参与分享DEX的最新讨论

Topic Background

晴天游园会

币圈小白

BlockBeats 消息,2 月 4 日,据 Coinglass 数据,比特币今日凌晨短时跌破 7.3 万美元后回升至 7.6 万美元上方。资金费率数据显示市场看跌情绪较昨日有所缓解,但仍全面看跌。多个交易平台比特币资金费率由负转正,但仍维持看跌态势,大部分交易平台以太坊资金费率仍为负值,空头将继续支付费用给多头以维持头寸,市场对以太坊的悲观情绪更为浓厚。

BlockBeats 注:资金费率(Funding rates)是加密货币交易平台为了保持合约价格与标的资产价格之间的平衡而设定的费率,通常适用于永续合约。它是多空交易者之间的资金交换机制,交易平台并不收取此费用,用于调整交易者持有合约的成本或收益,以使合约价格与标的资产价格保持接近。

当资金费率为 0.01% 时,表示基准费率。当资金费率大于 0.01% 时,代表市场普遍看多。当资金费率小于 0.005% 时,代表市场普遍看跌。

rap之母路青

币圈小白

2026年2月4日(周三)核心速览:BTC约7.6万美元(-3.10%)、ETH约2280美元(-3.72%),市场极度恐慌;仅SocialFi、AI、DePIN少数板块逆势。

一、市场行情

• BTC:日内一度跌破7.3万美元,现约7.6万,7日跌幅超20%;恐慌与贪婪指数22%,处于极度恐慌区间。

• ETH:表现弱于BTC,7日跌幅25.08%;Lido等质押协议TVL7日下滑超25%,部分质押者撤出。

• SOL:TVL7日跌10.60%,但24小时DEX交易量达51.59亿美元,链上活跃度仍高。

• 板块亮点:SocialFi(+2.14%)、AI(+0.06%)、DePIN(+0.01%)逆势;TON(+2.80%)、WLD(+2.03%)、AR(+2.40%)领涨。

