The secret behind Bitcoin prices: Why are chip-dense areas prone to large fluctuations?

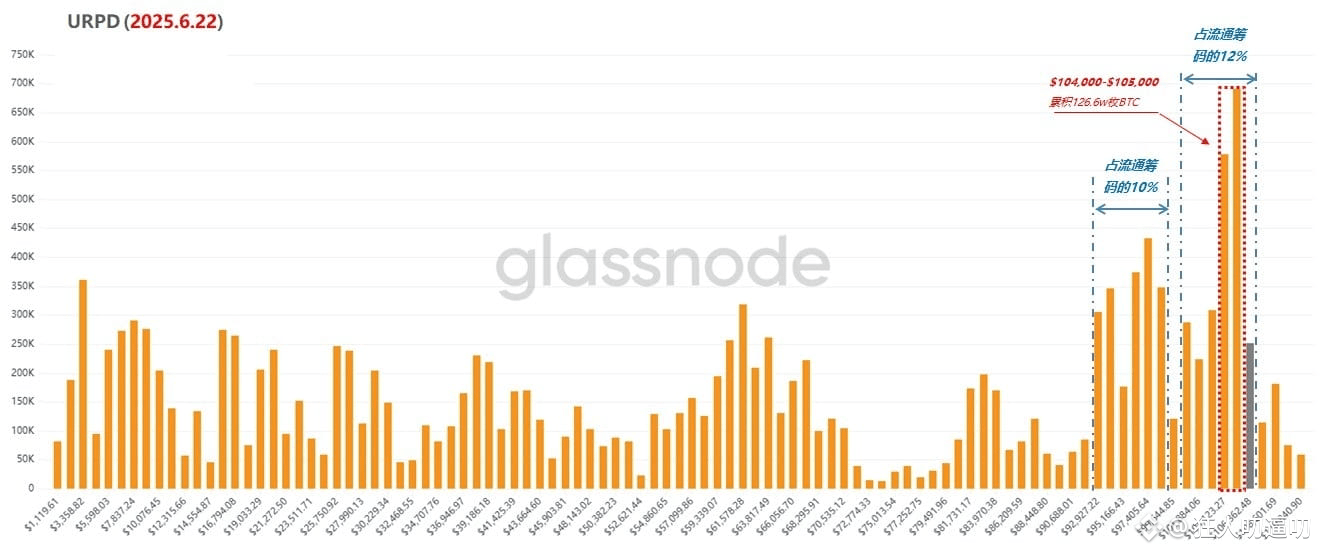

Recently, many players have been puzzled about why the "chip concentration" has increased and why it may cause drastic fluctuations. By analyzing the URPD (realized price distribution) data on the chain, a clearer understanding can be obtained.

From the overall price distribution, the current Bitcoin chips show an obvious dense structure, especially concentrated in the two key ranges of US$92,000 to US$98,000 and US$100,000 to US$106,000. The former accounts for about 10% of the total circulation of Bitcoin, while the latter is as high as 12%. In other words, the price band of only US$15,000 has accumulated 22% of the circulating chips, forming a significant structural dense area.

In addition, in the narrow range of US$104,000 to US$105,000, more than 1.266 million Bitcoins have been accumulated. This level of chip accumulation is extremely rare, and there is obviously deep involvement of institutional funds behind it. It is difficult for ordinary players to continue to buy in large quantities in this price range.

The problem is that when prices fluctuate repeatedly in these dense areas, it is bound to cause a greater concentration of chips. However, the market is essentially a dynamic balance, and chips cannot be accumulated infinitely. They will eventually be forced to redistribute to other price areas, either breaking through upward or releasing downward.

At the same time, dense chip areas are extremely sensitive to price changes. Once the market fluctuates slightly, some holders may quickly waver, thereby accelerating market fluctuations and amplifying price reactions.

The current structure shows that the Bitcoin market is approaching an important direction selection node, and subsequent fluctuations may be significantly intensified.