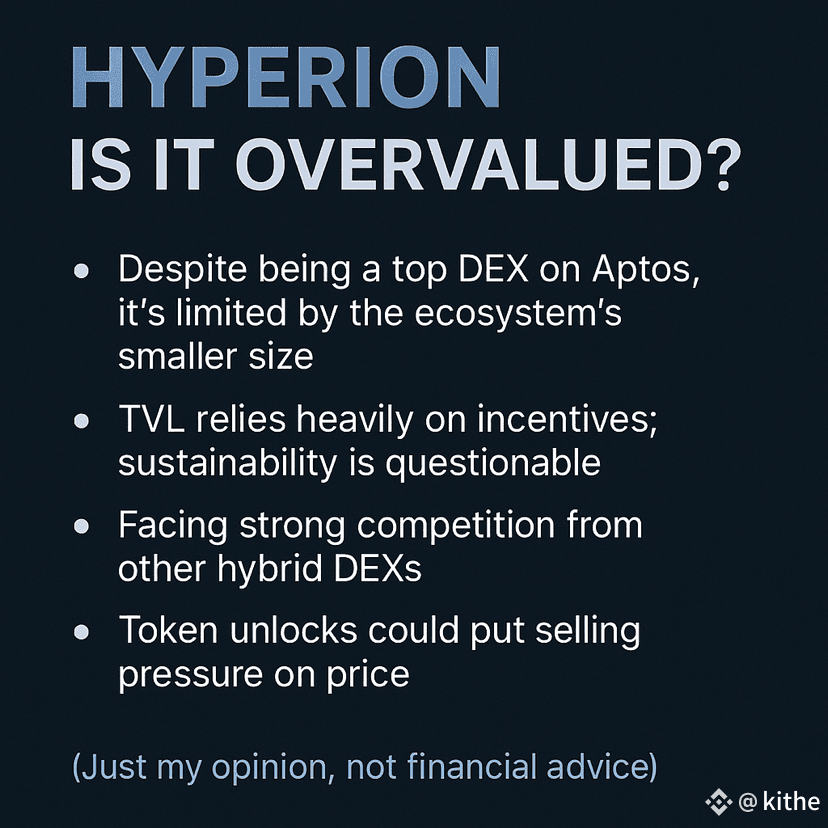

After observing Hyperion (@hyperion_xyz) for a while recently, I'm relatively conservative.

First, while it's a leading DEX in the Aptos ecosystem, Aptos itself still lags significantly behind mainstream public chains like Ethereum and Solana in terms of active users and on-chain capital. Hyperion's TVL is currently around $130 million, which seems impressive, but a large portion relies on liquidity incentives. If these incentives decrease, retention will become significantly more difficult.

Second, while the hybrid orderbook + AMM model is technically sound, the market already has many established competitors (such as Raydium, ApeX, dYdX, etc.), and these competitors have larger user bases and deeper trading volumes. It will be challenging for Hyperion to surpass them in terms of trading experience, fees, and market coverage.

Looking at the token economics, there's a significant gap between $RION's market capitalization and its fully diluted valuation, suggesting significant pressure to unlock future tokens. If trading volume fails to continue to expand, the token price is likely to come under pressure.

Overall, Hyperion's position within the Aptos ecosystem is stable, but ecosystem ceilings, incentive dependency, and external competition all represent significant risks worth noting. While it's worth monitoring its trends in the short term, whether it can overcome these limitations in the long term remains to be seen.