$BTC broke through $120,000, sending the market into a frenzy.

Three major drivers are behind this surge: a continued influx of institutional funds, with BlackRock's ETF now worth $84 billion;

The depreciating US dollar is driving safe-haven flows; and

Shifting political trends are bringing favorable policies.

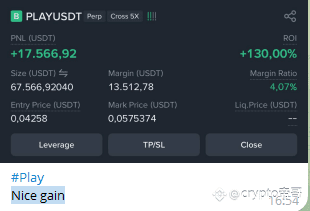

But amid the revelry lies a hidden risk: 110,000 positions were liquidated within 24 hours, wiping out $350 million.

Leveraged trading is like walking a tightrope; a single misstep can lead to a fall.

The key question now is: how far can this rally go?

Achieving $150,000 by the end of the year is highly likely, but significant fluctuations along the way are inevitable.

History shows that markets are often most dangerous when they are at their craziest.

Smart money is doing two things: holding onto core positions while keeping some cash in anticipation of a correction.

Remember, making money in a bull market requires courage, but holding onto profits is the true skill.

#BinanceAlphaNews #ETHBreaksOver4300 #BTCReturnsTotal120,000 #CryptoTotalMarketCapHitsRecordHigh #BitcoinMarketCapOvertakesAmazon