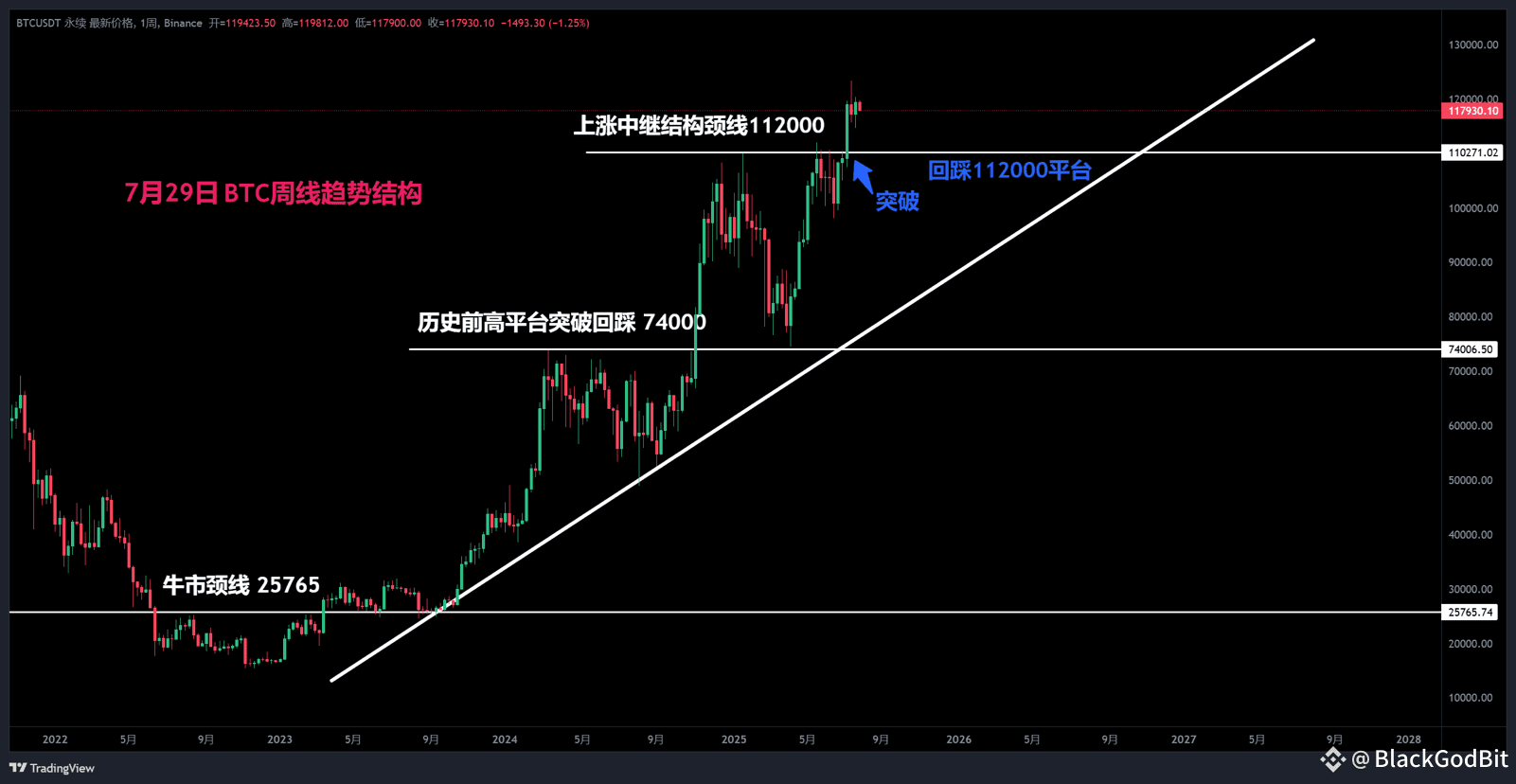

$BTC continues to watch the current accumulation process. The trend of Bitcoin in this cycle remains in the accumulation state after breaking through the relay structure neckline (historical high). There is no change in nature at present, and it is still in a relatively strong horizontal consolidation accumulation stage. Now from the 4-hour structure, it is a shock accumulation in the 116000-120000 box range. You can continue to do high-altitude low-long and short near 119500 in this range. If it breaks through 121100 above, stop loss for short orders. Go long near 116000, and if it falls below 114800, stop loss for long orders. It is enough to eat 2% of the fluctuation range of 4% back and forth. Don't be greedy in the shock accumulation stage~ Once it falls or breaks through, the reverse order must be decisively exited~ I think Bitcoin will step back and break through the support platform of the original historical high of 112000~

