Historical rules reveal: Why can this signal of Bitcoin always trigger the market?

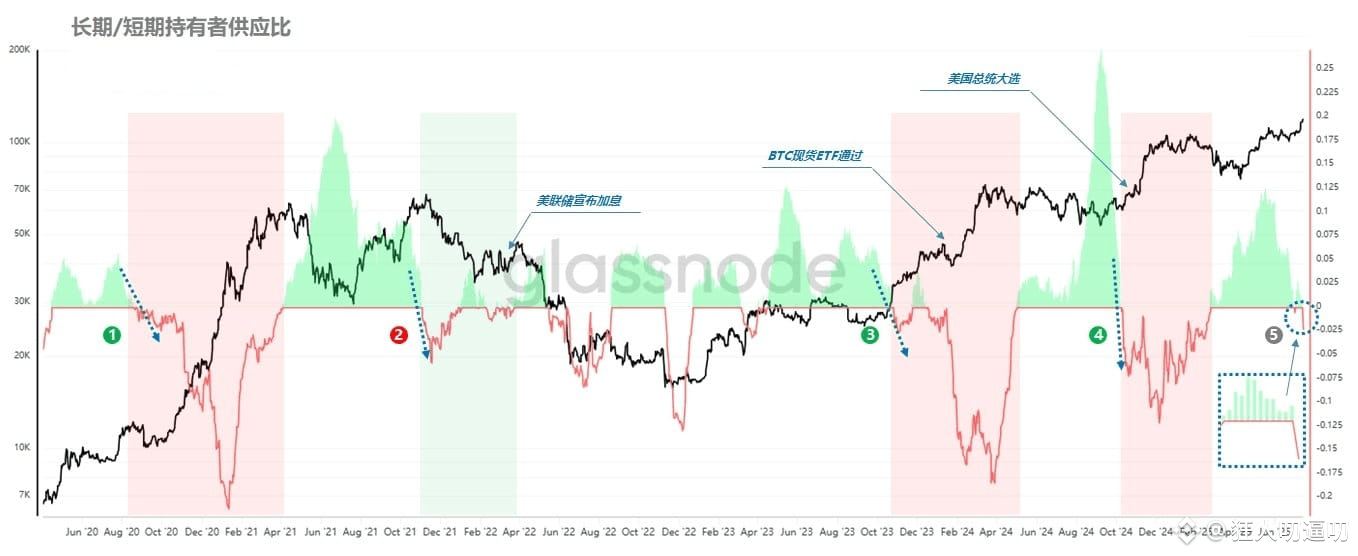

The supply ratio of long-term and short-term holders turned from positive to negative, and this market signal has appeared again recently. From past experience, the turning of this indicator is often a prelude to trend change - it may accelerate the original trend or become the starting point of the end of the trend.

Looking back at the four key nodes in history (1 to 4), there are obvious differences in their subsequent trends. The core of this difference lies in whether market demand can absorb the new supply when long-term holders turn from increasing holdings to reducing holdings. If the demand is sufficient, the market is expected to continue to improve; if the demand is insufficient, the price may fall back.

And macro events often amplify the impact of this signal. For example, after node 2, the Federal Reserve started to raise interest rates, node 3 was followed by the approval of Bitcoin spot ETF, and node 4 coincided with the US presidential election. These events have become important catalysts for driving the market.

Now, the long-term and short-term supply ratio has turned negative at node 5, so what key events that will affect the market will appear after it? This suspense is waiting for the market to give an answer.