kii

币圈小白

Follow

If the recession triggers a sharp decline, how would I buy at the bottom?

Today I happened to talk about this issue with my friends. I will talk about my personal opinions. Just personal opinions do not mean that they are correct. The data selected are all economic recession data after 2000.

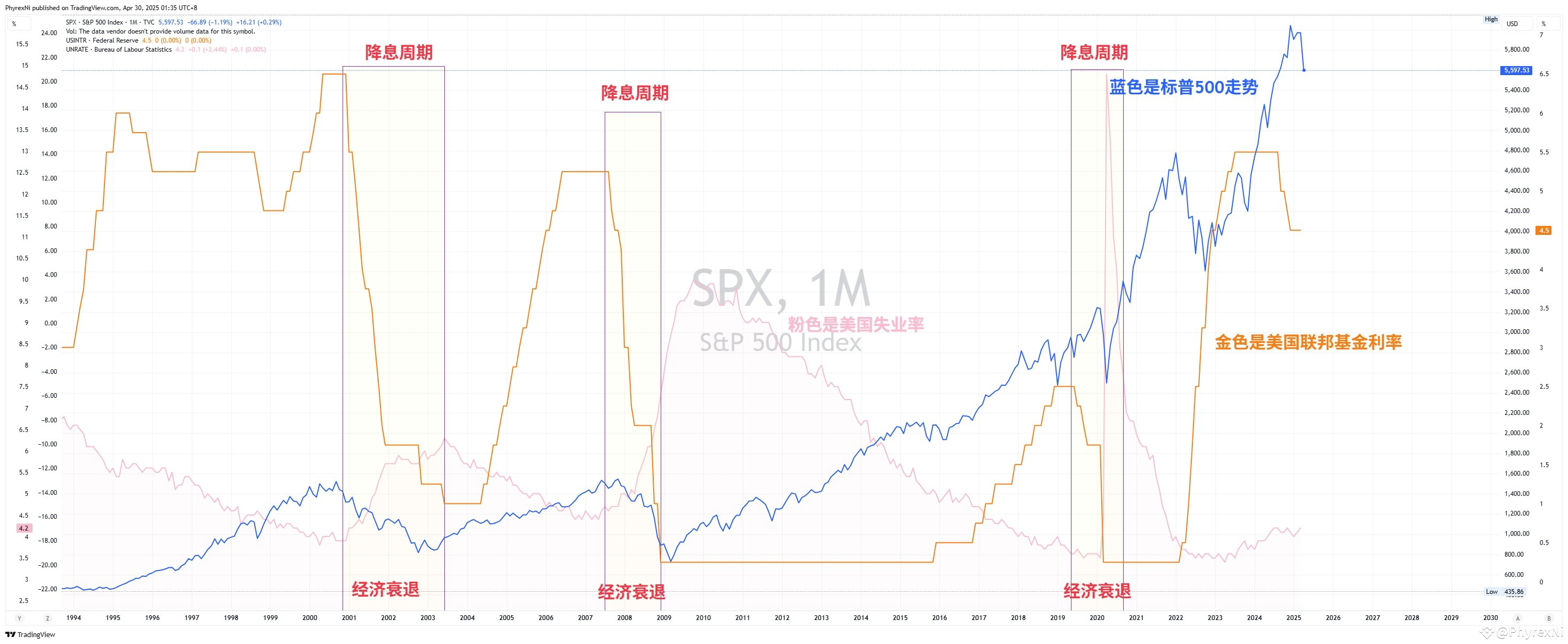

1. Use the S&P 500 as a reference

Recessions often bring about declines in risk markets, and S&P is basically a good reference:

A. In the recession caused by the bursting of the technology bubble in 2001, the S&P 500's largest decline was -49%, and the average decline was -22%.

B. In the recession caused by the financial crisis in 2008, the S&P 500's largest decline was -57%, and the average decline was -38%.

C. In the recession caused by the COVID-19 pandemic in 2020, the biggest decline of the S&P 500 was -34%, and the average decline was -28%.

So if this is a recession, then my first bottom-buying point should be after S&P fell 20%. According to the current S&P 500 price, it fell below 4,000 points (or 4,400 points) and started to buy Bitcoin.