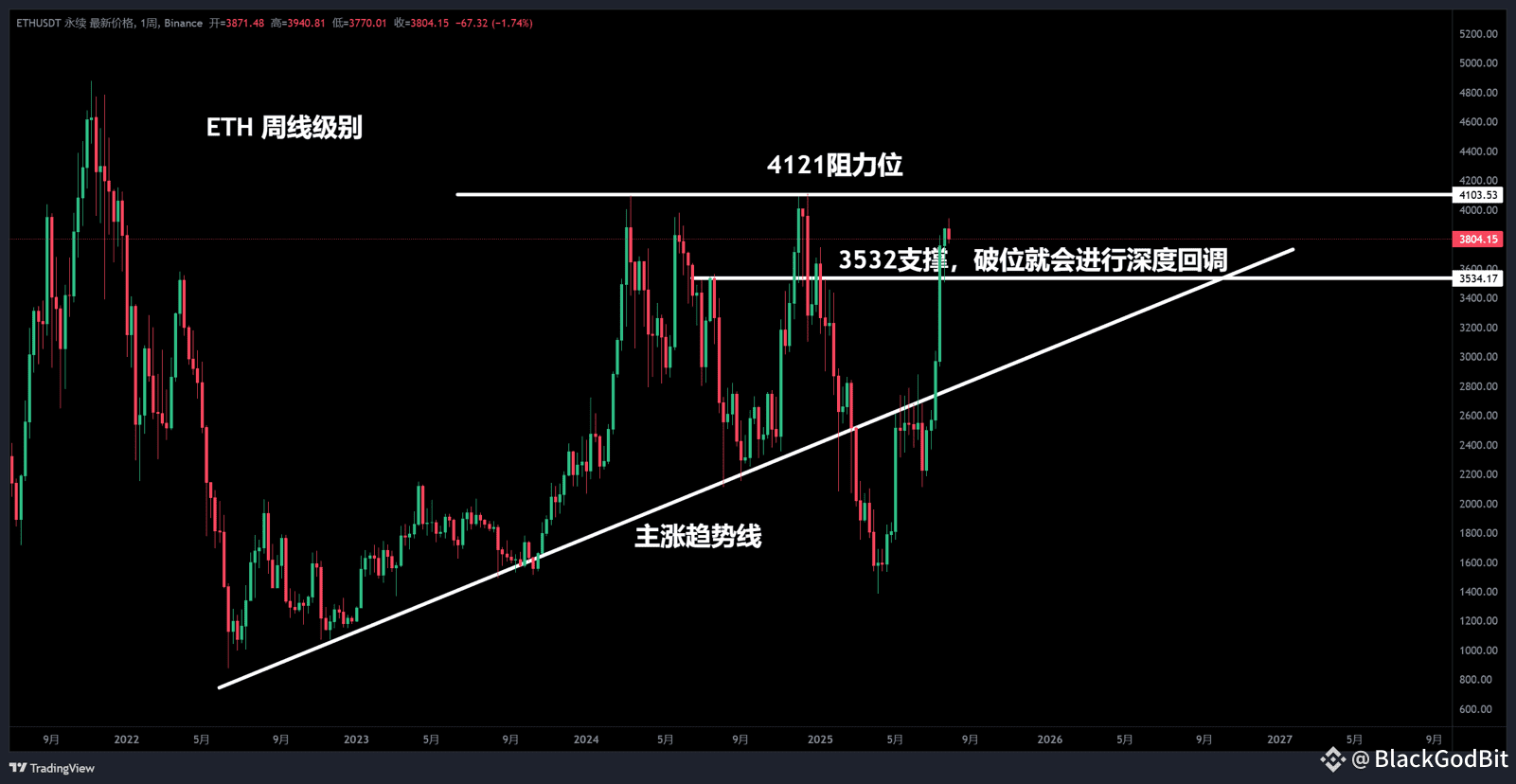

$ETH pauses its strong offensive posture. But the current form and trend are clear, and the short pause is to accumulate strength for the next attack. The next target of attack is the 4121-line space resistance level, which is the historical high in the past year. With the emergence of a short-term high last week, those who hold long orders or spot should pay attention to the support position of 3532. If it falls below, there will be a deep correction. Don't forget to run at that time~ Overall strategy, BTC and ETH have not caused new structural qualitative changes this week, and the overall operation is still in a state of waiting for breakthrough. At present, the box strategy is still used for operation~ If it breaks through the box, the reverse order can be exited. ETH currently regards 3581-3850 as a range accumulation stage.

Short order operation method: short near 3850, stop loss at 3960, take profit near 3646

Long order operation method: long near 3600, stop loss at 3525, take profit near 3810