二、资金与机构

• ETF资金:比特币ETF持续净流出,贝莱德ETF单日流出超3亿美元。

• 机构调仓:灰度减持1.2万枚BTC,增持ETH;HashKey Capital从币安提取1480万美元ETH。

• 大额异动:50.55万枚SOL(约5034万美元)转入币安;币安转移1433枚BTC(约1.09亿美元)。

三、链上与监管

• 链上动态:两沉寂5年的ETH地址激活,存入4.45万ETH并借入1.04亿USDT,再购4.59万ETH。

• 监管进展:美国《CLARITY法案》在参议院农业委员会以一票优势通过,监管框架趋明但两党分歧仍存。

四、市场观点

• 看多:Tom Lee称触底要素就位;Michaël van de Poppe认为周期底部已现。

• 看空/谨慎:Bernstein Research认为或下探至6万美元;Wintermute警示流动性危机与清算风险。

anhuoshequ

币圈小白

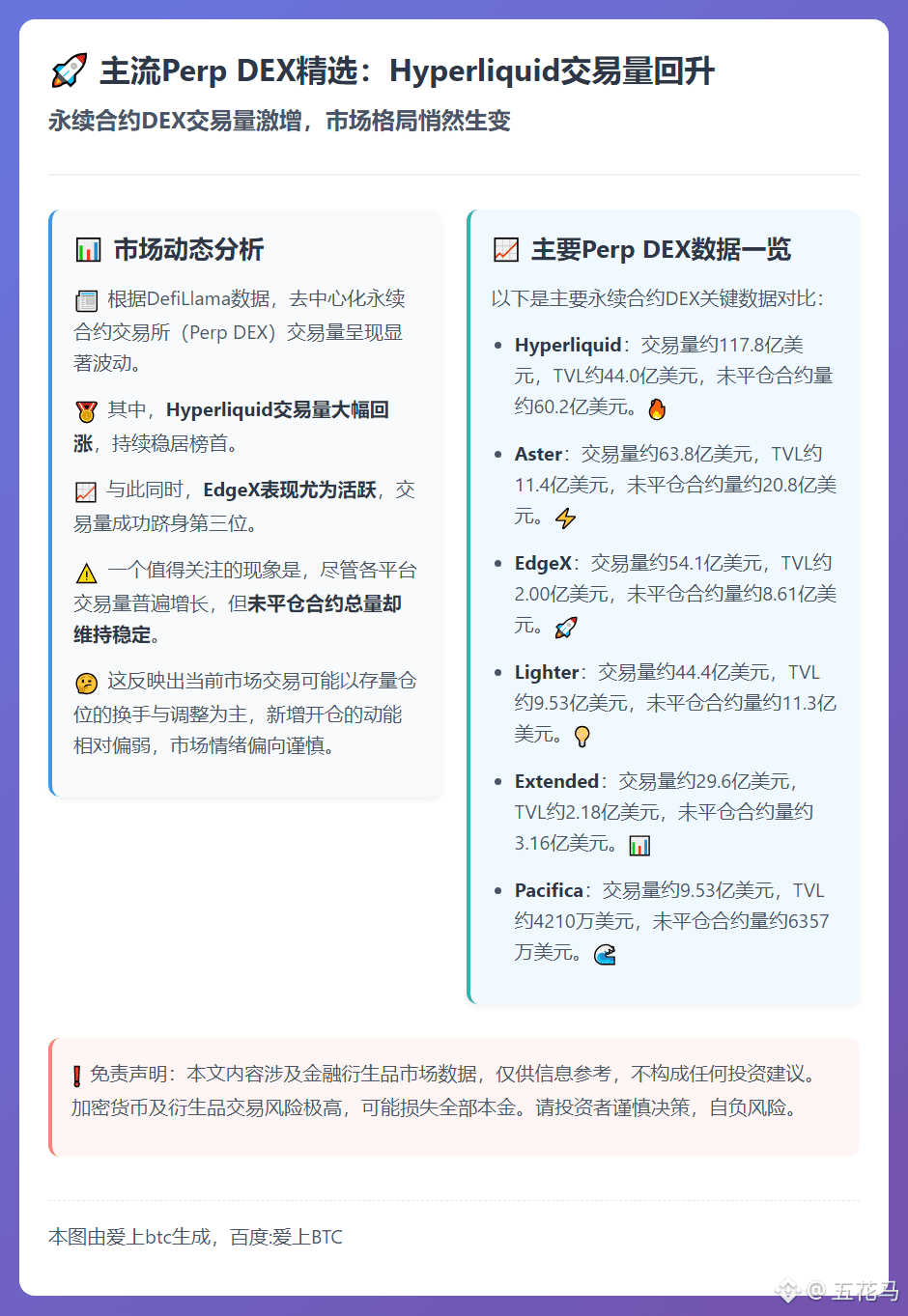

币界网消息,2 月 3 日,据 DefiLlama 数据,Hyperliquid 交易量大幅回涨至 117 亿美元,持续位居榜首;EdgeX 交易量近日表现活跃,反超 Lighter 现居第三。尽管各平台交易量显著增长,但未平仓合约量维持不变,反映当前市场交易或以存量仓位的换手与调整为主,新增开仓动能相对偏弱。当前主要 Perp DEX 交易量情况如下:Hyperliquid 24 小时交易量约 117.8 亿美元,TVL 约 44.0 亿美元,未平仓合约量约 60.2 亿美元;Aster 24 小时交易量约 63.8 亿美元,TVL 约 11.4 亿美元,未平仓合约量约 20.8 亿美元;EdgeX 24 小时交易量约 54.1 亿美元,TVL 约 2.00 亿美元,未平仓合约量约 8.61 亿美元;Lighter 24 小时交易量约 44.4 亿美元,TVL 约 9.53 亿美元,未平仓合约量约 11.3 亿美元;Extended 24 小时交易量约 29.6 亿美元,TVL 约 2.18 亿美元,未平仓合约量约 3.16 亿美元;Pacifica 24 小时交易量约 9.53 亿美元,TVL 约 4210 万美元,未平仓合约量约 6357 万美元。