Bitcoin's current trend is still in the cyclical divergence channel

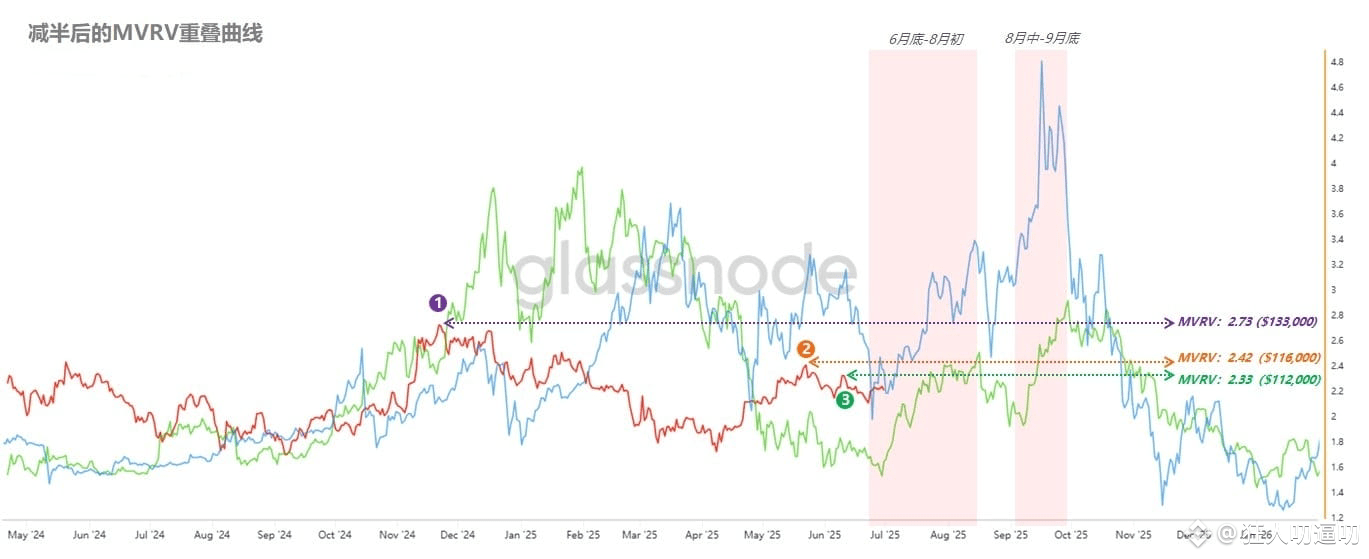

Recent technical models suggest that the current trend of Bitcoin may reach a critical node in the second half of 2025. Model deduction shows that in the two time periods from the end of June to the beginning of August, and from mid-August to the end of September, the three MVRV curves have the possibility of synchronous upward movement, which will release potential upward space for the future market.

However, it must be pointed out that MVRV is still in the "divergence suppression" structure in the long-term dimension. From the historical trend, the three high points of the current cycle show a decreasing trend (the third is lower than the second, and the second is lower than the first), showing that the market's momentum is declining after continuous highs.

The green line, orange line, and purple line in the figure correspond to the three key high points in this cycle. If Bitcoin can approach the green or orange line level again in the above time period, the price may rise to the range of US$112,000 to US$116,000, which is a reasonable upper limit under the "top rebound" framework.

If the market has the ability to break the divergence structure and truly enter the trend reversal state, the target will point to the purple line. Combined with the current realized price (RP), the theoretical Bitcoin price corresponding to this level is close to $133,000. If time goes on, the target price may be raised.

Historical experience shows that in the past cycles, MVRV has never successfully broken through the upper limit of the large cycle deviation. Therefore, if this round wants to break through the previous high, the driving force required will be far greater than before, and the difficulty should not be underestimated.