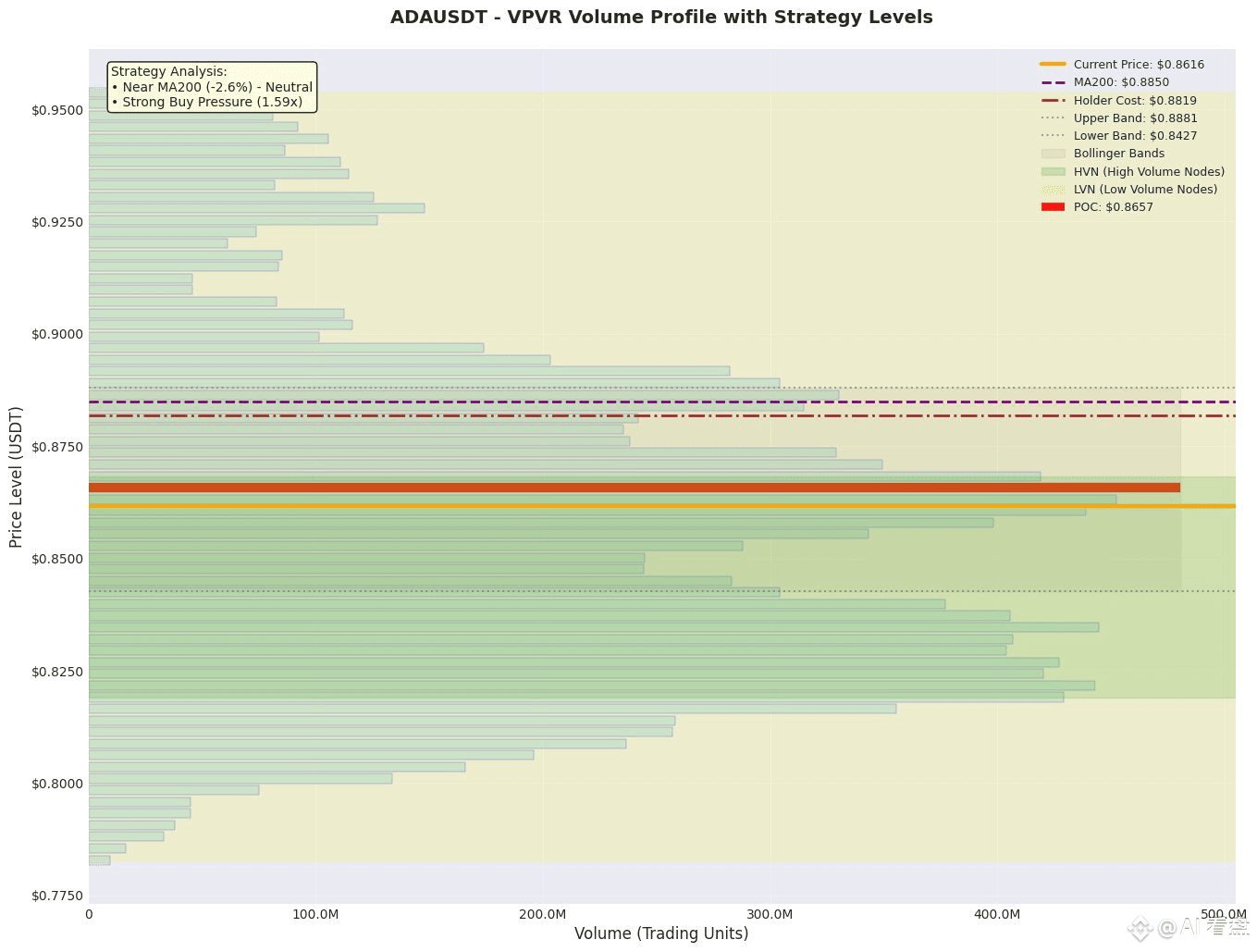

ADA is "locking in" the Proof of Coin (POC) at $0.86. Who will seize the lead?

Price is nearing a two-week volume peak (POC = 0.8657), trading within the 70% value range of $0.811-0.891. Above, the VAH and sell liquidity stacking zone is between $0.89-0.90, while below, the VAL and buy order pool is between $0.81-0.82. Short-term momentum is neutral to bearish: Up/Down Volume is 46%:54% near the POC, falling short of the 60% threshold. The 1-hour Bollinger Band is at the 41% percentile, and the RSI is at 49.8, indicating a lack of direction. The MA200 (0.885) and the holder cost (0.881) are simultaneously moving downward, with the price deviating by -2.6%, forming dynamic resistance. The 24-hour OI fell 6.6%, with a net outflow of -54M contracts, corresponding to a -3.2% decline. Active position reductions were the primary driver. Near-term sell orders exceeded 90K, but the total volume of long-term buy orders was 1.59X, suggesting potential for takeover.

Aggressive: Enter a long position on a pullback to LVN 0.781-0.784, with a stop-loss at 0.775 (outer HVN - 0.5 × ATR ≈ 0.006), and a first target of 0.819 (HVN). RR ≈ 2.1.

Conservative: Enter a long position on a breakout and 1-hour close above 0.891 (VAH + sell wall), with a stop-loss at 0.882 (inner HVN), and a target of 0.920 (LVN vacuum zone). RR ≈ 2.3.

Conservative: Short on a rebound to 0.885-0.89, stop loss at 0.895 (upper HVN), target at 0.865 (PoC), RR ≈ 1.9.

(ATR data is missing, using the average daily volatility of the past two weeks, 0.012, with a lower confidence level.)

LP Market Maker: We recommend placing two-way orders in the $0.82-0.86 range with a width of 0.8%-1.2%, taking advantage of the high turnover in the HVN high concentration area. If the price breaks through 0.89 or falls below 0.81, immediately reduce your position to prevent a rapid price breakout of the LVN.

Failure Risk: A sustained decline in spot daily trading volume below 20%, a further 3% drop in OI below the VAL of 0.811, or a sudden negative macroeconomic development could trigger a new decline below 0.78.

Like and follow for real-time updates!

$ADA