Bitcoin made a profit of $4.3 billion in a single day! Behind the reversal of market supply and demand, bull market signals have emerged comprehensively

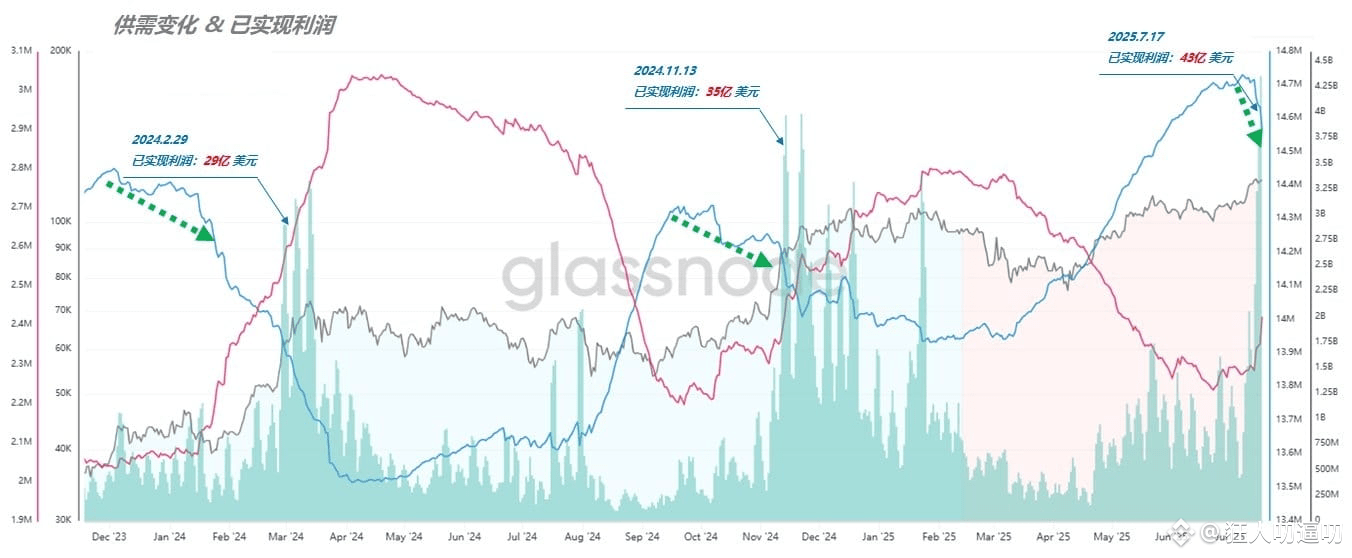

The crypto market has recently ushered in a key turning point: Bitcoin has realized a profit of $4.3 billion on July 17, which not only broke the recent record, but also surpassed the two interim highs in 2024. The changes in the market structure are not limited to this - long-term holders have ended the four-month asset accumulation cycle that started in March and officially entered the distribution stage. This behavioral change has become an important indicator for observing the market.

Usually, large-scale profit realization is prone to cause price declines, but the current market has shown amazing carrying capacity. Prices remain stable against the background of increased supply, which directly reflects the strong degree of short-term demand. Buyer funds are sufficient to absorb the existing selling pressure, which is a typical feature of a strong market.

The market divergence that occurred in the second quarter of this year is still vivid: the rise of Bitcoin from April to May was considered by many analysts to be an "atypical market" due to the lack of potential energy, which is far from the active state of the traditional bull market. Today, the market has completed a key transformation - the demand side continues to exert force, the potential energy gradually accumulates, and the new funds entering the market continue to increase. The core characteristics of a bull market are clearly visible.

From the perspective of trend logic, the dual strength of demand and potential energy provides support for the continuation of the market. But dialectically speaking, this sudden market outbreak has concentrated energy, and its sustainability is similar to a physical limit challenge, which is difficult to predict with a fixed period. For players, they can participate moderately in the current stage of rising market sentiment, but they need to stay sober: when the market is generally trapped in FOMO, rational judgment and risk awareness are the key to dealing with fluctuations.