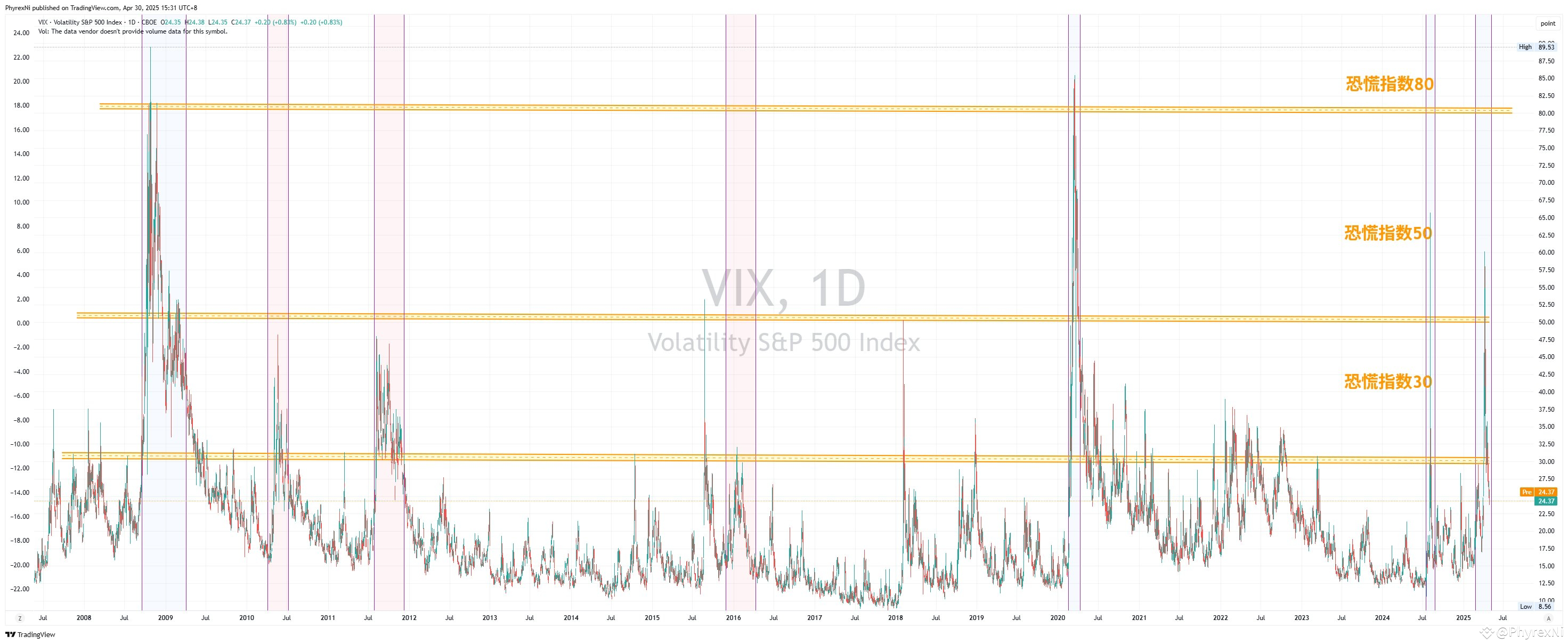

2. Use VIX as a reference

VIX is equivalent to the panic index of the US stock market and is also a very useful data. I have talked about it many times before. Generally speaking, Panic 30 can be regarded as a pullback. Over 50 is basically taking the recession route. Over 80 is the peak of the recession. It can be seen that the peaks in 2008 and 2020 are both above 80.

So my idea is that when VIX exceeds 70 (take the intermediate value) and start buying at the bottom, it is still to buy Bitcoin.

3. Use URPD as a reference

I won’t say much about the URPD data. I have been working every day, and the support of URPD has been verified again in the past two months, including the $BTC $70,000 bottom support mentioned earlier is also effective. Also I don't rule out the possibility of a pin breaking below $70,000, but it's very likely that between $70,000 and $80,000 is the regular range of recession.

So my idea is to start buying Bitcoin at the bottom when it fell below $75,000, but because I was not sure whether I could reach this position, I used the reference method of "Public 500" and "VIX". Basically, these three types arrive first and start. Every time I buy at the bottom with the position, and the more I fall, the more I buy it.

