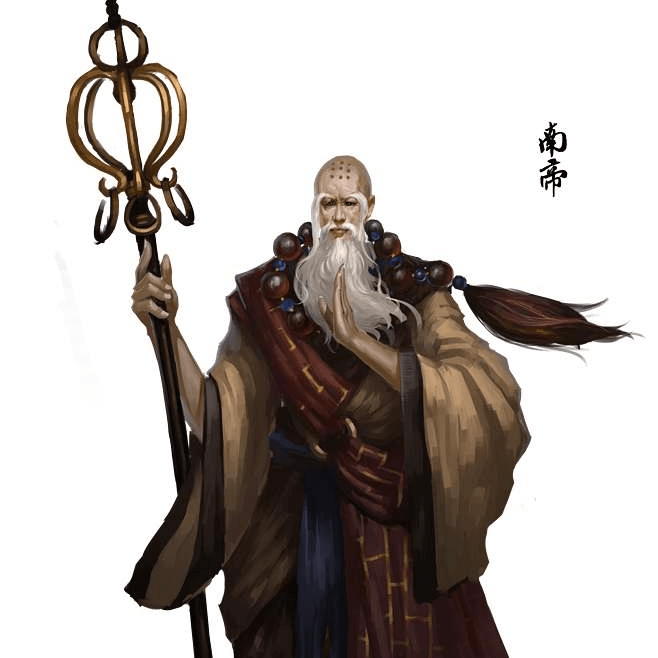

南帝一灯大师

币圈小白

1d ago

Follow

Pay attention 😠 Pay attention 😠 Pay attention 😠

The change disk node has arrived

$BTC The daily line closed above 94500 in the morning. It has been 7 days since the sideways fluctuated, and it is about to change. At present, the 5-day MACD level in the large cycle is about to be selected, and the 12-8-6-4-hour level in the small cycle is in adjustment. The daily line closes to forcefully close the positive line.

Data impact: The number of ADP employment will be announced tomorrow night, the annual rate of PCE price index, and the No. 5.2 non-agricultural data will be announced. This is a key factor affecting whether the market can truly break through 95,000 or whether it will take the trend to retrace and confirm 90,500.

The stablecoin data continued to rise in April, and as of April 19, 2025, USDT supply increased from US$138 billion at the beginning of the year to US$145 billion. By April 25, Tether's market share was about 66%. On April 23, according to Whale Alert monitoring, Tether issued 1 billion USDTs on Tron Network, and Tether CEO said that this additional issuance is a supplement to inventory.

For USDC, as of April 19, its supply has climbed to nearly US$61 billion, a significant increase of US$17 billion from US$44 billion at the beginning of the year, an increase of 38.6%. On April 21, Circle issued an additional USDC of 250 million on Solana Network. So far in 2025, they have cast 12.75 billion USDCs on Solana. On April 25, according to Golden Finance, USDC's market value exceeded US$61.7 billion, setting a record high.

The critical point for the global market value of the crypto market has also regained its critical point of $3 trillion. This is the decline below the range point in late February. The market avoided suspicion and funds returned to the market one after another in early April. However, the Fed's interest rate cut has not yet been determined. The market is speculating on the interest rate cut in June. The market value of Bitcoin remains high and remains at 63% market share. $ETH Ethereum's market value is 7.39% and even if the speculation is upgraded, it has not effectively broken through the pit of 1,800. It is really a bit waste.

In addition to SUI, the $SOL series, DOGE series, and second-tier series coins are also adjusted to rebound by 50-70% but less than one-third of the decline. The market was bullish at the moment, but it did ignore market risks. Bitcoin sideways fluctuating counterfeits rarely make up for the rise. The individual coins and small coins have taken turns to rise, which has indeed attracted many retail investors to chase the rise. However, if you want to make a real breakthrough, you still need favorable support and capital injection, especially between the alternation of the end of the month and the beginning of the month. It may be safer to choose to avoid suspicion. Let's wait and see the market trend after the release of various data in the next step, and choose the direction to be more stable.

BTC

-1.38%

ETH

-3.28%

USDT

-0.03%

Risk and Disclaimer:The content shared by the author represents only their personal views and does not reflect the position of CoinWorld (币界网). CoinWorld does not guarantee the truthfulness, accuracy, or originality of the content. This article does not constitute an offer, solicitation, invitation, recommendation, or advice to buy or sell any investment products or make any investment decisions

0

31

0

26

0

No Comments