This paragraph is too realistic:

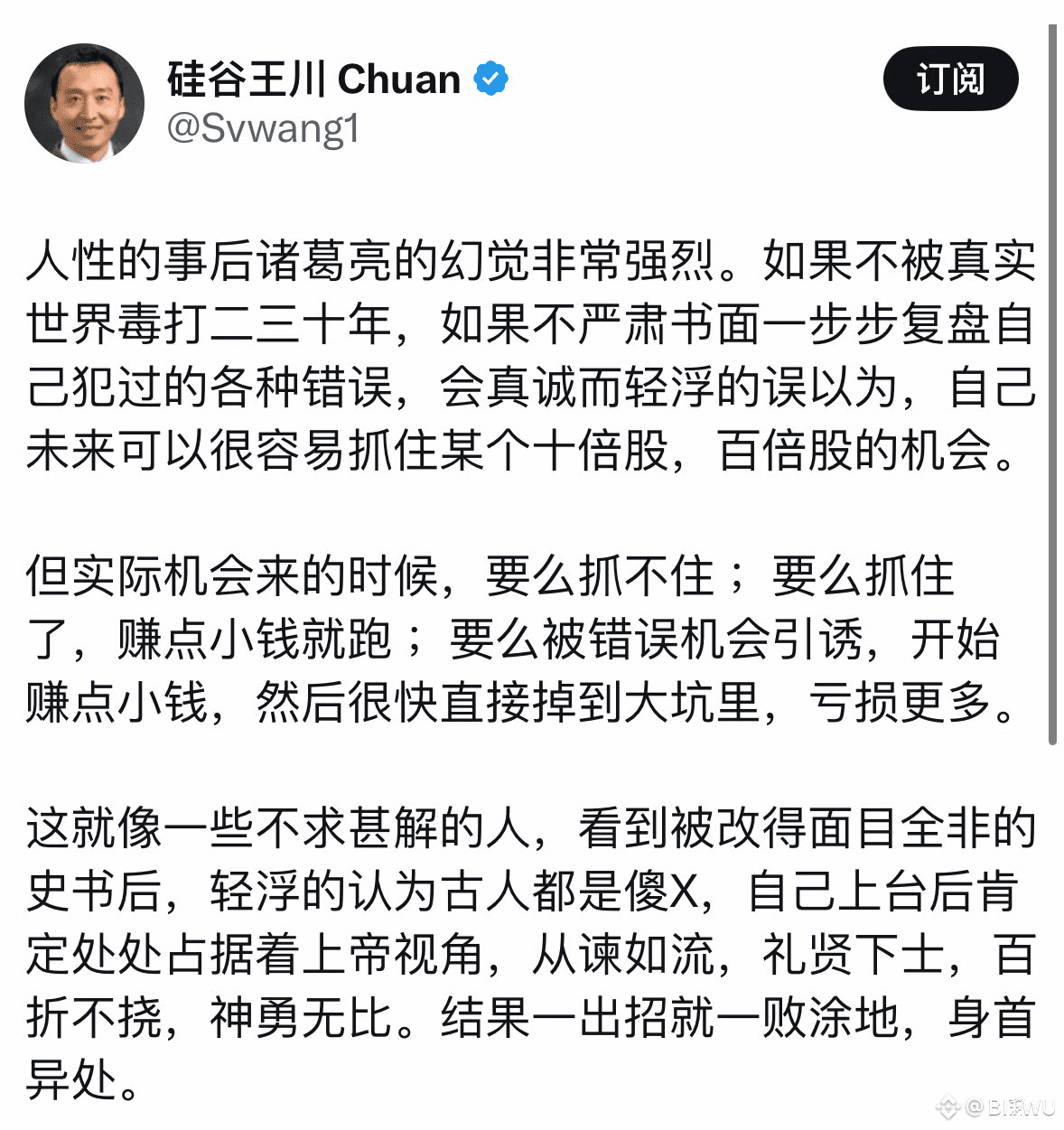

The illusion of hindsight is very strong in human nature.

If you are not beaten by the real world for 20 or 30 years, if you do not seriously review the various mistakes you have made step by step in writing, you will sincerely and frivolously mistakenly believe that you can easily seize the opportunity of a ten-fold or a hundred-fold stock in the future.

But when the actual opportunity comes, you either fail to catch it; or you catch it and run away after making a little money; or you are lured by the wrong opportunity, start to make a little money, and then quickly fall into a big pit and lose more.

This implies a complex reflection on human misjudgment, self-cognition, investment psychology, historical analogy and the way knowledge evolves -

1. The biggest investment illusion is to think that "the current me" can make "the future god operation".

2. Opportunities are not seized by intuition, but are expanded inch by inch by the cognitive boundaries.

3. If you cannot honestly review the stupidity of the past, you cannot truly understand the difficulties of the future.

4. Reflection is not a review of the results, but a training on how to make judgments that are less influenced by emotions in the present.

5. If you want to cross the cycle, you must first find information that others do not see but you can understand - this is the source of alpha.