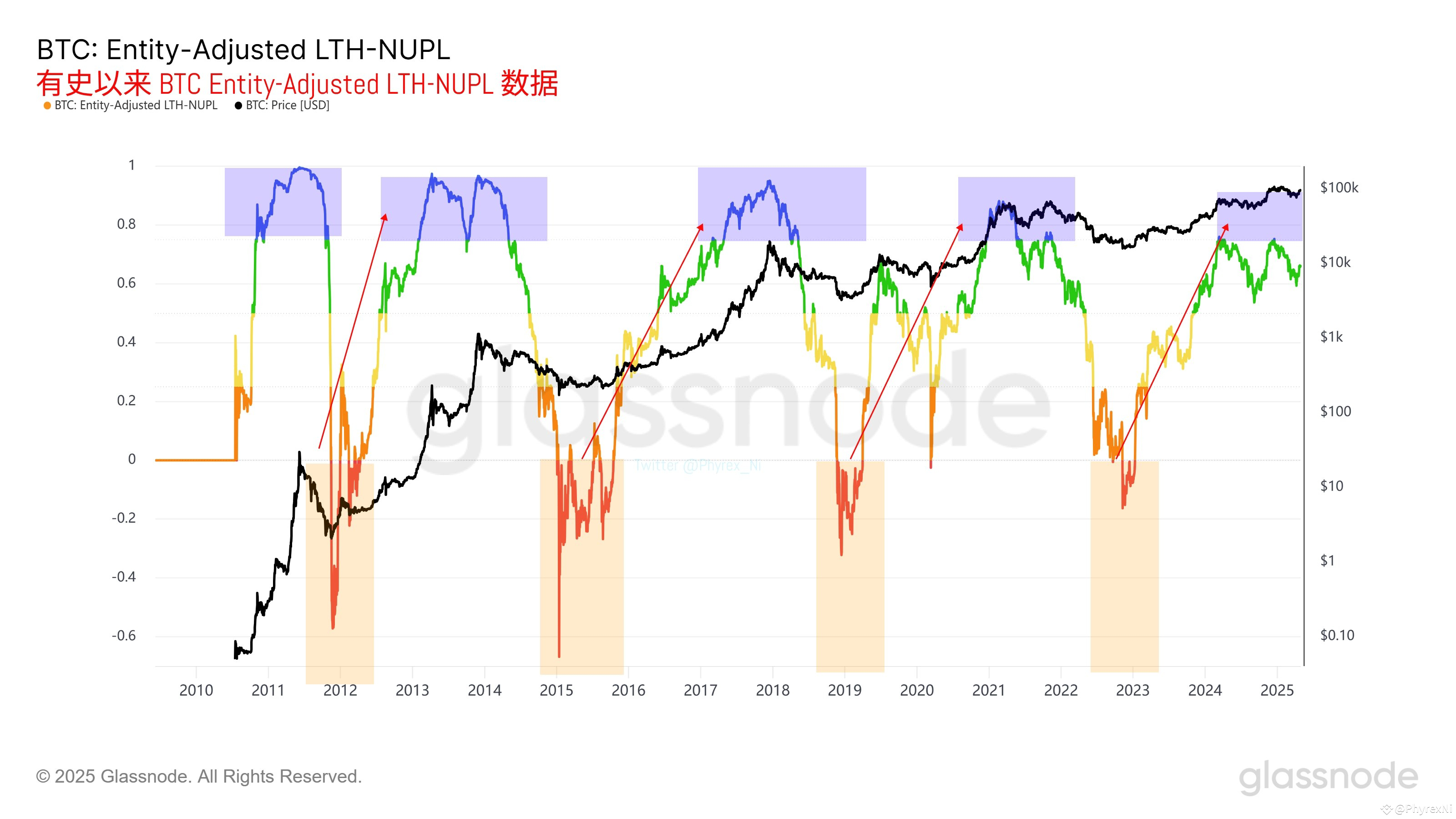

4. Use Entity-Adjusted LTH-NUPL as a reference

This data has been used in the past few days when talking about $ETH. The $BTC data is better and has never been missed. But the reason I put this data at the end is that I am not sure that even if the economic recession is still able to put Bitcoin into the red range. If it can really enter, this indicator will be my main bottom-buying indicator.

When you enter the red, you start buying, and the more you fall, the more you buy.

Apart from the fourth Entity-Adjusted LTH-NUPL data, I cannot be sure that the bottom-buying must be the right place. Moreover, even the Entity-Adjusted LTH-NUPL data does not mean that the bottom-buying can reach the lowest point. Therefore, if there is really a recession, leading to Bitcoin's decline, the bottom-buying should be gradual. These are still the standards in the data, and we still need to look at events in the macro field.

It is just personal opinion, and do not protect your rights.

This tweet is sponsored by @ApeXProtocolCN|Dex With ApeX

BTC

-0.42%

ETH

-0.59%

Risk and Disclaimer:The content shared by the author represents only their personal views and does not reflect the position of CoinWorld (币界网). CoinWorld does not guarantee the truthfulness, accuracy, or originality of the content. This article does not constitute an offer, solicitation, invitation, recommendation, or advice to buy or sell any investment products or make any investment decisions

0

36

0

34

0

No Comments