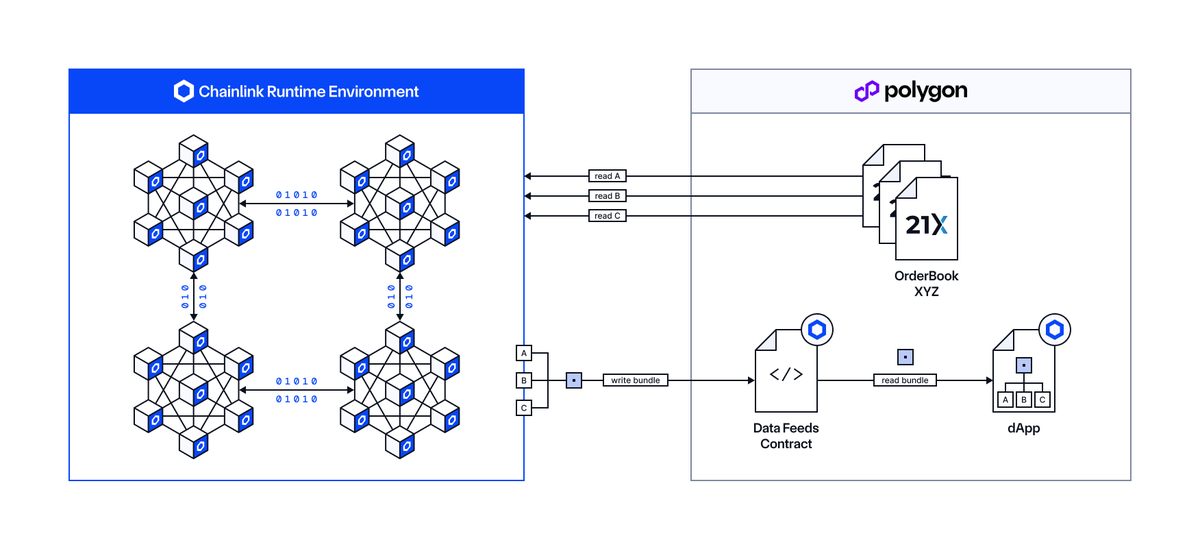

Chainlink, now live and powered by the Chainlink Runtime Environment (CRE), enables verifiable post-trade data, including the latest trade prices and bid/ask quotes for securities listed on the 21X platform, directly accessible in real time on the @0xPolygon blockchain.

This integration enables EU-regulated tokenized equities, debt securities, and funds to be used as collateral in lending protocols and traded in secondary markets, while also unlocking a range of other use cases in the on-chain economy.

Black Manta Capital Partners' USMO, a tokenized note backed by the UBS USD Money Market Fund, is the first security on the 21X platform to have its data streamed on-chain via Chainlink.

Max Heinzle, CEO of 21X, said, "The Chainlink standard enables 21X to securely and reliably bring real-time, verifiable market data for tokenized securities to blockchain. By integrating Chainlink into our regulated DLT trading platform, we can provide the transparency, auditability, and collateral utility that institutions require for on-chain trading, while fully complying with the regulatory requirements of the German Federal Financial Supervisory Authority (BaFin). Adopting Chainlink is a cornerstone in bridging traditional capital markets with the blockchain economy."

Looking ahead, 21X is expanding its integration with Chainlink to include pre-trade data, deeper analytics, and additional asset classes. Ultimately, this integration represents a significant step towards building a more transparent, composable, and efficient financial system, and opens the floodgates for institutional capital to flow on-chain.